Key Takeaways

- Google signed a $2.4B licensing deal with AI startup Windsurf, gaining access to its code-generation technology.

- Windsurf’s CEO and top executives will join Google’s DeepMind unit to advance agentic AI initiatives.

- The deal structure leaves Windsurf independent, offering partial liquidity to investors without a full acquisition.

- Alphabet shares rose as investors reacted positively to the strategic AI move.

AI startup Windsurf finalized a deal with Google on Friday, July 11, under which CEO Varun Mohan, co-founder Douglas Chen, and key R&D staff will join the tech giant to accelerate its development of agentic AI technologies.

The departing executives will join Google’s DeepMind division, while the majority of Windsurf’s employees will remain in place to continue building the company’s enterprise AI platform.

As part of the deal, Google will pay $2.4 billion in license fees for non-exclusive access to portions of Windsurf’s code-generation technology, while the team joining DeepMind will focus on agentic coding initiatives, contributing to the Gemini AI program, according to a Reuters report.

The deal does not involve equity or a controlling stake, allowing Windsurf to operate independently and its backers to retain ownership while gaining partial liquidity through the licensing arrangement.

The agreement comes after a failed acquisition attempt by OpenAI, which had been in talks to acquire Windsurf for approximately $3 billion. Those talks reportedly broke down over exclusivity concerns and timing, opening the door for Google’s offer.

Google Shares (Alphabet) Rise on Windsurf Deal & DeepMind Expansion

Alphabet Inc. shares (GOOGL.O) climbed on Monday following the announcement of a $2.4 billion licensing deal with AI startup Windsurf, a move seen by investors as a reaction to the company’s aggressive push into agentic AI.

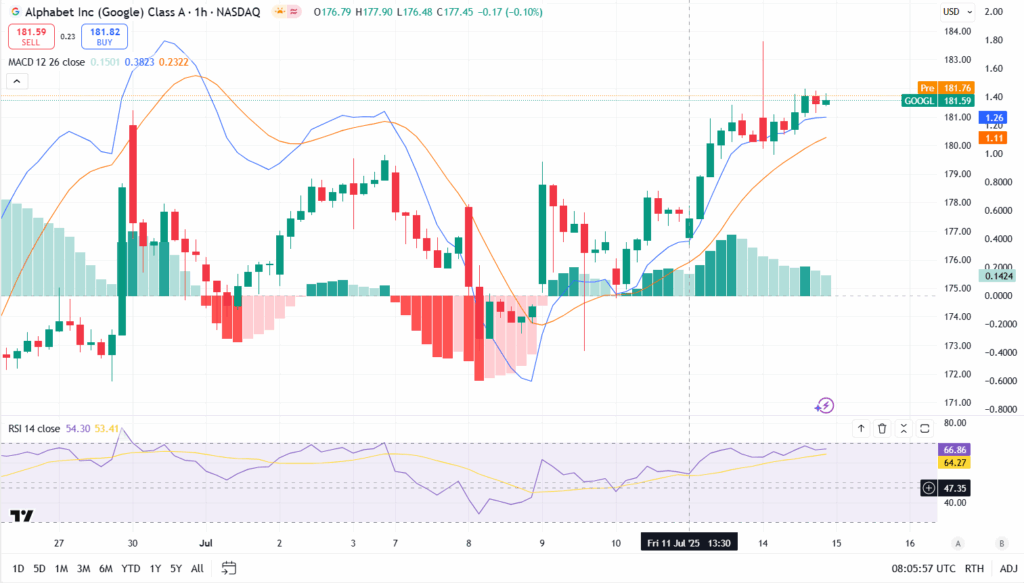

Short-Term Momentum: 1-Hour Chart

In the 1-hour chart, Alphabet stock touched intraday highs of $181.76 before pulling back slightly to close at $181.59, marking a minor -0.10% dip amid broader market consolidation. Despite the pullback, the recent breakout from the $176–$179 range signals ongoing bullish momentum in the short term.

- RSI (Relative Strength Index) is at 54.30, slightly above the neutral 50 level. This suggests the stock isn’t overbought or oversold, but recent gains are being digested. It hints at buyer caution near resistance levels while still leaving room for the rally to continue.

- MACD (Moving Average Convergence Divergence) shows a continued bullish setup, with the MACD line staying above the signal line. This suggests that upward momentum is still in play, though the narrowing histogram bars point to a possible short-term slowdown or pause in gains.

The Bigger Picture: Daily Chart

On the daily timeframe, Alphabet shares closed at $181.56, up +0.76% for the session and approaching highs last seen in March. The stock has been climbing steadily for more than two weeks, and Monday’s move signals a potential breakout above a key resistance level near $180.

- MACD shows a bullish crossover that occurred in late June, with expanding positive histogram bars. This points to increasing upward momentum, and the MACD line staying above the signal line suggests the bullish trend is gaining strength.

- RSI is currently at 62.01, edging closer to the overbought zone at 70. This indicates strong buying pressure, but also warns that the rally could face resistance soon, especially if market sentiment shifts.

Outlook

Alphabet’s recent price action reflects renewed investor confidence in its AI strategy, with the Windsurf licensing deal seen as a strategic move in the escalating race for agentic coding talent. The price surge above the $180 level shows growing investor optimism and could pave the way for Alphabet to retest its March highs in the $183–$185 range.

Short-term indicators show some cooling, but overall momentum remains intact. If buying pressure continues and broader tech sentiment stays favorable, Alphabet could see further upside toward $188–$190 in the coming weeks.

However, investors may watch for signs of consolidation near current levels, especially as RSI approaches overbought territory.

The stock’s response highlights that AI developments, rather than just earnings, are becoming key drivers of valuation across big tech.

Read More: True Trading Launches: The First AI-Powered DEX That Learns as You Trade