Key Takeaways

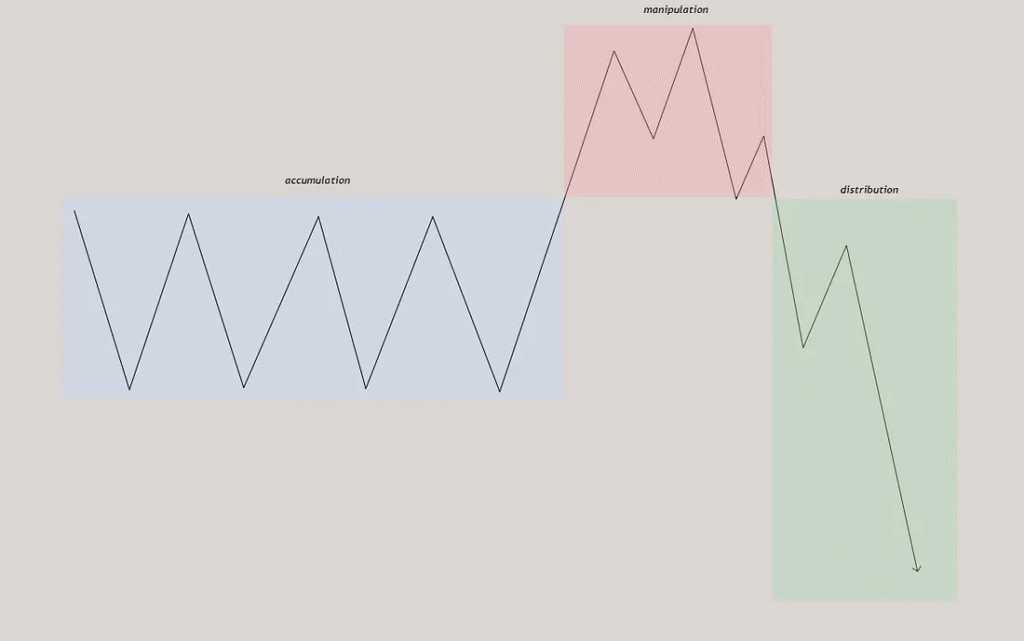

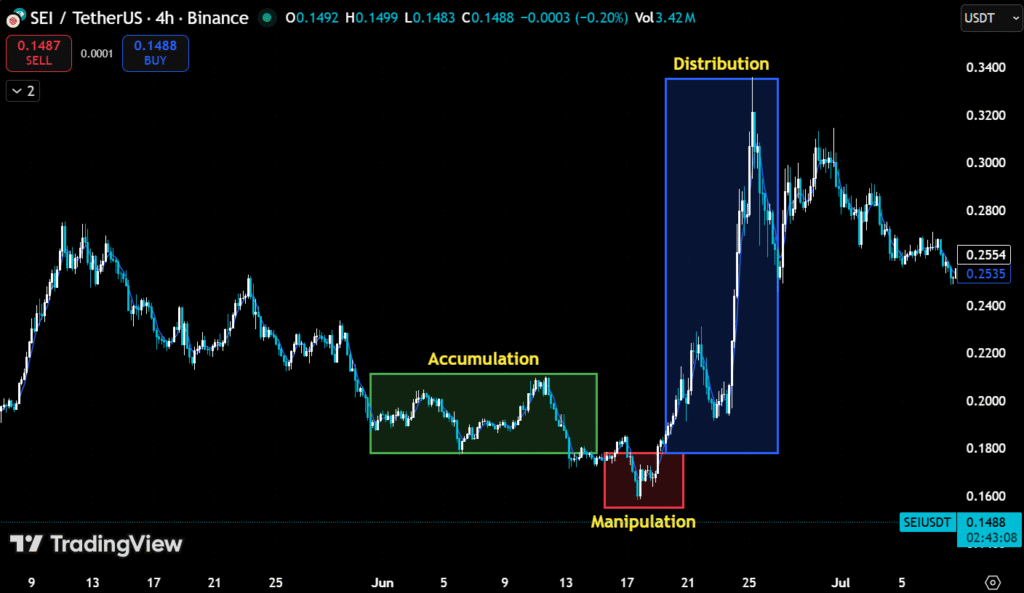

- The AMD (Accumulation, Manipulation, Distribution) model explains the market trend in both bullish and bearish scenarios.

