The movement of cryptocurrency prices, whether positive or negative, rarely provides a complete narrative. Behind every move, there is on-chain activity that shows market participants’ behavior. Whether market participants are moving assets to or from exchanges, their actions tell a story of accumulation and sell-off.

On-chain metrics assist investors by providing insights that go beyond price action and technical analysis. Several on-chain analytic tools show these participants’ activity, which helps break down the market sentiment rather than speculation.

What is On-Chain Activity and Why Does it Matter?

On-chain activity refers to everything that occurs directly on a blockchain and is recorded publicly, such as transactions, wallet movements, token transfers, whale activity, and exchange inflows to outflows. In simple terms, it shows what market participants are doing on the exchanges.

On-chain data matters because the prices alone don’t tell the full story. A token can be rising on hype, or falling even when strong accumulation is happening in the background, that what on-chain data shows. For example, rising exchange inflows often signal selling pressure, whereas falling exchange reserves usually point to accumulation and long-term confidence.

It also helps identify early trends by revealing whale (Investors with massive holdings) movements, changes in active addresses, or sudden spikes in network usage that often appear before major price moves.

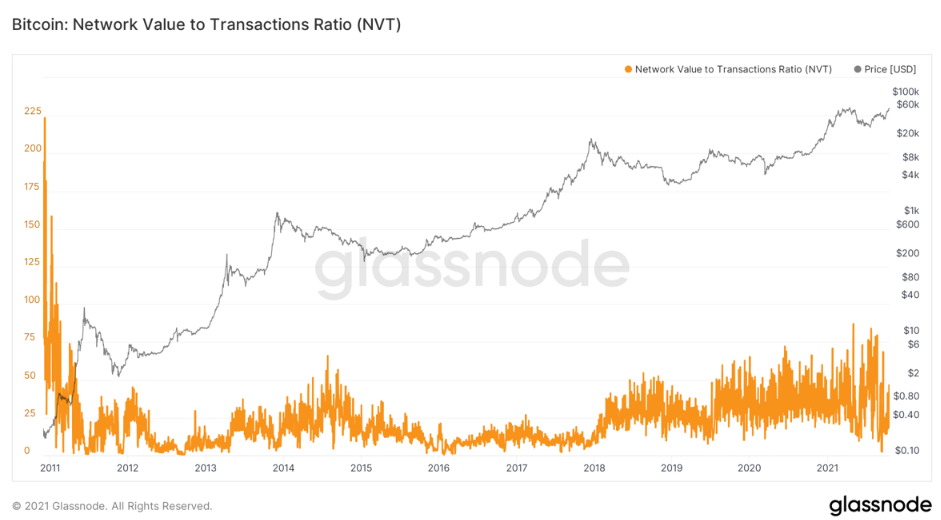

What is the NVT Ratio?

The Network Value to Transactions (NVT) ratio compares a cryptocurrency’s market value with its on-chain transaction activity.

The value measures whether the network’s usage justifies its current valuation. Currently, these metrics are available on Glassnode, CryptoQuant, and Santiment.

What High NVT Signals?

A high NVT ratio means the asset value is moving up much faster than what’s actually happening on the network. In most cases, it points to price being driven more by speculation than real activity. When NVT continues to rise for a longer period, it usually suggests the asset is moving into a risky zone rather than being supported by its fundamentals.

What Low NVT Signals?

A low NVT ratio simply shows that transaction activity on the network is strong compared to its market value. This usually means the blockchain is being actively used, not just traded on speculation.

Historically, lower NVT levels have appeared during accumulation phases, where smart money builds positions quietly.

Also Read: 2.8 Million Ethereum Accumulated at $3,150 amid 3% Price Drop!

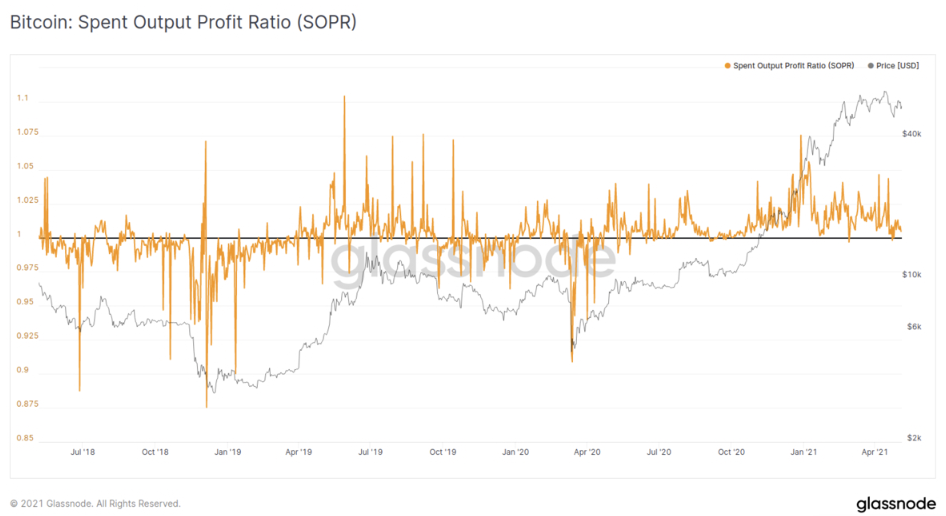

What is SOPR?

