Key Takeaways

- Macro & Crypto Outlook: Raoul Pal predicts 2026 will be a year of opportunity, with quality assets, altcoins, and high-performing L1S leading the market. Avoiding FOMO and using leverage responsibly are the main practices..

- Payments and Adoption: Stablecoins and blockchain are the instruments aiding the transition from traditional finance to crypto.

- Security & Policy: User education, compliance, and trust are the major contributors to the total crypto adoption.

Market Insights & On-Chain Intelligence

Raoul Pal began the day with a market thesis pointing towards the future; he stated that the recent market declines are merely corrections and the bull trend remains intact. He pointed out altcoins and high-performing L1s as investments, and at the same time, he insisted on a behavioural discipline: no to leverage, no to short-term hype, and yes to long-term value.

On-chain specialists Alex Svanevik (Nansen), Benjamin Cowen (Into The Cryptoverse), and Nicolas Vaiman (Bubblemaps) were very much on the topic of AI and data analytics and their impact on trading.

Next-Gen Payments & Tokenization

Mastercard, Ripple, and TON executives came together to tell how blockchain and stablecoins are making payments easier. Stablecoins are being used in different parts of the world like Africa and LATAM, particularly, overcoming limitations in remittance speed, financial accessibility, and transaction costs.

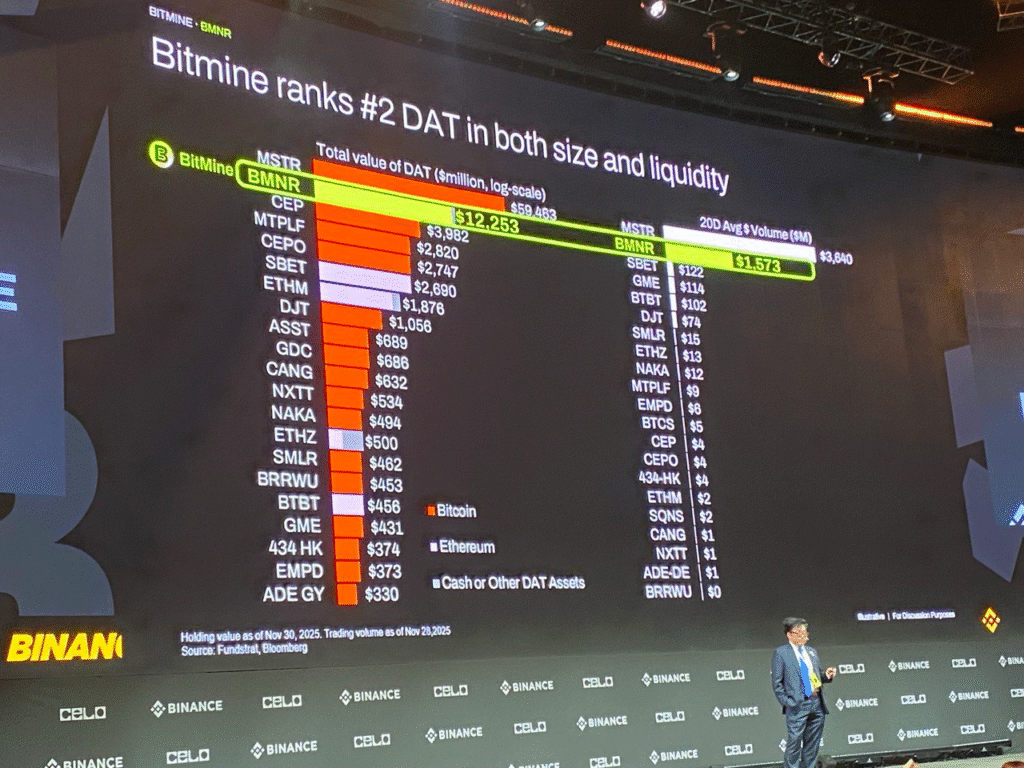

Tom Lee (BitMine) described Ethereum as the foundation of tokenization and estimated significant growth in adoption in the near future. He branded ETH as “undervalued” and pointed to fractional ownership and prediction markets as the two drivers of the next crypto unlock.

Security, Compliance & Emerging Policies

The regulators from the UAE and the Circle company discussed together the matters of trust, education, and compliance. It is vital for the users to be aware of their ownership rights and how to protect them. The establishment of worldwide regulations and the open dialogue between regulators and industry are the most important factors in preventing fraud and encouraging adoption.

Bitcoin vs Tokenized Gold

The most-awaited discussion between CZ and Peter Schiff was over the topic of the future of money. Schiff said that gold would be useful and scarce in the long run, whereas CZ viewed that the network of Bitcoin, which is global and trustless, gives it a value that is not comparable. The dialogue made it evident that one of the industry’s trends is that digital scarcity and networked assets are winning the battle.

Innovation & Community

The Innovation Stage served as a platform for exploring community building, Web3 marketing, and enterprise blockchain. Cloud giants and blockchain projects demonstrated their infrastructure and applications in areas such as property, identity, and payments. The creators and local Binance Angels shared their knowledge about the adoption process from a bottom-up perspective and the expanding Internet of Value.