Key Takeaways

- Crypto Pension: Coinbase and OKX are launching services for Australian Self-Managed Super Funds (SMSFs).

- This service targets a piece of Australia’s $2.8 trillion pool of retirement savings.

- In his strategy, Mitch addresses compliance and custody implications for retirees interested in crypto pension exposure.

Table of Contents

Crypto Pension Ahead

The rush to unlock crypto pension with institutional capital has found a brand new frontier: retirement savings. Crypto exchange titans Coinbase and OKX have now made a strategic move into Australia’s enormous pension system by launching services focused on Self-Managed Super Funds (SMSFs). This effort directly targets the country’s A $ 2.8 trillion retirement pool and is the most significant effort to bring digital assets into the mainstream retirement space.

The Adoption Path

The model has been built to bypass the technical and regulatory challenges that could once have deterred SMSF trustees. Rather than forcing investors through the maze of custody and compliance alone, we are seeing the exchanges guiding packaged up solutions. These include the custody, record keeping, ready for audit, and referrals to accounting and legal practices that know and understand the SMSF rules intimately. These solutions drastically decrease barriers to entry for retirees thinking about a crypto pension allocation.

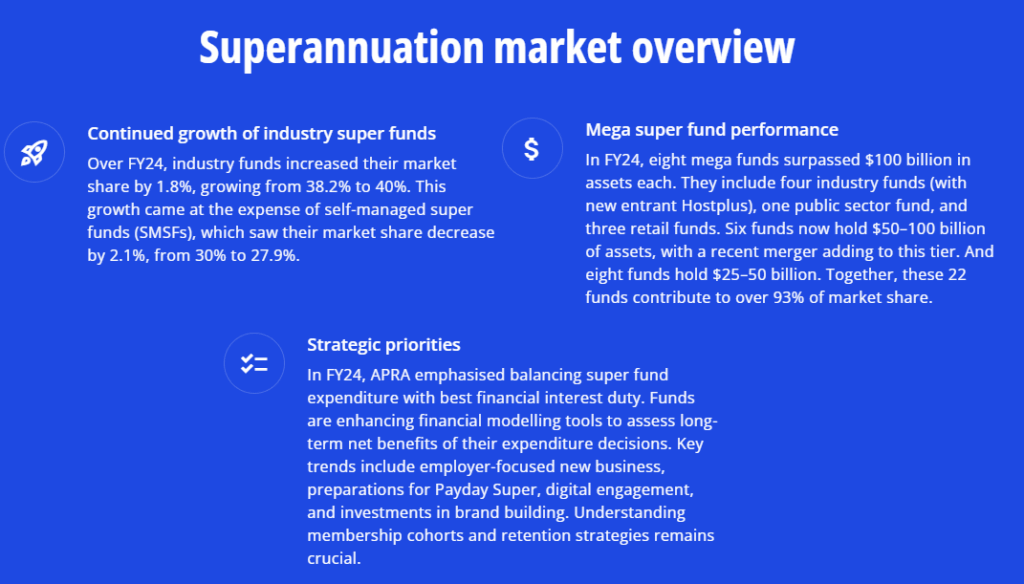

Market Overview

To this point, the addressable market is significant. SMSFs hold around a quarter of Australia’s retirement savings, and already hold an estimated A$1.7 billion (around $1.1 billion) in digital assets, increasing at a rate seven times higher than in 2021.

Coinbase reportedly has over 500 investors on its waiting list, the majority looking to allocate up to A$100,000 each. This has parallels to wider trends in retirement planning that appear to be coinciding with recent pro-crypto changes to 401(k) rules in the U.S.

These initiatives are a significant development for acceptance of crypto pension in this country. In putting together a compliant and structured pathway, OKX and Coinbase are not merely chasing liquidity but legitimizing digital assets as a legitimate long-term, conservative investment option. However, Australian regulators are still cautioning consumers not to be overexposed to this asset class, given its volatility.

Final Thought: With the constant blurring of the lines between traditional finance and crypto, the retirement savings of millions could be the next big battleground for institutional adoption.

FAQs

What is an SMSF?

A Self-Managed Super Fund is a retirement savings account in Australia, where the trustee is the individual member who makes the investment decisions, instead of a large fund manager.

How are Coinbase and OKX making it easier?

They are providing a bundled service that navigates the complex custody and audit compliance required by Australian legislation, which individuals would have to do on their own.

Is this a safe way to invest retirement savings?

Although the service claims to be compliant with Australian rules, regulators warn that crypto is a highly volatile asset class for retirement savings, and investors should be careful with their crypto pension allocations.

For more crypto pension strategies, read: Crypto in 401K Plans, Trump Ends Operation Checkpoint 2.0, BTC Futures Open Interest Surge