Key Takeaways:

- Ondo’s OUSG Goes Live on XRPL: Investors can now buy and sell OUSG directly on the XRP Ledger, settled via Ripple’s RLUSD stablecoin.

- Institutional Access Expands: The XRPL integration enables 24/7 access to treasury assets without relying on traditional financial infrastructure.

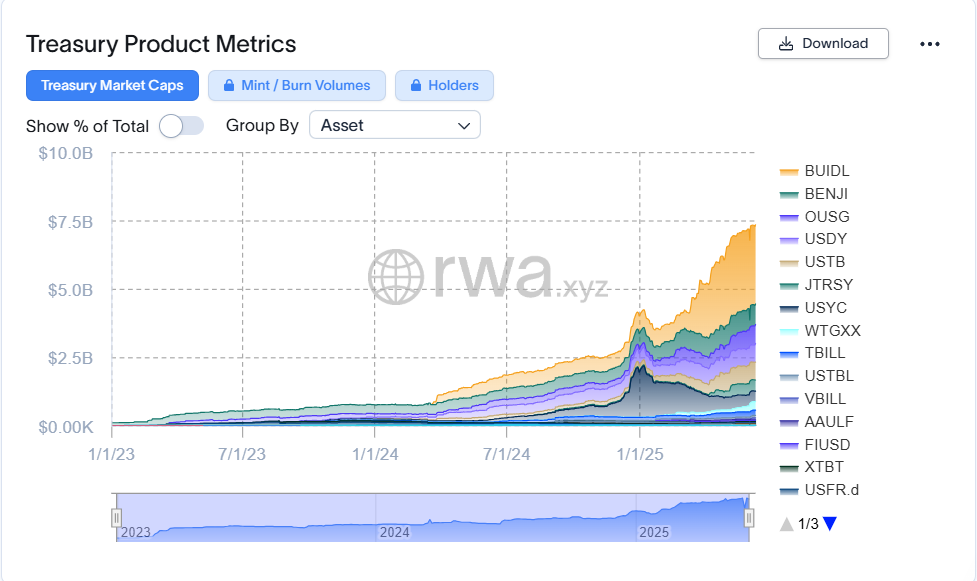

- Global Market Tops $7B: Tokenized treasury products have grown significantly, led by BlackRock’s BUIDL, with Franklin Templeton, Circle, and Ondo among other key players.

Ondo Finance has launched its tokenized short-term U.S. treasury product (OUSG) on the XRP Ledger (XRPL). This move allows qualified investors to buy and sell OUSG directly on XRPL, with transactions settled through Ripple’s stablecoin, RLUSD.

According to Ripple’s announcement, (OUSG) treasury is one of the largest tokenized Treasury products on the market, with more than $670 million in assets. By moving to XRPL, it becomes easier for institutional investors to access these assets anytime, without relying on traditional banking hours or outdated settlement systems, allowing faster transactions and better capital management.

Tokenized Treasuries Gain Ground as Institutions Embrace Digital Bonds

Tokenized treasuries— digital versions of low-risk government bonds —are gaining popularity as a practical use of blockchain technology, reaching more than $7 billion in total value.

This digital space is currently led by BlackRock, whose tokenized fund, known as (BUIDL), has surpassed $2.5 billion in assets. This alone represents more than 40% of the total tokenized treasury market. Franklin Templeton is another major player in the sector, with its BENJI fund holding around $707 million. Both funds offer investors exposure to short-term government bonds through blockchain platforms, allowing faster, seamless settlements.

Other firms include Superstate, whose (USTB) fund manages roughly $654 million, and Circle, which offers the (USYC) fund with about $378 million in assets.

Financial giants such as Fidelity and Apollo are also entering the space. Fidelity has filed to launch a tokenized money-market fund and recently introduced its own stablecoin. Similarly, Apollo, part of a consortium investing in real-world asset tokenization, is actively exploring opportunities in digital treasuries.

The appeal of these products lies in their ability to combine the safety and yield of government bonds with the flexibility and speed of digital infrastructure. Through tokenized treasuries, investors can trade or redeem holdings 24/7, manage liquidity in real time, and bypass many of the inefficiencies associated with traditional finance.

Read More: Hong Kong Partners with Chainlink to Test Cross-Chain CBDC Transactions