Key Takeaways:

- Helius Medical Technologies (HSDT) raised over $500 million to turn its strategy and build a massive Solana treasury.

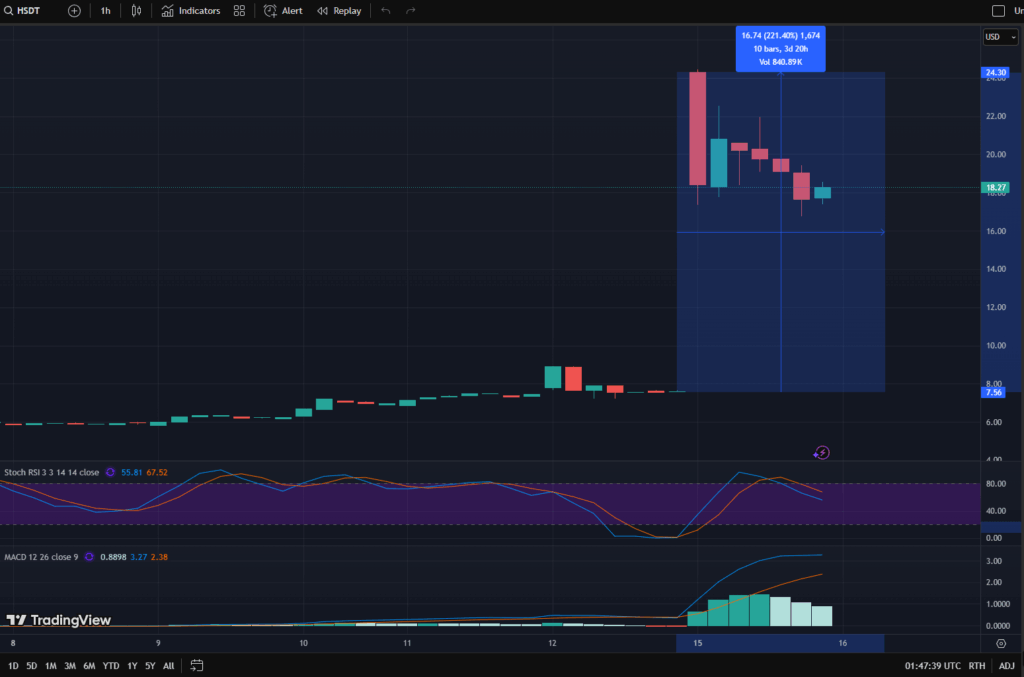

- The news sent its Nasdaq-listed stock (HSDT) soaring over 220% in a single day.

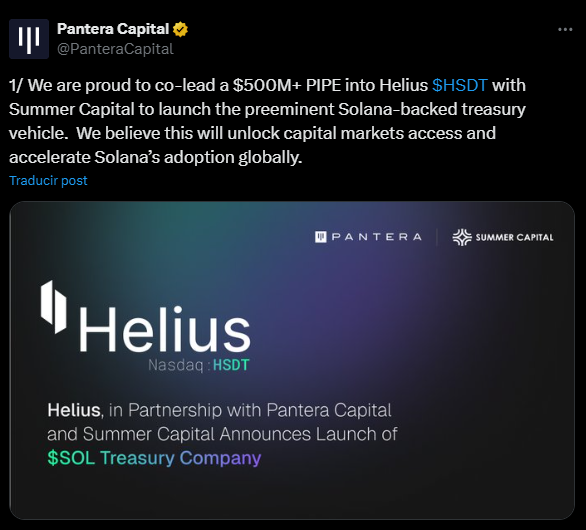

- The play is led by crypto giants partners Pantera Capital and Summer Capital, showing massive institutional conviction in Solana’s technology.

Table of Contents

From Medical Devices to Crypto Treasury

In a stunning corporate pivot, Helius Medical Technologies, a Nasdaq-listed company (ticker: HSDT) previously focused on neurological medical devices, is completely transforming its business. The firm announced it has successfully raised over $500 million in a private investment in public equity (PIPE) offering. The sole purpose of this capital? To acquire SOL and become a premier Solana treasury company, mirroring the strategy MicroStrategy pioneered with Bitcoin.

Support from Crypto Experts

The fundraising round was not only successful, but it was also oversubscribed and included true legends from the crypto finance community who participated as backers of this round. Pantera Capital, one of the oldest, established, and respected crypto-only investment firms, co-led this round with Summer Capital. A massive syndicate of other backers led the supporting investment syndicate, which included Arrington Capital, Animoca Brands, and HashKey Capital, to name just a few.

The level of backing for this funding round will serve as a heavy vote of confidence in Solana’s long-term projection as a foundational blockchain for a new, innovative financial system.

Read also: Promising SOL Strategies Set for Nasdaq Debut, Boosting Solana’s Institutional Profile

Why This Matters for Solana and Crypto

Helius’ pivot is the latest, and one of the biggest in a growing trend of public companies designating SOL as their primary treasury reserve asset. SOL has a native staking yield unlike non-yielding assets, which has the potential to generate income for the company. So far, this institutional demand provides tremendous buying pressure and liquidity for SOL, further legitimizing the ecosystem while flooding in even more traditional capital into the crypto sector.

Solana Treasury: The Updated Corporate Strategy

Helius has effectively established a revised corporate strategy: to utilize public market access to raise capital and invest that capital, in turn, into productive crypto assets. This development demonstrates an evolution of the market that leads institutional players to not only invest in crypto companies but to utilize public vehicles to gain direct exposure to these assets.

On the other hand, for the Solana ecosystem, this is a stamp perspective, demonstrating its appeal; achieving the retail base was only the minimum.

Final Thought: If a medical device company can turn into a crypto treasury giant overnight, what does this mean for the future of traditional corporate finance?

FAQs

What is a PIPE?

A Private Investment in Public Equity (PIPE) is an investment structure where investors acquire shares in a public company from the company directly, typically at a discount to the open market price.

What is a treasury company?

A treasury company structure is a company that holds a large portion of its assets in a particular crypto (e.g., Bitcoin, Ethereum, Solana) as an investment strategy in order to earn capital appreciation and yield.

Why is this good for Solana?

It provides a massive institutional investment and buying pressure into the SOL ecosystem, thus providing increased liquidity, legitimacy, and value of the asset as a reserve in the network.

For more institutional crypto adoption stories, read: Ondo & Pantera Launch $250M ‘Catalyst’ Fund in RWA Tokenization Arms Race