The Spent Output Profit Ratio (SOPR) tracks whether assets are being sold at a profit or at a loss. It compares the price at which assets were last moved to the price at which they are spent. Market participants can find these on-chain metrics on analytics platforms like Glassnode and CryptoQuant.

SOPR Behavior in Bullish Markets

In the bullish scenario, SOPR generally stays above the neutral level, and it highlights that investors are selling their holdings at a profit, while investors remain confident enough to absorb that selling pressure. Strong bull markets often see SOPR consistently hold above current levels.

SOPR Behavior in Bearish Markets

During a bearish scenario, SOPR metrics tend to fall below the break-even, indicating that investors are selling their holdings at a loss, which is often driven by fear in the market.

What is the MVRV Ratio?

When MVRV is high, most holders are sitting on profits. This is where the chances of profit booking soar. Conversely, falling MVRV points to holders’ losses, and that zone may attract long-term holders.

How to Read MVRV Levels

When MVRV is high, most holders are sitting on profits. This is where the chances of profit booking soar. Conversely, falling MVRV points to holders’ losses, and that zone may attract long-term holders.

MVRV in Bull and Bear Markets

In a bull market, MVRV usually moves higher as prices rise and more holders slip into profit. During bear phases, however, it tends to fall into lower ranges, and as profits shrink, selling pressure gradually fades.

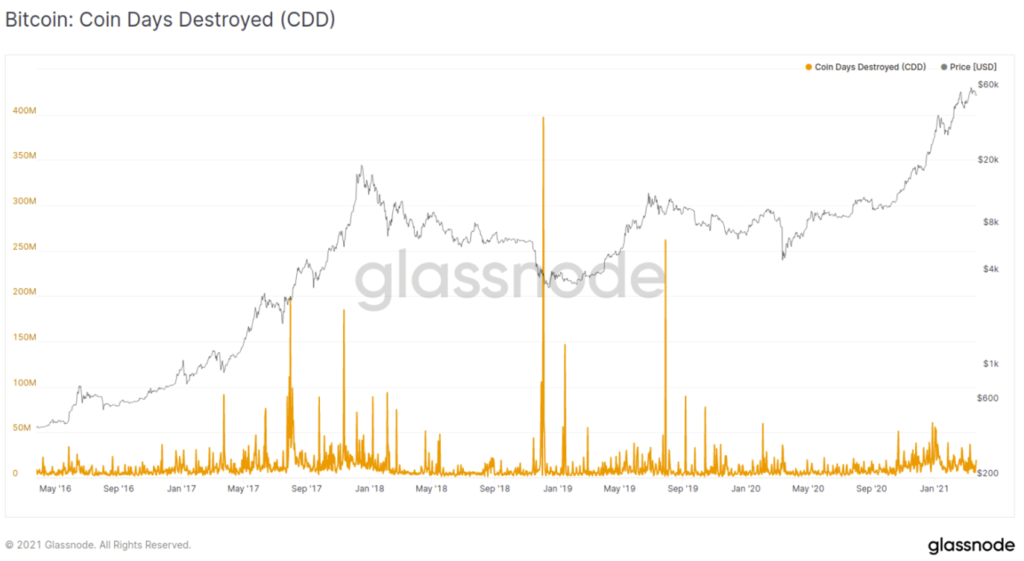

What is CDD?

Coin Days Destroyed (CDD) is an on-chain metric that tracks how long coins are held before they are moved. The longer coins remain untouched in a wallet, the more “coin days” they build up.

When those coins are finally spent, the accumulated days are destroyed, which often reflects long-term holders becoming active. This metric can currently be tracked on platforms like CryptoQuant and Santiment.

How CDD Tracks Long-Term Holders

This metric is especially useful for tracking an asset’s long-term holders. When the dormant holders move their holdings after a long period, it signals that long-term investors are becoming active to take profits.

What CDD Spikes Indicate

Sharp spikes in CDD often appear near major market turning points. Rising CDD during price rallies may signal distribution, while stable or low CDD during pullbacks suggests long-term holders are holding firm.

Also Read: Chainlink (LINK) Exchange Reserves Decline 43.2 Million, But Price not Moving!

Conclusion

These on-chain metrics, NVT, SOPR, MVRV, and CDD, highlight every side of market behavior. When used together, they provide a clearer picture of any asset apart from its current trend, such as sentiment and long-term investor activity. While none of these metrics should be used in isolation, combining them with price action and volume helps investors make more informed decisions in the volatile market.