Key Takeaways

- Metaplanet has Acquired an additional 2,205 Bitcoin, bringing its total holdings to 15,555 BTC.

- Metaplanet is positioning (BTC) at the heart of its treasury, aiming to enhance shareholder value through aggressive accumulation.

- Metaplanet raised ¥74.9B ($510M) by issuing 54M new shares to EVO FUND, marking the first step in its $5.4B Bitcoin accumulation strategy.

Japan-listed crypto giant Metaplanet has acquired an additional 2,205 Bitcoin, the company announced on X on Monday. The purchase, valued at approximately ¥34.49 billion ($213 million), brings the firm’s total holdings to 15,555 BTC.

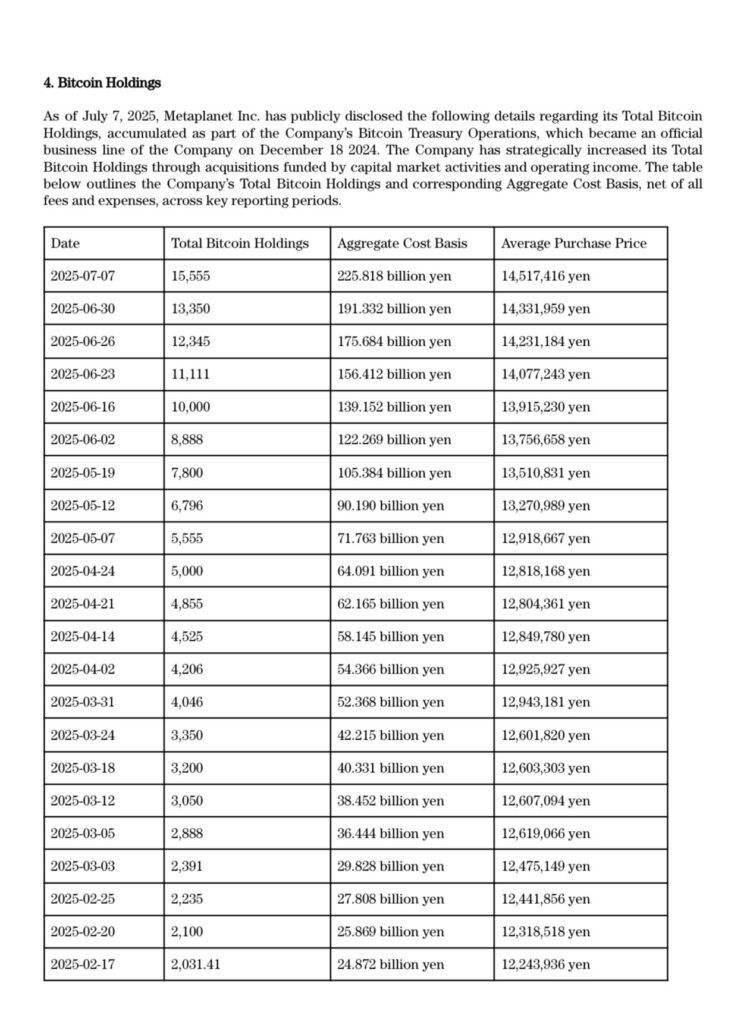

The Tokyo‑based company, which formally launched its Bitcoin Treasury Operations in December 2024, has been aggressively expanding its crypto reserves this year. With the latest acquisition, Metaplanet’s cumulative Bitcoin investment now stands at approximately $1.54 billion, at an average purchase price of $99,307 per BTC.

According to the company’s balance sheet, Metaplanet has added over 13,500 BTC over the past five months, positioning itself among the most active corporate Bitcoin accumulators globally.

The purchases are part of a bold strategy to establish Bitcoin as the core pillar of its corporate treasury, with the company emphasizing the asset’s potential to significantly enhance shareholder value through its proprietary BTC Yield metric.

Metaplanet Advances 555 Million Plan with Fresh Funding and U.S. Focus

This latest purchase follows a major capital raise announced by Metaplanet last month. On June 25, the company disclosed it had secured ¥74.9 billion ($510 million) through the issuance of 54 million new shares.

The shares were acquired via the exercise of special stock acquisition rights granted to EVO FUND. The transaction marked the first significant milestone in Metaplanet’s “555 Million Plan”, a long-term strategy to raise $5.4 billion exclusively for Bitcoin investments.

Additionally, on July 4, Metaplanet also executed a ¥9 billion ($61 million) partial bond redemption, funded through proceeds from the exercised rights. According tot the company, this move aims at increasing liquidity for Bitcoin acquisition and managing capital structure efficiently.

Looking ahead, the company plans to inject up to $5 billion into its U.S. subsidiary, Metaplanet Treasury Corp., based in Florida. The capital will be used to strengthen global execution capabilities and support its expanding footprint in the U.S., which Metaplanet views as the financial epicenter for Bitcoin adoption.

In conclusion

Metaplanet’s sustained accumulation of Bitcoin reflects the growing shift among companies toward digital asset-based treasury strategies.

By financing its purchases through equity issuance and bond restructuring, the company has positioned itself as one of the most visible corporate adopters of Bitcoin in Japan.

While the approach has driven notable gains in share price and BTC Yield, its long-term impact will depend heavily on market conditions and regulatory developments. As Bitcoin adoption expands globally, Metaplanet’s stock may increasingly serve as a proxy for institutional crypto exposure, even as it remains subject to the volatility and risks inherent in digital asset markets.

Read More: US Dollar Index Trims Post-NFP Gains On Independence Day, What’s Next?