Key Takeaways:

- Hyperliquid’s influential trader, AguilaTrades, closes a short position with a loss worth over $1.8 million.

- AguilaTrades switches from short to long on ETH with 15x leverage worth $43.3 million.

- Ethereum’s on-chain analysis shows more ETH is being withdrawn from exchanges than deposited.

One of Hyperliquid’s most influential and well-known traders, going by the name AguilaTrades, just changed his trading position, going from shorting Ethereum (ETH) to going long on it. Going by the username @AguilaTrades with over 40K followers on X, the trader is quite infamous for massive leveraged positions on Hyperliquid (HYPE), ranging in millions of dollars. Hyperliquid is a decentralized perpetual exchange operating on its own layer-1 blockchain, HyperEVM.

AguilaTrades has opened multiple short positions on ETH on several occasions in the past, such as a $42 million short position using 25x leverage and $128.45 million position using 15x leverage.

In another case, prior to these trades, the trader opened another short position on ETH worth $122.35 million before closing it at a loss of $1.86 million.

After facing three losses from those short positions, AguilaTrades flipped to a long one following the market’s positive sentiment surrounding ETH. The trader’s long trade is worth $43.3 million (10,000 ETH) at 15x leverage.

After undertaking a series of short positions on ETH, the trader’s changed stance sends a sense of optimism into the markets. Several experts shared their stance on AguilaTrade’s position. Famous crypto investor and Key Opinion Leader (KOL), Ted Pillows, tweeted about this, saying-

Lesson learned: don’t short Ethereum.

At the time of writing, AguilaTrades’ current 15x leveraged long position on ETH is sitting on an unrealized profit of over $1.4 million, with the entry price at $4,309.19 and liquidation price at $4,028.14.

On-Chain Analysis

According to data from Santiment, upon observing ETH’s active withdrawals and active deposits, we notice a higher number of active withdrawals from exchanges rather than active deposits. Active deposits or withdrawals refer to the number of unique deposit or withdrawal addresses that were active on a specific day for a specified asset.

This further suggests a sentiment of hoarding or accumulation amongst active investors or those holding for a medium-short-term basis. The number of ETH being withdrawn is 9,719, and the number of ETH being deposited is 6,810.

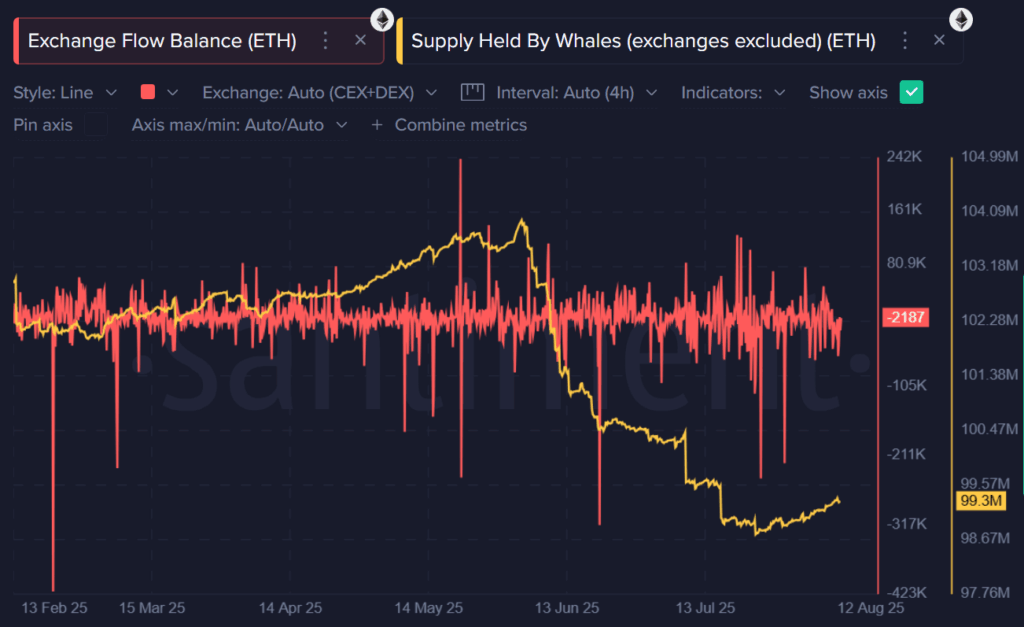

This graph illustrates ETH exchange flows (red) and whale holdings outside exchanges (yellow). The red line represents the net flow of ETH onto and off exchanges. Positive spikes indicate that more ETH is being transferred to exchanges (frequently a sign of potential selling), whilst negative spikes indicate that ETH is being removed from exchanges (usually bullish as coins are moved to wallets or staked). Currently, the exchange flow balance stands at negative 2,187 ETH at the time of writing.

In the graphic below, the yellow line shows the amount of ETH held by large holders (whales) outside the exchanges. From late May to early June, whales were heavily accumulating, but mid-June saw a sharp drop, suggesting significant selling or redistribution. The whale holdings further fell before eventually stabilizing. Nonetheless, not at the same levels as before the massive fall in mid-June. If this trend continues alongside ETH leaving exchanges, it could create bullish price pressure. However, despite a big drop in whale holdings, the price of ETH kept increasing solely due to institutional interest from exchange-traded funds (ETFs) and corporate treasuries.

AguilaTrades’ shift from repeatedly shorting ETH to taking a substantial long position marks a change in sentiment, both for the trader and the broader market. The trend observed based on on-chain data shows that coins moving off exchanges continue alongside stable or rising institutional adoption, which could fuel additional upward momentum for Ethereum’s price.