- Bitcoin breaks six-week resistance, eyes next key hurdle on the path to refreshing all-time high.

- On-chain clues, market chatter point to long-term holders setting sights on $140K.

- Macro mix favors BTC upside — US trade deal hopes, Trump’s “Big, Beautiful Bill” signal, and job data loom.

Bitcoin (BTC/USD) holds steady around $109K during Thursday’s European session, confidently defending the previous day’s breakout above a six-week resistance.

This cautious but growing optimism isn’t just technical — on-chain data and market whispers also suggest that BTC buyers are gearing up for another clash with a key multi-month resistance, aiming for the much-discussed $140K target.

Key On-Chain Signals

Beyond breaking a six-week descending trendline and growing market optimism fueled by US trade deals, Trump’s tax and spending bill hopes, and a likely strong jobs report, several on-chain signals keep Bitcoin (BTC/USD) buyers confident. Notably, the Market Value to Realized Value (MVRV) metric and Unrealized Profit/Loss stand out, highlighting a bullish bias among Long-Term Holders (LTHs).

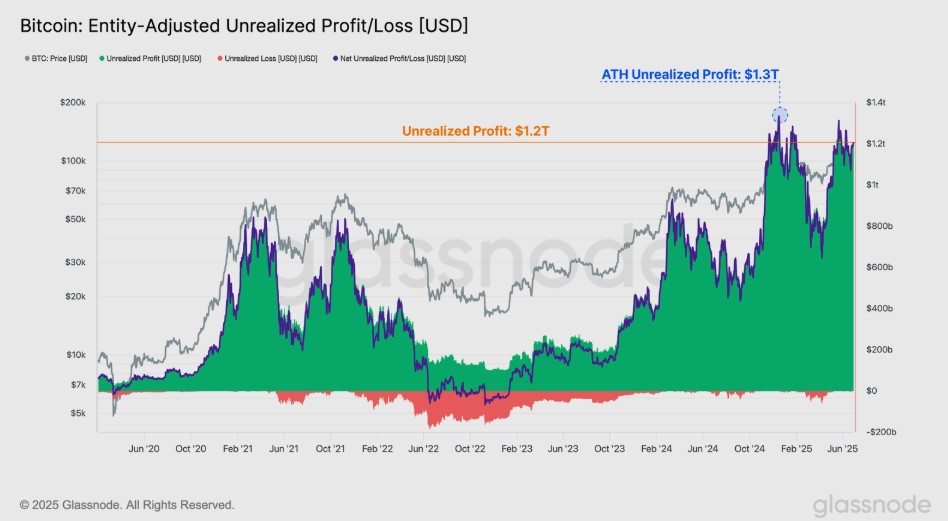

Unrealized Gains

As per the latest report from Glassnode, the combined unrealized BTC gains stand around $1.2 trillion, speedily approaching the record top of $1.3 trillion marked during late 2024. This suggests the unrealized average gains over 125% per investor.

Source: Glassnode

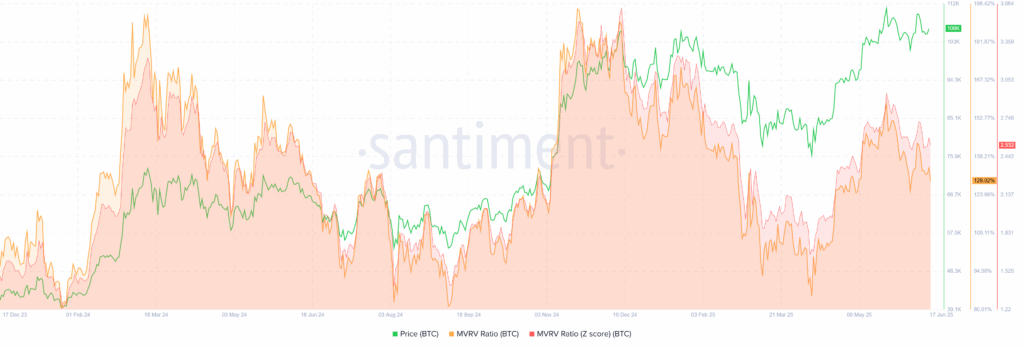

MVRV Ratio & MVRV Z Score

Looking at Bitcoin’s MVRV Ratio and MVRV Z-Score charts from Santiment, current levels suggest there’s still room to run. The MVRV ratio sits near 135%, down from ~160% in May and well below the late 2024 peak around 195%. Meanwhile, the MVRV Z-Score is at 2.5, compared to 2.95 in May, 3.63 in December 2024, and 3.23 in March 2024. When lined up with BTC/USD price points — ~$112K in May, ~$109K in December, and ~$74K in March — it’s clear the market isn’t near overbought levels yet.

Source: Santiment

Notably, crypto writer Darkfost highlighted in a recent Quicktake blog post that the aggregate cost basis — or realized price — for long-term holders (LTHs) is around $33,800. He noted that the price level where LTHs’ unrealized profits would match 2024 highs acts as a “market magnet,” adding: “To return to those profit levels, BTC would need to reach $140,000 — a price many are calling for.”

In addition to Darkfost’s insights, Cointelegraph and trader Rekt Capital have also maintained a bullish outlook on Bitcoin.

Technical Analysis

Bitcoin’s decisive upside break above a six-week-old descending trendline is reinforced by a strengthening 14-day Relative Strength Index (RSI) hovering near 60, alongside bullish signals from the Moving Average Convergence Divergence (MACD) indicator — all of which keep buyers optimistic about further gains.

BTC/USD: Daily Chart Suggests Further Upside

Source: Tradingview

With the recent resistance breakout, Bitcoin (BTC/USD) bulls now look poised to challenge the upward-sloping resistance line from late December 2024, currently near $114K. However, the 14-day RSI could approach the overbought threshold of 70.00 by then, potentially slowing the rally. If bullish momentum holds, BTC may quickly advance toward the 50% and 61.8% Fibonacci Extension (FE) levels of the April–June move, situated around $117K and $122K, respectively.

Should BTC/USD break past the $112K barrier with conviction, further upside could be tested at the 78.6% and 100% FE levels — near $128K and $135K — before aiming for the much-discussed $140K target.

On the flip side, bearish pressure is unlikely to return unless BTC sees a daily close below the previous resistance line from late May, around $108,600. If that breaks, the weekly low of $105,300 and the 100-day Exponential Moving Average (EMA) at $100,800 could come into play. Further south, the 200-day EMA near $95K stands as the final line of defense for BTC bulls.

Conclusion

Bitcoin’s sustained hold above key breakout levels, backed by improving momentum indicators and bullish on-chain signals, keeps the broader outlook constructive. Long-term holders (LTHs) continue to show strong conviction, as reflected in MVRV and unrealized profit/loss metrics. Macro tailwinds — including U.S. trade optimism, fiscal stimulus hopes, and positive employment expectations — further support the case for continued upside. While near-term resistance could test buyer strength, the path toward $140K remains in focus, provided key support zones hold firm.