Key Takeaways:

- AuCan Gold is launching one of Canada’s largest tokenised gold initiatives, aiming to tokenise 1.5 million ounces of gold reserves.

- Dubai-based virtual asset hub TheBlock will oversee tokenisation infrastructure and regulatory compliance.

- The AuCan Gold Token will be backed by corporate resource assets, while the AuCan Pro Token entitles holders to one redeemable ounce of gold at a future delivery date.

- The ecosystem will accept only qualified investors initially, with broader access anticipated in the future.

Canadian gold exploration and management firm AuCan Gold Inc. is launching one of the country’s largest tokenised gold initiatives, bringing 1.5 million ounces of gold reserves onto the blockchain in partnership with Dubai-based virtual asset chamber TheBlock.

The initiative, currently accessible to accredited investors, includes the rollout of two regulatory-compliant real-world asset (RWA) tokens. The first, the AuCan Gold Token, is backed by the company’s physical resource assets in Ontario’s Abitibi region. The second, the AuCan Pro Token, offers full holders’ entitlement to one ounce of redeemable gold at a future date, with price initially below current spot levels.

The project will span six properties covering more than 8,700 hectares in Ontario’s Timmins region, one of the country’s most established mining sites, the company said in a press release.

AuCan Gold also operates a permitted regional mill nearby and is actively assessing additional sites for expansion. The company believes total reserves could exceed initial estimates, citing promising geological structures often associated with deeper, high-grade gold deposits.

Real World Asset tokenisation of Canadian gold assets and physical gold provides global investors, both small and large, with a new and innovative way to participate in the long-term growth of one of the largest gold producing and geo-politically stable regions in the world,” said Leon Dadoun, President of AuCan Gold Inc.

AuCan Dubai, the company’s wholly owned subsidiary, will oversee gold sourcing, acquisition, storage, and long-term management on behalf of token holders. The entity will manage a diversified portfolio of internally produced and third-party gold, according to the company.

Meanwhile, TheBlock. will manage the tokenisation infrastructure, supporting the development of a compliant real-world asset (RWA) framework and facilitating the ecosystem’s launch preparations.

This is exactly the type of project TheBlock. was built for, real assets, innovation, and clear tokenisation pathways,” said Farbod Sadeghian, CEO and Founder of TheBlock.

The full tokenised ecosystem is set to launch in Q4 2025. While the initial offering is limited to qualified investors, broader participation may follow, subject to regional securities regulations.

From Vault to Chain: The Rise of Digital Gold

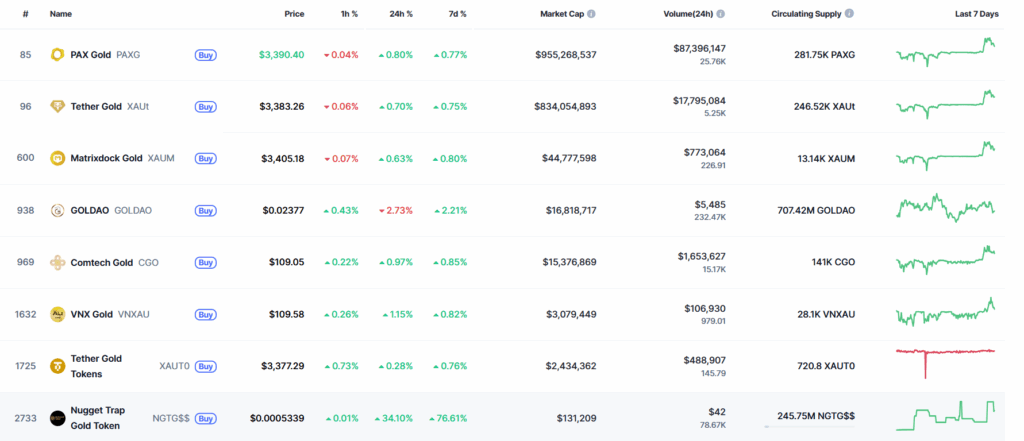

As the real-world asset (RWA) market matures, investor interest is increasingly shifting toward tokenised gold, which is viewed as a stable, flexible on-chain store of value. The digital gold market is now worth nearly $1.87 billion, driven by growing demand for tokens that combine the reliability of real-world gold with the accessibility of blockchain.

Top players like PAX Gold (PAXG) and Tether Gold (XAUT) dominate the space, each with market caps above $950 million and $830 million, respectively, and both closely tracking the spot price of gold.

Newer names, such as Matrixdock Gold (XAUM) and Comtech Gold (CGO), are gaining traction with more accessible, fractional ownership models.

On the edge of the market, projects like GOLDAO and Nugget Trap Gold Token, characterized by very small market caps, extreme volatility, and limited liquidity, serve more speculative investors, blending the digital gold trend with higher risk.

While stablecoins continue to dominate on-chain RWA volumes, gold-backed tokens are rapidly gaining favor among investors seeking digital assets anchored in real-world value and more resilient against fiat volatility.

Read More: Abu Dhabi Judicial Department Adopts AE Coin for Payments