Key Takeaways

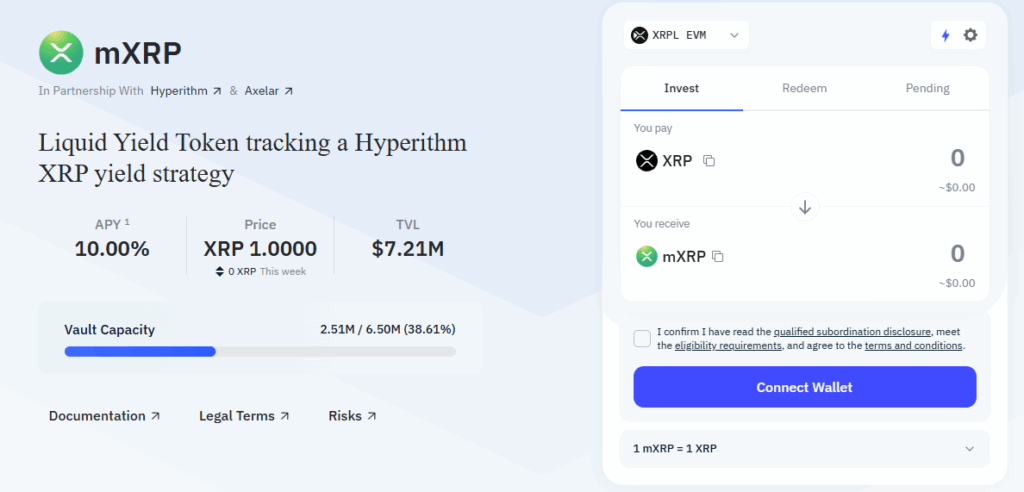

- New mXRP liquid staking token allows holders to earn a target yield of 6-8% Annual Percentage Yield (APY).

- mXRP is issued on the XRP Ledger Ethereum Virtual Machine (EVM) sidechain and utilizes Axelar’s technology to provide cross-chain interoperability.

- The mXRP token provides liquid, yield-bearing exposure to XRP when there were no similar options available to earn yield in the XRP ecosystem.

Table of Contents

Unlocking XRP’s DeFi Potential

Midas, in collaboration with Axelar, has introduced a new mXRP liquid staking token solution that is a breakthrough for the XRP community. Up until now, the XRP ecosystem has been devoid of any native staking or yield-generating capabilities, resulting in a large portion of the total supply being idle. Users are able to deposit XRP into the protocol and mint mXRP tokens that represent their staked position, which they can accumulate yield through a set of curated decentralized finance (DeFi) strategies being handled by the asset manager Hyperithm, such as providing liquidity and market-making.

Seamless Cross-Chain Integration

A major feature of the new mXRP liquid staking token is the interoperability built into it. With Axelar’s bridging technology, the token is not limited to the XRPL. It can be easily transferred to over 80 connected blockchains. This allows holders of mXRP to acquire loans or provide liquidity on other networks by using the mXRP as collateral, thus generating additional yield potential beyond the base.

Read also: Gemini’s XRP Credit Card Launches: Earn 4% Crypto Back on Everyday Spending

A New Era for XRP Utility

The launch of the new mXRP liquid staking token module significantly increases the utility of XRP, shifting its use case from primarily speculative to productive in the growing Web3 economy. The smart contracts are fully audited, and the reporting is transparent, instilling the security and trust needed by both retail and institutional participants. This essentially links the growing XRP ecosystem to the expanding DeFi world.

The New mXRP Staking Token: From Dormancy to Productivity

The new mXRP liquid staking token effectively mitigates one of the most critical limitations in the XRP ecosystem. By providing a secure yield-generating wrapper, it incentivizes holders to keep it while creating liquidity and utility in the DeFi space, a big step forward for the on-chain evolution of XRP.

Final Thought: Is mXRP the key to unlocking the long-promised utility of the asset in the global financial system by putting idle XRP to work?

FAQs

What is liquid staking?

Liquid staking is a model that allows you to stake your tokens to earn rewards while retaining a liquid token, which can be used elsewhere in the DeFi space, whereas traditional staking locks your assets.

Where does the yield come from?

Yield comes from professional risk curators who deploy the pooled XRP into different on-chain strategies, such as providing liquidity to decentralized exchanges (DEXs) or lending protocols.

Is my XRP locked?

No. That’s the “liquid” part. You receive a new mXRP liquid staking token that represents your staked XRP, and you can freely trade or use those tokens in other DeFi applications while still earning the underlying yield.

For more Ripple’s XRP stories, read: Ripple’s Permissioned DEX Goes Live: Can XRPL Crack Institutional DeFi?