Key Takeaways

- A major highlight of the Future Blockchain Summit was the focus on data and application security in the crypto sector.

- Beyond security, the summit showcased the importance of such gatherings in driving industry collaboration and innovation.

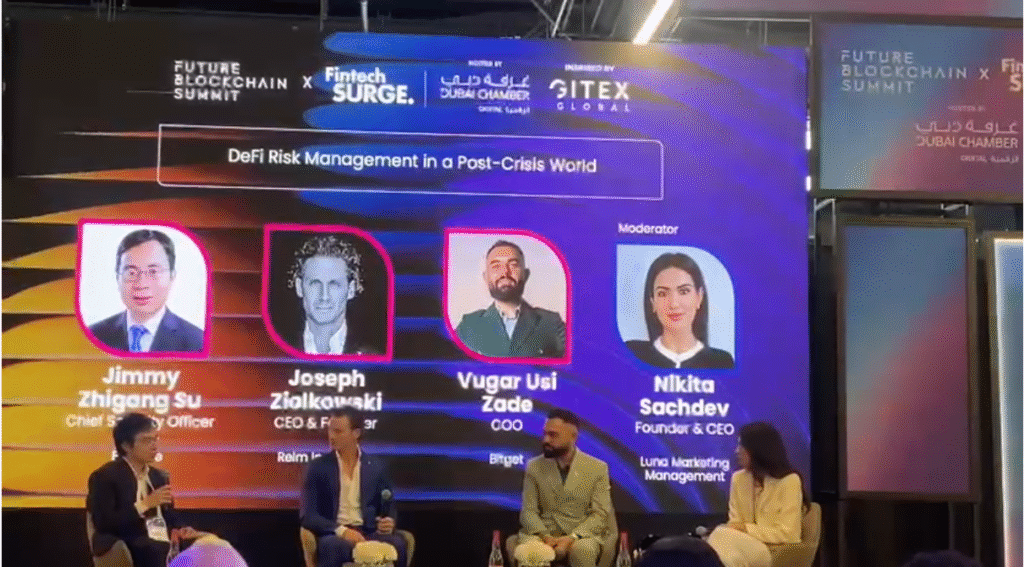

- Industry leaders at the Summit delved into the future of decentralized finance (DeFi) during a session titled “DeFi Risk Management in a Post-Crisis World.”

Table of Contents

The Future Blockchain Summit wraps up on a high note, emerging as a beacon of optimism for crypto investors. The four-day event brought together global leaders and analysts, who shared insights on how blockchain, AI, and stronger regulations are shaping the next phase of digital finance.

One of the major highlights of the summit was the focus on data and application security in the crypto sector. Experts told Times Crypto that safeguarding user assets must be the industry’s top priority.

The discussions on the mainstage emphasized that developers and ethical hackers need to study real-life cyberattacks to better anticipate threats. This proactive approach, they said, will help build trust and resilience across decentralized platforms.

Beyond security, the summit showcased the importance of such gatherings in driving industry collaboration and innovation. These gatherings give leaders, developers, and investors a forum to exchange innovations, talk about difficulties, and investigate cutting-edge technologies. According to experts, events like Future Blockchain Summit help the sector remain in sync, adjust to market developments, and cooperate to resolve shared problems, which speeds up the development of blockchain and cryptocurrency ecosystems.

The summit also played a key role in shaping the industry’s strategic direction. Through panels on regulations, market trends, and technological adoption, participants gained insights that can inform business decisions and policy frameworks.

Future Blockchain Summit: Wil Over Regulation Kill The Crypto Sector?

At the Summit, industry leaders discussed the future of decentralized finance (DeFi) in a session titled “DeFi Risk Management in a Post-Crisis World.” Speakers included Vugar Usi Zade from Bitget, Joseph Ziolkowski-CEO of Relm Insurance, and Jimmy Su from Binance.

The panel reflected on lessons learned from past crises, emphasizing that DeFi must move beyond hype and focus on measurable stability. Usi Zade said that success of the industry now depends on establishing valid, long-term strategies backed by data and security. Ziolkowski added that governance and transparency are essential for restoring user confidence in DeFi platforms.

Su highlighted that most users judge platforms by their UI/UX experience but fail to recognize the security trade-offs between centralized and decentralized models. The debate over CEX vs DEX remained central-Usi Zade noted that centralized exchanges offer stronger protection but are easily targeted by government scrutiny, while Su suggested a hybrid approach combining the best of both worlds.

Ziolkowski pointed to growing adoption of proof-of-reserves (PoR) frameworks, though he noted that PoR alone is insufficient without proof-of-liabilities. The panel also questioned whether innovations like RWA (Real-World Assets) and CBDCs are truly transformative or simply digital replicas of traditional finance.

Discussing regulation, panelists agreed it is both inevitable and necessary. Usi Zade questioned who should regulate and how, warning that over-regulation could stifle innovation. Ziolkowski called regulation a natural evolution of the industry, while Su noted that regulators are becoming more informed and proactive.

Overall, the session underscored that DeFi’s maturity will depend on collaboration, between innovators, ethical hackers, and regulators, to build a safer, more transparent financial ecosystem.

Also Read: GITEX 2025: AI, Web3, and Blockchain Dominate Spotlight for Crypto Traders

Data And Application Security Becomes New Important Topics For Crypto Industry

At the event, industry leaders and analysts told Times Crypto that data and app security have become the biggest priorities in crypto today. With hackers growing more sophisticated, they believe developers and ethical hackers need to go beyond coding.

The discussions revolved around ideas that the industry must study real-life attack cases and learn to think like hackers themselves. This mindset, experts said, is key to staying one step ahead of threats.

By understanding how attackers operate, the crypto industry can build stronger defences, protect user assets, and create a safer, more trustworthy environment for blockchain innovation to thrive.

Healthcare System Banks on Blockchain Based Data Resources

Additionally, the Future Blockchain Summit saw healthcare experts express that the future of medicine will be shaped by blockchain and AI working together. They explained that blockchain can give patients secure, transparent control over their medical records, while AI can analyze that data to deliver faster and more personalized treatments.

The combination could transform how hospitals, insurers, and doctors share and use information, cutting out inefficiencies and protecting privacy at the same time. Experts believe the tech-driven approach will make healthcare smarter and more patient-focused, marking a major step toward the next generation of medical innovation.

Are Websites Overrated?

The event also saw experts explore a bold question- are traditional websites becoming outdated in the age of AI? Speakers suggested that static web pages could soon give way to AI-driven interfaces that interact with users more naturally.

Instead of scrolling or clicking through menus, people could simply tell an AI what they need, and it would instantly deliver results. The approach could make online experiences faster, smarter, far more personal and less cumbersome. But alongside the excitement, panellists also warned that as AI takes over the user interface, developers must prioritize transparency and data protection to ensure people can still trust the technology powering their digital lives.