Key Takeaways

- Vanguard Group will now permit trading of select Vanguard crypto ETFs and mutual funds on its brokerage platform.

- The move grants over 50 million clients, with $11 trillion in assets, access to regulated crypto exposure.

- This marks a dramatic shift for the historically skeptical firm, driven by overwhelming investor demand.

Table of Contents

A Historic Reversal in Investment Philosophy

One of the most significant developments in traditional finance is that Vanguard Group, the world’s second-largest asset manager, has broken its long-standing history of opposing digital assets by allowing its clients to buy and sell a select number of Vanguard crypto ETFs.

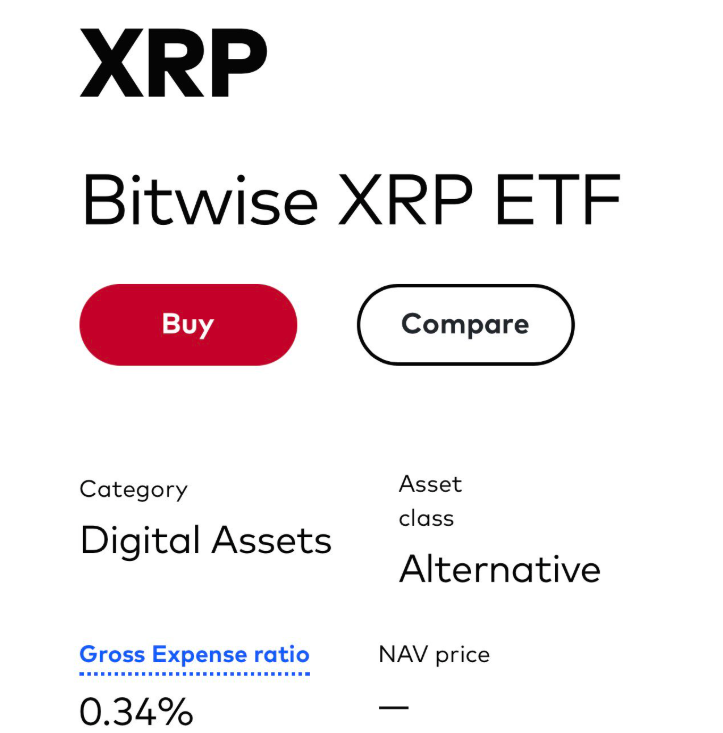

Effective immediately, Vanguard clients will be able to trade Bitcoin, Ethereum, XRP, and Solana ETFs and Mutual funds on Vanguard’s previously established brokerage platform.

The transition from a firm that categorically forbade the inclusion of crypto in ‘serious’ portfolios (due to their high volatility and speculative nature) to now offering crypto ETFs is a 180-degree turn from their previous stance.

Read also: U.S. Launches Scam Center Strike Force to Combat $10B Crypto Fraud Epidemic

Responding to the Inevitable Demand

The decision to list Vanguard crypto ETFs is in direct response to the rapidly growing consumer and institutional interest in these investment products. Andrew Kadjeski, Head of Vanguard Brokerage & Investments, outlined that internal testing confirmed the Vanguard Crypto ETFs functioned as expected straightforwardly for investors.

By listing these Vanguard Crypto ETFs, the firm is responding to an industry trend that has been gaining traction. The firm acknowledges that regulated crypto products have become an unavoidable segment of modern finance, as evidenced by BlackRock’s nearly $7 billion Bitcoin spot ETF (IBIT).

Read also: Spot XRP ETF Listing Approved: First U.S. Fund Begins Trading on Nasdaq Nov 13

A Cautious but Consequential Embrace

In September 2025, Vanguard announced that it would allow third-party crypto ETF providers onto its platform. The asset manager has confirmed that the company is not planning to create its own crypto funds and will exclude any funds related to “memecoins.” Vanguard’s methodical and compliant approach enables the firm to satisfy the needs of its customers while upholding conservative investment practices.

The introduction of Vanguard crypto ETFs may be the clearest indication thus far that digital currencies are becoming an established part of mainstream institutional investing. It is expected that millions of dollars will flow into the crypto economy as a result.

FAQs

Which assets are included in the Vanguard crypto ETFs?

Vanguard will allow trading of ETFs and mutual funds focused on Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL) that meet its regulatory standards.

Why did Vanguard change its mind?

Overwhelming investor demand and the proven success of regulated spot Bitcoin ETFs since their launch in January 2024 have forced a reassessment. The firm recognizes crypto as a legitimate, fast-growing asset class clients want to access.

Can I buy crypto directly on Vanguard?

No. The policy only applies to exchange-traded funds (ETFs) and mutual funds that hold crypto as an investment. You cannot buy Bitcoin or Ethereum directly on the platform.

For more crypto ETF and related stories, read: Hong Kong Approves World’s First Solana ETF Through ChinaAMC