In a historic move, the International Monetary Fund (IMF) has included digital assets like Bitcoin and tokenized instruments (stablecoins) in its Balance of Payments Manual (BPM7), offering global guidelines on how countries should classify and report crypto activities.

The BPM7 is like the world’s accounting rulebook for tracking cross-border money flows from trade and investments to remittances and, now for the first time, digital assets are included in its latest 7th edition. Just as businesses use accounting standards to report their finances, countries use BPM7 to report what they earn, spend, and invest across borders. By including crypto, BPM7 makes digital assets officially count in how countries measure their economies.

Recognizing Bitcoin and Tokenized Assets

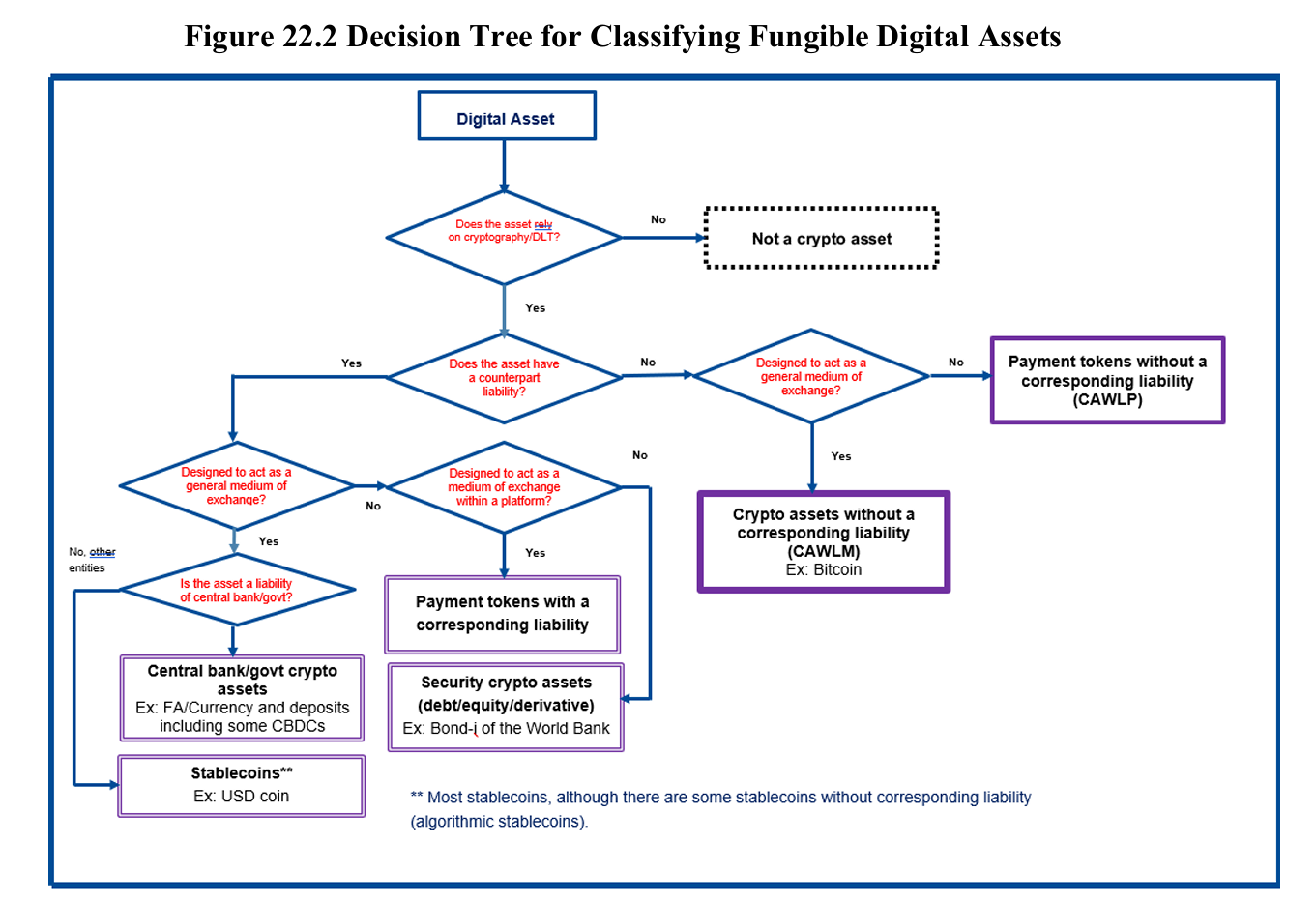

According to the draft BPM7 chapter, cryptocurrencies like Bitcoin are now recognized as “non-produced, non-financial assets”, meaning they are capital assets without liabilities or links to production. This classification aligns Bitcoin with intangible and scarce assets such as patents or trademarks.

Stablecoins and equity security crypto assets that carry liabilities such as being backed by fiat or collateral are categorized as financial instruments. The manual also distinguishes between fungible and nonfungible tokens (NFTs), classifying them based on usage and backing.

Mining and Staking Now Count as Services

For the first time, activities like crypto mining and staking are recognized as productive services. These are now recorded as computer service exports or imports based on whether the validator or miner operates across borders. This distinction allows national accounts to factor in the economic contribution of blockchain infrastructure providers.

Why It Matters

BPM7 represents the IMF’s most comprehensive modernization of financial reporting since the digital asset boom began. Built on consultation with over 190 countries, this update aims to enhance transparency, comparability, and trust in how crypto-related activities are tracked in national and international accounts.

Although each country retains discretion on how quickly to adopt these standards, the IMF’s guidance offers a unified framework to legitimize and standardize how digital assets are treated globally.

No, the IMF Didn’t Call Bitcoin “Digital Gold”

Despite rumors circulating online, the IMF did not label Bitcoin as “digital gold.” It simply referred to cryptocurrencies as assets “designed to be used as a means of payment a neutral description acknowledging their intended function, not a validation of price stability or safe-haven status.

What are the implications for the entire industry?

The IMF’s inclusion of digital assets in BPM7 is a watershed moment for the crypto industry. It not only offers clarity to policymakers and statisticians but also opens the door for mainstream recognition of digital assets in national accounts, cross-border flows, and global financial regulation.

As adoption grows and digital finance evolves, this new classification could be the starting point for how countries treat crypto with the same seriousness as other asset classes.