Key Takeaways

- Gemini is all set to go public after a recent SEC filing reveals that it filed for a Nasdaq listing under the ticker GEMI.

- Gemini and Ripple Labs had reached a financing agreement back in July that allows the exchange to borrow up to $75 million.

- Gemini is also dividing its operations between two organisations.

Crypto exchange Gemini is all set to go public after a latest SEC filing reveals that it filed for a Nasdaq listing under the ticker GEMI. However, what has caught investor attention is the firm’s huge half-yearly losses and a credit facility provided by Ripple.

In the first half of 2025, Gemini reports a net loss of $282.5 million, which was significantly higher than the $41.4 million loss for the same period the previous year. On the other hand, the exchange also revealed a credit arrangement with Ripple Labs that provides access to loans of up to $75 million.

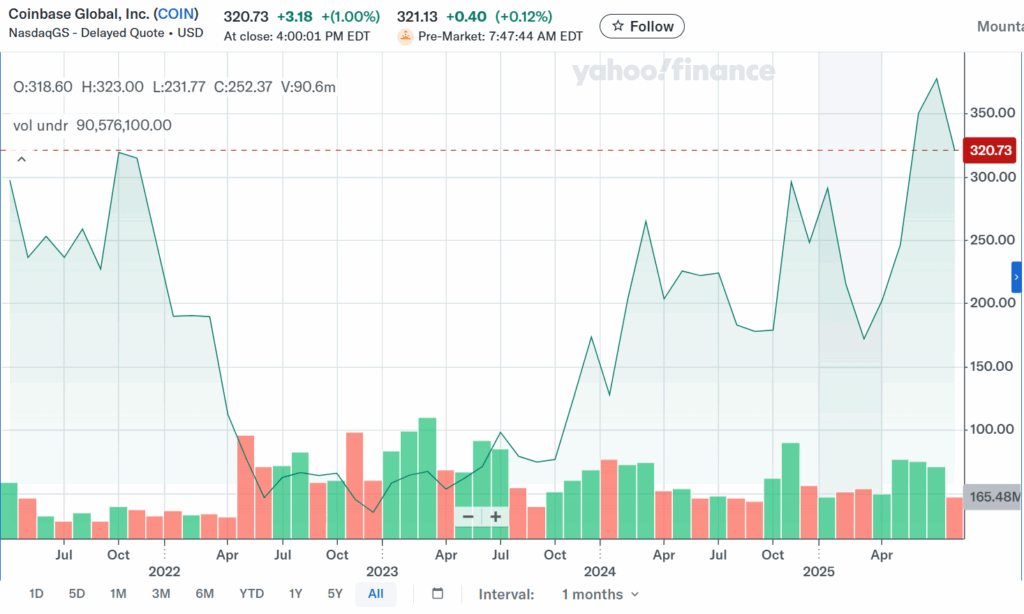

Gemini will become the third cryptocurrency exchange in the US to go public with the IPO. Coinbase (COIN), which debuted on the Nasdaq in 2021, was the first. More recently, CoinDesk’s parent business, Bullish (BLSH), had its New York Stock Exchange debut just last week. By expanding the number of cryptocurrency exchanges in public markets, Gemini’s IPO would provide investors with an additional avenue to access the market.

Gemini’s Losses Reflect Tough Year For the Crypto Exchange

Gemini’s current financial difficulties have made many wonder if the exchange will be able to overcome IPO related hurdles. The exchange lost $282.5 million in the first half of 2025, which is significantly more than the $41.4 million it lost in the same period the previous year.

Additionally, its revenue decreased little from $74.3 million to $68.6 million. The business has pointed fingers at declining platform trade, increased legal fees, and hiring expenses. However, Gemini’s figures demonstrate how difficult the previous year has been, despite indications of a revival in the larger crypto market.

Ripple’s Credit Facility Likely To Keep Gemini Afloat

The SEC filing also reveals that Gemini has a credit deal with Ripple, which is likely a way for the company to get funding or manage its finances. Essentially, Gemini is preparing to raise money through the stock market while dealing with financial challenges.

The financing agreement was finalised back in July and allows the exchange to borrow up to $75 million, with the possibility of loaning up to $150 million under specific terms.

Each loan must be secured by collateral, have a minimum amount of $5 million, and have an interest rate of 6.5% or 8.5%. Gemini has the option to withdraw money in Ripple’s RLUSD stablecoin if borrowing exceeds the first $75 million. The business hasn’t taken out any loans under this arrangement as of yet.

RLUSD could also benefit greatly from this deal. Gemini will generate genuine demand and demonstrate that institutions have faith in RLUSD for significant transactions if it begins borrowing in the stablecoin. It also spotlights the token, increasing its liquidity and visibility in the cryptocurrency market. In general, the participation of a significant exchange such as Gemini may increase the recognition and usage of RLUSD.

Crypto Exchange Gemini Eyes Dual Entity Functioning

To remain adaptable and compliant, Gemini is dividing its operations between two organisations. The majority of customers will engage with Moonbase in Florida, while its New York subsidiary, Gemini Trust, manages regulatory needs.

Gemini may now provide services like staking without violating New York’s stringent BitLicense regulations thanks to this configuration. This will allow the business to continue serving consumers throughout the United States and developing while adhering to the law.