Table of Contents

Key Takeaways:

- Kenya Digital Token ($KDT) Hybrid Model: Private developers + government endorsement avoids CBDC dangers

- Diaspora Focus: Solana’s liquidity targets Kenya’s $4B+ remittance market

- Inclusion Tools: AR education and USSD wallets aim for mass adoption

- Cautious Optimism: Lessons learned from Argentina/CAR debacles shape approach

A Digital Leap for East Africa

Kenya has just taken its most audacious step into the Web3 space. The Ministry of Information fully endorsed the Kenya Digital Token ($KDT), a government-backed but privately created token that was just released on the Solana blockchain. Different from other failed state crypto experiments from around the world, Kenya’s $KDT is not a government central bank digital currency (CBDC) disguised; rather, it is a hybrid model built by private innovators, while the government prefers to stay out of the way of the regulations (but provides some air cover if needed).

The government called the token “a tech-driven platform for financial inclusion,” particularly aimed at the unbanked youth of the country, as well as the young Kenyans living in the diaspora. The project has a national pride aspect to it, but also an equal parts decentralized aspect, given that 60% (600 million) of the total supply of 1 billion was reserved for Kenyans (now available for claiming through X account verification).

Why Solana? Why Now?

Kenya chose Solana over Ethereum or other local options due to three key reasons:

- Cost: At $0.00025 per transaction, Solana’s fees are 99% cheaper than Kenya’s mobile money giant M-Pesa.

- Speed: The blockchain’s 4,000 transactions per second (TPS) exceeds traditional banking infrastructure.

- Diaspora Reach: Solana’s global liquidity pools ease remittances, critical for a country where overseas workers sent home $4.4B in 2024, an increase of 18% from previous years.

The token’s whitepaper reveals ambitious utilities:

- Augmented Reality (AR)-powered education in slums like Kibera

- Micropayments for rural solar energy networks

- On-chain ID verification (though explicitly not a national ID substitute)

Skepticism Meets Opportunity

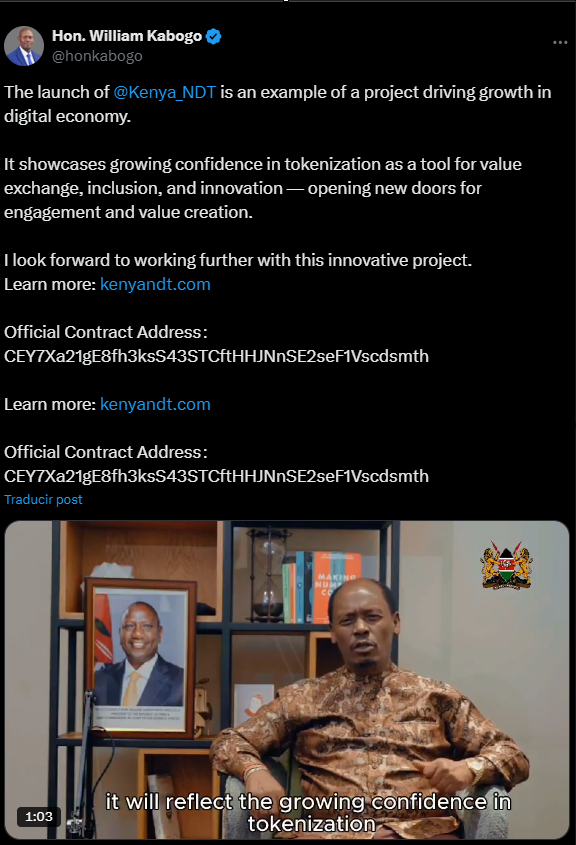

While Kabogo applauds Kenyan Digital Token ($KDT) as aligning with Kenya’s “Virtual Assets Service Providers Bill,” from 2024, some critics note the government’s hands-off approach. Contrasting Argentina’s disastrous $LIBRA experiment or CAR’s memecoin flop, Kenyan officials say this is private-sector-led, which could indeed help cover them from the future consequences of price speculators/failures.

For some crypto community members, the moment you see ‘national token’ and ‘Solana’ in the same sentence, red flags go up. But if they’re smart enough to avoid price speculation and focus on utility, this could literally help communities.

The Bottom Line

If this enterprise works, Kenya could design a new model for emerging markets by leveraging global blockchains for local impact without centralized control. But what if it fails? Another warning tale in the volatile marriage of crypto and nation-states.

Moreover, success depends on two factors:

- Adoption: The team’s “RTX Wallet” aims to onboard users via Unstructured Supplementary Service Data (USSD) codes, critical for Kenya’s 92% mobile penetration but 35% smartphone ownership rate.

- Regulation: With no legal tender status so far, for Kenya Digital Token ($KDT), the challenge lies in demonstrating its substantive value beyond just marketing, especially within Kenya’s dynamic crypto regulatory landscape.

Final Thought: Kenya’s about to find out if crypto can really take off when the government takes a hands-off approach instead of trying to control everything. Will this last?

For more Africa crypto-related stories, read: Central African Republic Tokenizes Land to Sell Via its MemeCoin