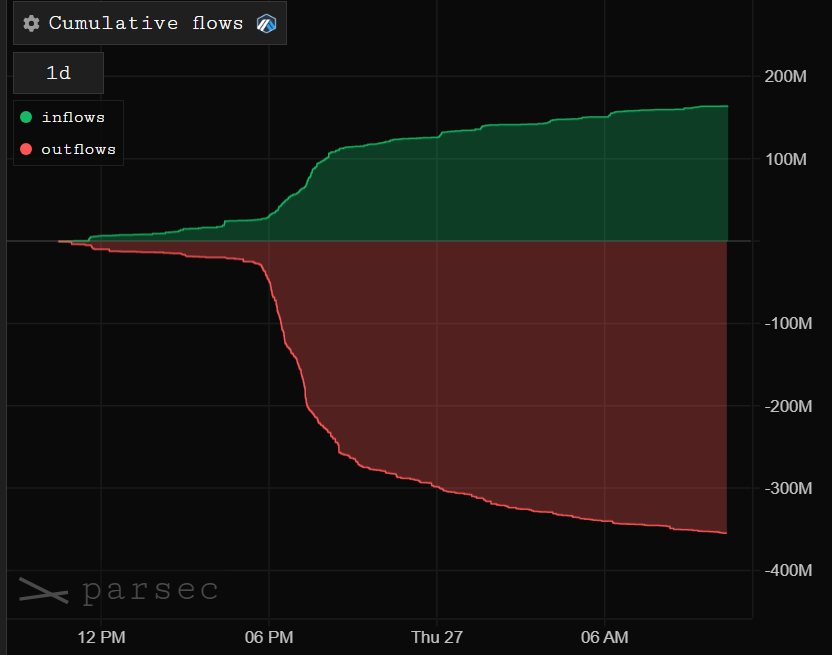

Back in 2023, an exploit on dYdX exposed the cracks in the system of Decentralized Exchange (DEXs). Now, another storm is brewing, and it’s Hyperliquid in the spotlight, another DEX player. Hyperliquid finds itself in hot water over the forced closing of positions involving JELLY token, triggering $340M in USDC outflows and renewed concerns over decentralization.

The issue arose when blockchain data from Parsec flagged a manipulation involving two wallets. One took a massive 430M JELLY short position and pulled its margin; the other opened a long, pushing prices up and causing forced liquidations. Hyperliquid’s Provider Vault (HLP) absorbed the losses, crashing from $540M to $195M (DeFiLlama).

Its native token HYPE fell 10%, and the value of its HLP vault plunged nearly 64% from its peak of $540 million to $195 million, intensifying investor concerns.

