Key Takeaways:

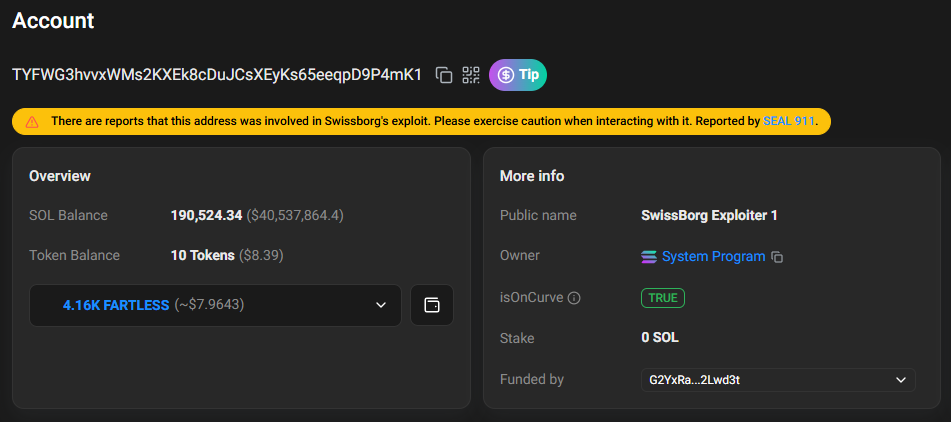

- The SwissBorg SOL exploit saw 193K SOL (around $41.5 million) stolen from a wallet managed by staking partner Kiln.

- The exploit impacted less than 1% of users and only the SOL Earn program. All other funds are unaffected.

- SwissBorg has committed to reimbursing all user losses from its treasury and is now collaborating with security firms to recoup funds.

Table of Contents

The Anatomy of the SwissBorg SOL Exploit

SwissBorg, the European crypto platform, has reported a substantial breach that resulted in a loss of 193,000 SOL (worth approximately $41.5 million). The SwissBorg SOL exploit did not originate from its own system, but rather resulted from a compromised Application Programming Interface (API) at its staking partner, Kiln; this highlights the risks of integrating third parties in decentralized finance (DeFi).

The attack, identified on September 8th, was a clear reminder that security is only as strong as the weakest link. It was clear that while the core of SwissBorg’s platform (the place where users have their funds) is secure, attackers were able to take hold of an API by Kiln, the external partner that managed SwissBorg’s Solana staking operations. The attackers were then able to drain funds from the dedicated staking wallet.

A Transparent and Swift Response

SwissBorg’s response it’s a great lesson in crisis management. CEO Cyrus Fazel wasted no time addressing the community, providing clear details about the extent of the situation. Most importantly, he said the company is financially robust and it will use its own treasury to ensure that no user is left without a refund. The platform temporarily suspended SOL Earn withdrawals while it worked with top-tier white hat hackers and companies like Chainalysis to trace the stolen funds back across blockchain addresses.

Read also: Shocking LuBian Bitcoin Hack: How $3.5B Vanished in Crypto’s Biggest Heist

The Wider Implications

This event illustrates a significant weakness within the crypto ecosystem: the reliance on third-party service providers. Even with all due diligence, a lapse in a partner’s security can come at a steep price. It shifts the risk from direct exchange hacks to the security of the entire complex DeFi structure.

A Test of Resilience

The SwissBorg SOL exploit is a significant hit; nonetheless, their commitment to making the user whole and their transparent communications will perhaps ultimately help in establishing trust. It also provides a vital lesson for the industry regarding vetting and monitoring external partners.

Final Thought: Does this issue push the industry to reevaluate how they consider third-party risk, and look toward more decentralized and self-custodial staking solutions?

FAQs

Was the SwissBorg main app hacked?

No. The SwissBorg SOL exploit was limited to an external Application Programming Interface (API) offered by their staking partner, Kiln. All other funds on the platform are secure.

Will those affected be made whole?

Yes. SwissBorg has guaranteed to make users whole by paying 100% of the losses from their own treasury.

What do they mean by API compromise?

This means that hackers found some flaw in the software bridge (API) connecting different services that allowed them unauthorized access to the system they connected to.

For more crypto exploit stores, read: Kinto Exchange to Wind Down Operations Following Crippling $2.4M Exploit