Key Takeaways

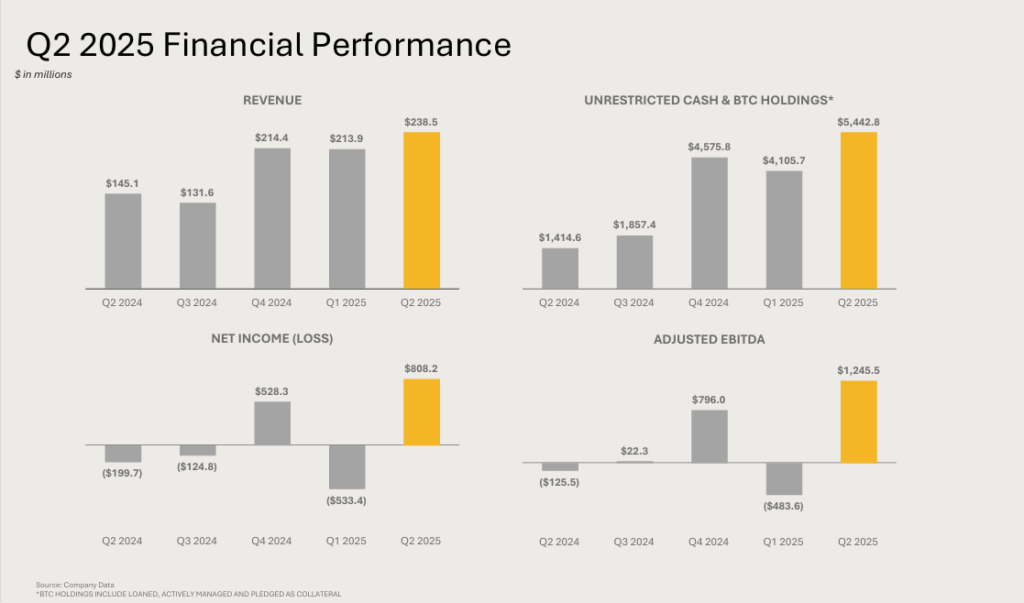

- Marathon posted $808M in Q2 report, marking its most profitable quarter to date.

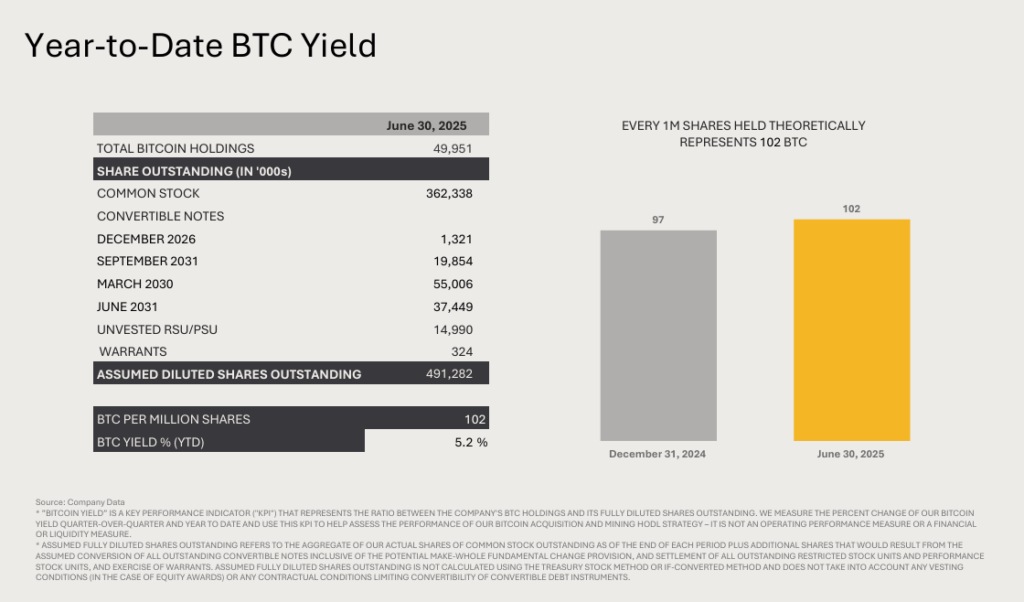

- Bitcoin holdings rose to 49,951 BTC, with 31% generating a 5.2% yield year-to-date.