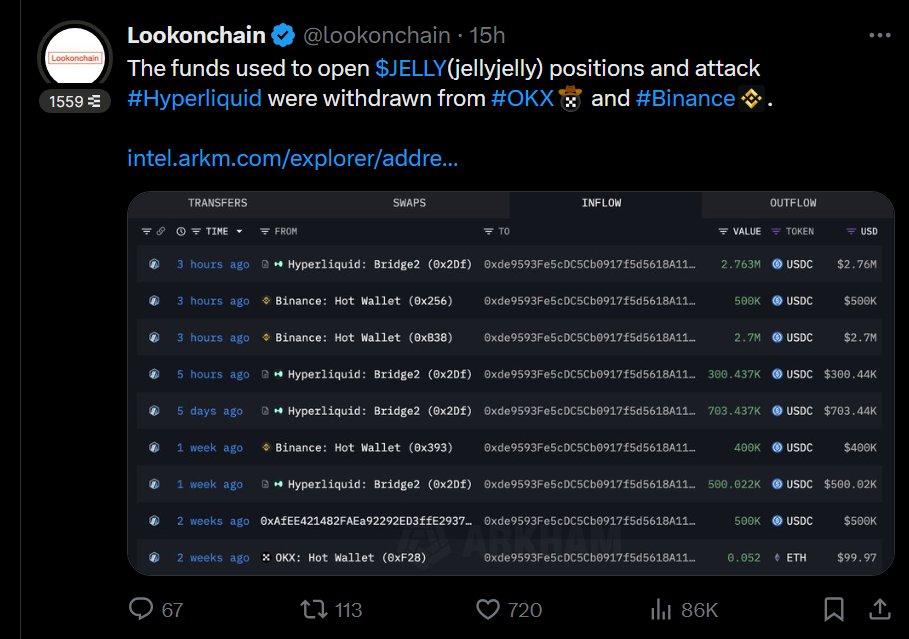

Arkham Intelligence a renowned blockchain analytics platform, later revealed the trader used three accounts to place opposing bets. While the trader withdrew $6.26M, a large short was inherited by the HLP vault. The trader’s final position may leave them with a $1M loss, depending on locked funds.

Hyperliquid reacted by force-delisting JELLY and settling positions at $0.0095, claiming a $703K profit, a move that drew backlash as their vault value decreased massively. Bitget CEO Gracy Chen called the response “immature” and likened Hyperliquid to FTX 2.0.

Not once, but twice?

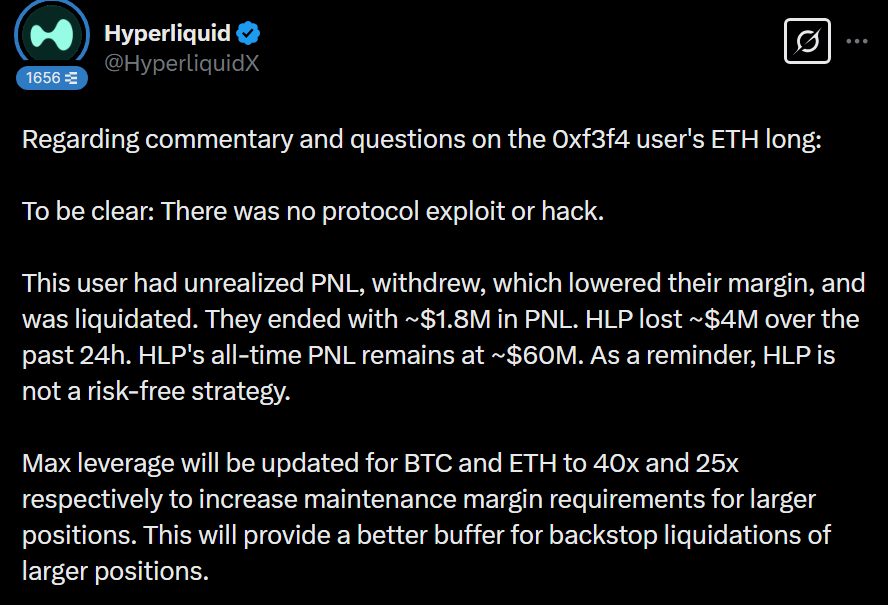

This isn’t the first controversy for Hyperliquid. Earlier in March 2025, the platform faced scrutiny after a $4 million loss on an ETH trade. Hyperliquid insisted it wasn’t an exploit but rather the result of a user withdrawing unrealized profits, inadvertently triggering liquidation.

Critics argue the real issue is Hyperliquid’s centralized-style response, despite its DEX branding. Emergency powers, unilateral delistings, and price settlements clash with the ethos of decentralization.

At its core, this was an oracle manipulation attack. With no circuit breakers, no safeguards against large trades on thin assets, and poor oracle defense, the system was gamed. The same playbook worked on dYdX use leverage, recycle profits, manipulate prices.

DeFi protocols must tighten up: position limits, circuit breakers, oracle diversity, and clearer governance. As flashy features attract traders, security must not be overlooked.

Reportedly, the attacker cycled over $7 million in capital across multiple accounts. This was high-stakes financial engineering with serious risks. For every exploit that profits, many others crash and burn.