- Ethereum hits six-month high; Bitcoin slips despite crypto optimism.

- Institutional inflows are similar for ETH and BTC, but exchange supply and funding rates favor Ethereum.

- ETH/BTC ratio climbs to five-month high, showing Ethereum’s edge, but overbought RSI may limit gains beyond 0.030.

Crypto optimism from U.S. House bill progress lifted major coins on Thursday, but Bitcoin slipped 0.7% to $117,800 while Ethereum stole the show, hitting a six-month high near $3,480 before settling at $3,410, up 1.2%.

Strong Ethereum buys by SharpLink Gaming and BitMine Immersion, combined with rising ETH ETF inflows and falling exchange reserves, fueled ETH’s rally. Meanwhile, Bitcoin’s gains were supported by Strategy’s growing reserves and robust BTC ETF inflows, keeping losses in check despite recent profit-taking pressure.

ETH vs. BTC

The ongoing ETH vs. BTC battle heats up as Ethereum gains ground with a six-month high and a rising ETH/BTC ratio, challenging Bitcoin’s dominance.

Company Plays

SharpLink Gaming bought $225M worth of Ethereum in July, while BitMine Immersion Technologies raised $250M in June and now holds over $500M in ETH. Meanwhile, Michael Saylor’s U.S. software firm Strategy has grown its market cap from under $2B to $128.5B in five years, thanks to its massive Bitcoin stash of 601,550 BTC—valued at $70B—in its treasury.

ETF inflows

Spot ETF inflows reveal growing excitement for top cryptocurrencies, with U.S. spot Ethereum ETFs hitting a record $2.27 billion in July—marking a fourth straight month of gains, according to sosovalue data.

Meanwhile, U.S. spot Bitcoin ETFs also rose for the fourth month but remain well below their November 2024 record, posting $4.89 billion in inflows for July.

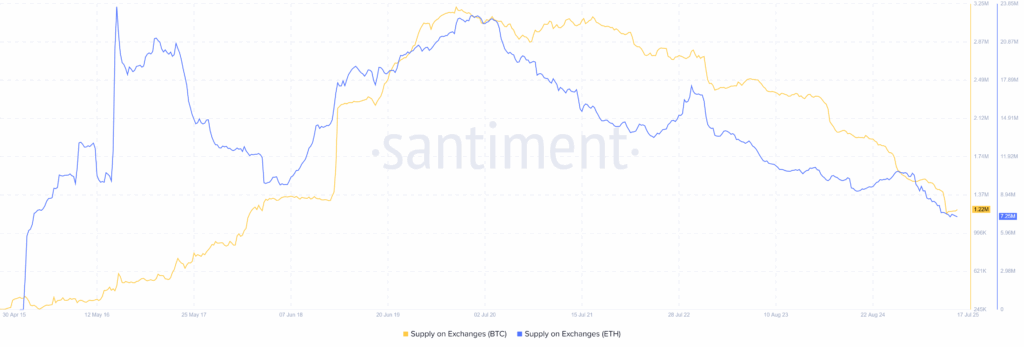

Supply on Exchanges

Institutional demand for Bitcoin and Ethereum is similar, but supply tells a different story—Ethereum leads. Year-to-date, Ethereum’s supply on centralized exchanges dropped nearly 31% to 7.25 million, while Bitcoin’s fell about 20% to 1.22 million, according to Santiment data. Lower ETH supply signals stronger price gains, making it more attractive to bulls than Bitcoin, especially given Bitcoin’s high price.

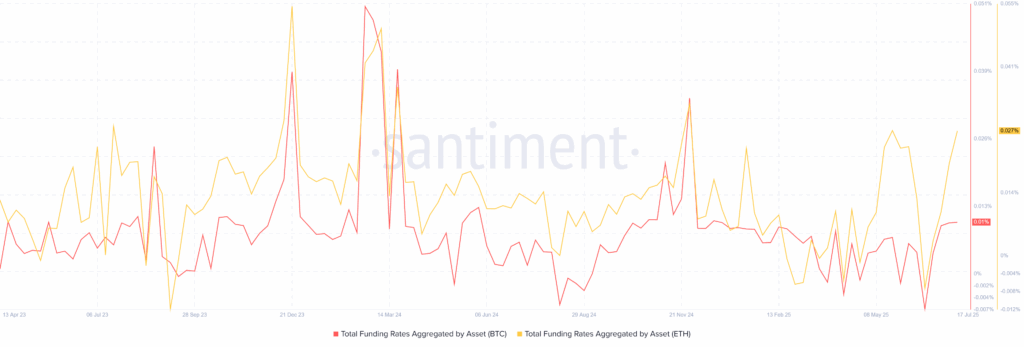

Funding Rates

Besides lower exchange supplies, funding rates also favor Ethereum traders over Bitcoin ones. According to Santiment data, ETH’s funding rate stands at 0.027%, more than double BTC’s 0.01%, indicating higher profitability for ETH traders.

The ETH/BTC Breakout

The ETH/BTC ratio has broken out above both its 200-day Simple Moving Average (SMA) and a two-month-old resistance, pushing to a five-month high and signaling stronger momentum for Ethereum over Bitcoin.

The 14-day Relative Strength Index (RSI) indicates overbought conditions, warning of potential resistance ahead, while the Moving Average Convergence Divergence (MACD) shows bullish momentum, highlighting a crucial six-month horizontal resistance zone around 0.03000.

Conclusion

Ethereum’s recent strength over Bitcoin—highlighted by record ETF inflows, shrinking exchange supplies, and a breakout in the ETH/BTC ratio—signals growing investor preference for ETH. However, with overbought RSI levels suggesting a potential pause or pullback near the key 0.030 resistance, traders should stay cautious. Looking ahead, if Ethereum clears this hurdle, it could pave the way for further gains, while Bitcoin’s stability amid profit-taking hints at continued resilience. Monitoring these technical and market dynamics will be key for navigating the evolving crypto landscape.