Key Takeaways

- JPMorgan Investment: The firm has made a $500 million allocation in Numerai’s AI-driven hedge fund, increasing its current $450 million Assets Under Management (AUM).

- Numerai’s fund returned 25.45% net to investors in 2024 with a Sharpe Ratio of 2.75 following a hard 2023.

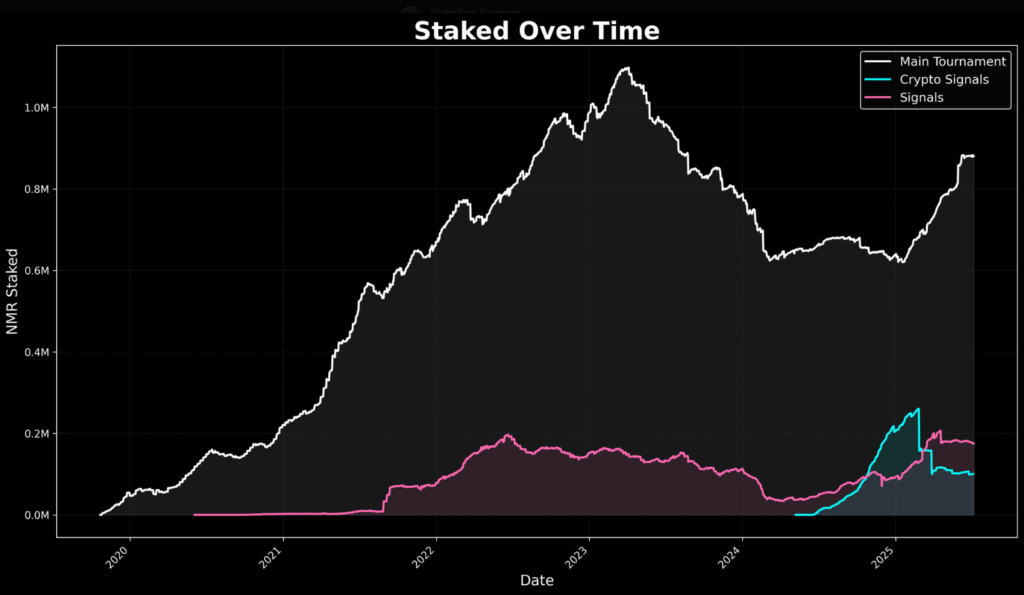

- The firm closed $1 million NMR token buyback for community alignment and to attract new and elite AI talent.

- Numerai’s model crowdsources trading algorithms from data scientists who staked NMR tokens to show their confidence.

Table of Contents

Wall Street Meets Crypto: The Numerai Play

In a massive fusion of traditional finance (tradFi) and decentralized innovation, JPMorgan Asset Management has committed $500 million to Numerai LLC. This hedge fund crowdsources artificial Intelligence (AI) trading models from data scientists worldwide and rewards them with its native NMR token.

This enterprise marks one of the largest institutional endorsements of a crypto-integrated quant fund and could more than double Numerai’s assets under management (AUM) from $450 million.

The JPMorgan investment follows a breakthrough year in which Numerai’s flagship fund posted 25.45% returns (net of fees) with only one down month in 2024, an astonishing rebound from its 17% loss in 2023.

JPMorgan, a top allocator to quant strategies, was likely influenced by this performance and Numerai’s unique cost-efficient model. Taking this into account, people don’t really invest until there’s a track record that supports the business model, and now there is.

“That’s when investors like JPMorgan started to be like, ‘Whoa, you guys aren’t just back, you’re way back.’People don’t really want to invest until there’s a track record. And when you’re doing something super unusual and different, like we are, they might wait even longer before they get excited.” - Richard Craib, Numerai’s founder.How Numerai’s Tokenized Crowdsourcing Works

Rather than employ costly teams, Numerai’s business model is based on a competitive international competition where data scientists submit predictive models with encrypted market data. Then, each submission requires participants to stake their NMR tokens on the accuracy of their algorithms, creating a skin-in-the-game mechanism aligning with incentives. The best performing predictive models are aggregated into Numerai’s market-neutral equity strategy.

In this context, these additional $500 million will be invested over the next year, and, in conjunction with the funding, Numerai is also conducting a $1 million buyback and launching a new stage of funding to reward the community and ensure sufficient liquidity to cover staking requirements. The firm has also been hiring talent from Meta and Voleon to scale and grow its operations..

JPMorgan Investment: Why This Matters for Crypto and Finance

JPMorgan investment decision suggests the institutional community is increasingly comfortable with tokenized incentive structures and AI-driven methods. JPMorgan’s choice also legitimizes the use of crowdsourcing as an alternative to traditional quants. Large quant funds can spend millions of dollars recruiting superstar traders.

So far, the crypto space has benefited by showing that tokens have utility beyond trading and speculation. For instance, in Numerai’s case, the NMR token plays a key role in risk management and attracting talent.

Final Thought: If you could have one hedge fund connected to all the talent in the world, would you change finance? Well, with JPMorgan investment backing, that vision is now a $500 million experiment.

FAQs

How does Numerai’s model differ from traditional quant funds?

By crowdsourcing algorithms from global data scientists who stake $NMR tokens, rather than relying on in-house teams.

What is NMR’s role in the ecosystem?

In this model, data scientists use it to stake on predictions, earning rewards for accuracy and losing stakes for poor performance.

Why did JPMorgan Investment take this decision?

Numerai reflected a strong 2024 performance (25.45% returns) and a cost-efficient, scalable model that diversifies risk through crowdsourcing schemes.

For more AI-driven investment stories, read: Poseidon AI Secures $15M From a16z to Build AI’s Missing Data Physical Layer