Key Takeaways:

- Arc Blockchain Debut: Circle unveiled Arc, an open Layer-1 blockchain built for stablecoin payments, FX, and capital markets, with USDC as its native gas token.

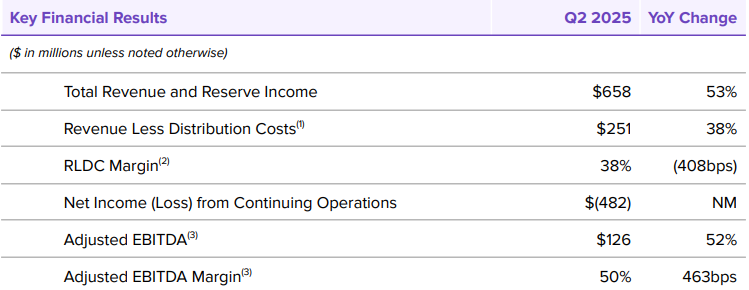

- Strong Revenue Growth: Q2 revenue and reserve income surged 53% year-over-year to $658 million, driven by higher USDC circulation.

- USDC Expansion: USDC in circulation rose 90% from a year earlier to $61.3 billion, boosting Circle’s stablecoin market share to 28%.

- IPO-Driven Loss: Despite strong operations, Circle posted a $482 million net loss due to $591 million in non-cash charges from its $1.2 billion IPO.

Circle Internet Group, widely known as the issuer of the USDC stablecoin, announced on Tuesday, alongside its quarterly earnings, the launch of Arc, an open Layer-1 blockchain aimed at powering stablecoin payments, foreign exchange and capital markets activity.

According to the report, Arc is an enterprise-grade infrastructure built to integrate directly with its existing platform and services, while maintaining interoperability with the dozens of blockchains that already support USDC.

Moreover, the new Blockchain is Ethereum Virtual Machine-compatible and will use USDC as its native gas token. It features an integrated stablecoin foreign exchange engine, sub-second settlement finality, and opt-in privacy controls to address a range of regulatory and commercial requirements.

The company described the launch of Arc as a “defining moment” in its transformation from a stablecoin issuer into a broader blockchain infrastructure provider, noting that a public testnet is scheduled for fall 2025, followed by wider deployment.

Earnings Beat on Revenue Growth, IPO-Related Losses

Circle reported total revenue and reserve income of $658 million for the second quarter, up 53% year-over-year, driven largely by growth in USDC circulation.

Additionally, USDC in circulation ended the quarter at $61.3 billion, up 90% from a year earlier, and reached $65.2 billion as of August 10, 2025. The company’s stablecoin market share climbed to 28%, a 595 basis point increase year-over-year.

Despite the growth, Circle posted a net loss of $482 million. The company said this was largely the result of $591 million in non-cash expenses linked to its IPO, which included $424 million in stock-based compensation, and $167 million from a higher valuation of its convertible debt as the company’s share price rose.

What the Arc Launch Could Mean for the Market

Analysts say the Arc launch signals Circle’s ambition to evolve from a stablecoin issuer into a broader financial infrastructure provider, potentially opening new revenue streams beyond USDC’s existing payment and settlement use cases.

If widely adopted, Arc’s integrated FX capabilities and faster settlement could position USDC at the center of digital finance, while intensifying competition with other Layer-1 networks targeting institutional-grade transactions.

Read More: Paxos Seeks National Trust Charter in Race for Stablecoin Dominance