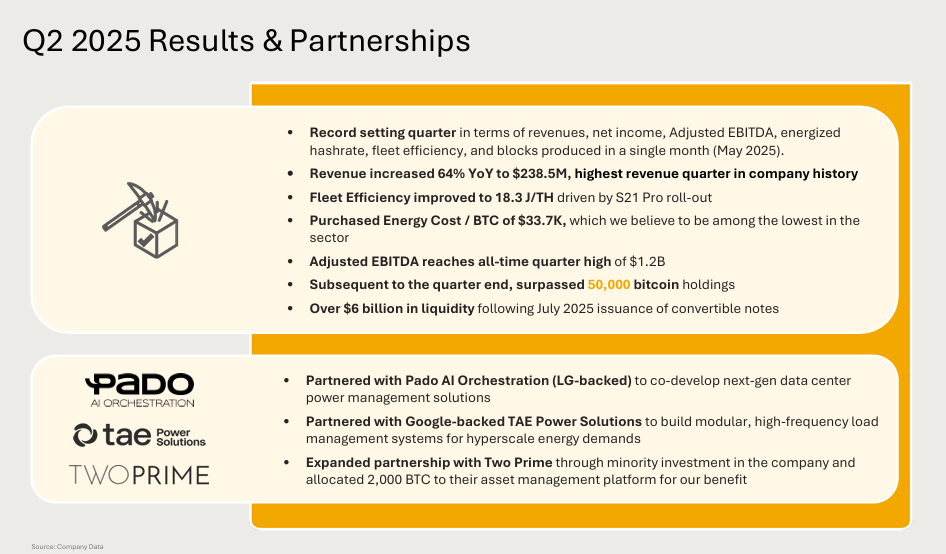

- Post-halving mining output remained strong with 2,358 BTC produced at $33.7K per coin.

- New partnerships signal a shift into energy infrastructure and institutional bitcoin services.

MARA Holdings reported on Tuesday a record second-quarter profit and a sharp increase in bitcoin holdings, as the cryptocurrency miner continued to scale operations and boost efficiency despite April’s halving event.

According to its Q2 report, Marathon Digital reported net income of $808 million, or $1.84 per share, for the quarter ended June 30, recovering from a $533 million loss in the previous quarter.

Additionally, revenue grew 64% year-over-year to $238.5 million, the highest in the company’s history.

The Las Vegas-based firm reported a 170% increase in bitcoin holdings from a year earlier, reaching 49,951 BTC at the end of the quarter. Approximately 31% of these assets are currently activated through lending, trading, or collateral arrangements, generating a year-to-date yield of 5.2%.

Moreover, bitcoin production increased 15% year-over-year to 2,358 BTC, despite reduced block rewards following the halving. MARA’s energized hashrate reached 57.4 EH/s, while its cost to mine one bitcoin averaged $33,700, which the company said remains among the lowest in the industry.

The company also announced further institutional-focused initiatives, including a 2,000 BTC allocation to asset manager Two Prime and strategic partnerships with TAE Power Solutions and Pado AI to develop power management technologies for data centers.

MARA Activates 31% of Bitcoin Holdings to Generate 5.2% Yield Year-to-Date

Beyond mining operations, MARA is also leaning into institutional-grade bitcoin asset management.

As of June 30, the company had activated approximately 31% of its bitcoin holdings, about 15,550 BTC, through lending, structured financing, and collateral arrangements.

These activities generated a 5.2% year-to-date yield, underscoring the firm’s strategy to treat bitcoin not just as a store of value, but as a productive treasury asset.

MARA Taps Two Prime to Develop Institutional Bitcoin Yield Strategy

In July, MARA allocated 2,000 bitcoin to asset manager Two Prime as part of a strategic move to develop institutional-grade bitcoin yield solutions.

The company described the initiative as an effort to combine disciplined risk management with long-term value creation, as demand rises from corporates, funds, and sovereigns exploring BTC as a treasury reserve.

The collaboration also builds on MARA’s push to position itself not only as a miner but as a provider of bitcoin-native financial services.

MARA Evolves as Miners Rethink Survival After Halving

The company’s record-breaking quarter, driven by efficient bitcoin production, strategic asset activation, and deepening institutional partnerships, highlights the survival mechanisms mining companies are adopting in the post-halving environment.

In addition to mining operations, the company is expanding into power and infrastructure solutions. MARA partnered with LG-backed Pado AI Orchestration to co-develop artificial intelligence-based systems for power load balancing across data centers. It also partnered with Google-backed TAE Power Solutions to design modular, high-frequency energy systems for hyperscale computing.

MARA’s strategic moves offer a potential blueprint for how bitcoin miners need to evolve to remain competitive following April’s Bitcoin halving, which reduced mining rewards by 50% and intensified pressure on operational efficiency and cost management.

Read More: Bitmain Bets on America: Chinese Bitcoin Mining Giant to Open First U.S. Factory