- Smart money builds the AMD cycle, defining trends that retail traders later follow.

- Distribution signals the end of a cycle, with early participants taking profits or exiting, while volatility increases.

The financial market moves through identifiable phases that provide the context for the AMD (Accumulation, Manipulation, Distribution) model to define trend shifts and investor behavior. The AMD model breaks the market into three stages, namely accumulation, manipulation, and distribution, which help identify price trends and the market participants’ behavior.

The model can be used in both bullish and bearish market conditions, enabling investors, traders, and analysts to study market structure, capital flows, and long-term trends.

What Is the AMD Model?

Let’s decode the AMD model in the context of the crypto market trends and price behavior. The model tracks how crypto prices evolve in each phase, reflecting the capital flows and trader psychologies:

- Accumulation: In this phase, smart money builds up positions when the market is sideways or range-bound. There is fear or greed in the market due to heavy sell-off or aggressive buying, and the price is stuck in a predefined range with no directional bias.

- Manipulation: Big market players, such as institutional players, move the market to induce other traders to buy or sell by faking out a breakout. The deceptive move is to collect liquidity and hit the stop losses. Small or retail traders get out of the market as they face a liquidity crunch, and this sets a target for the next phase.

- Distribution: Smart money and Big players exit from the market. High trading volumes mark the clear market direction, either upside or downside, in this phase. Retail traders enter this phase when the price moves in a particular direction, making it easy for small traders to open their positions.

By understanding these phases, market participants can make better-informed decisions without relying solely on short-term price swings.

The market Cycles

- Accumulation Phase

The phase is identified by relative calm, stable prices, and significantly lower trading volumes. The market moves sideways with no clear directional bias. The market prepares itself for the future directional shift. When a major trend ends, the market enters a consolidation phase. It marks the exhaustion of the market participants during the extreme price swings.

Investor sentiment becomes neutral, setting the stage for the next big market move, regardless of direction.

- In optimistic scenarios, institutions gradually accumulate positions before a surge.

- In a bearish setup, smart money builds positions and drives manipulation to lure retail buyers.

Key characteristics:

- Prices trade within a narrow range or in a sideways manner.

- Volumes and liquidity are low in this phase.

- Market sentiment is neutral or cautious during this time period.

- Whales and institutions start the accumulation process.

- Developers are still building and improving a product or protocol.

2. Manipulation Phase

The manipulation phase starts after the accumulation phase ends. Prices start moving upward when demand outweighs supply, a classic market action before the beginning of a fresh uptrend. Momentum attracts participants, narratives gain traction, and liquidity flows increase. The phase represents increased momentum along with rising volume.

In the bearish markets, manipulation follows the consolidation of the prices that happens amid the selling pressure in the market.

And in the bullish markets, the price drops sharply, hitting the predefined stop losses. The action creates fear in the market, and small traders exit with losses.

Following the bullish scenario, the manipulation is carried out to create the fear of breakdown prior to the distribution phase. It is important, as the seller’s liquidity is required prior to the upward move.

Key characteristics:

- Price breakouts or breakdowns take place from the accumulation range

- Trading volume spikes alongside volatility

- Retail investors react to the rapid price movement

- Market narratives grow more intense (FOMO in bullish, fear in bearish)

- Momentum-driven strategies start to dominate

- Distribution Phase

The distribution phase consists of prices moving either extremely high or low, depending on the trend. Early participants begin to unwind. Retail investors may come in too late; the momentum fades. After distribution, the market moves back into accumulation, and that starts a new market cycle.

Key characteristics:

- Prices move fast and abruptly with clear directional bias.

- Whales reduce exposure while retail continues trading.

- Speculative activity peaks during this period.

- Volatility rises and price swings intensify.

Why the AMD Model Works in Both Directions

The AMD model functions in both bullish and bearish markets, since crypto price movements often follow predictable patterns. The capital rotation metric exists between risk-on and risk-off phases, while fear and greed consistently influence investor behavior.

Smart money, or whales, systematically accumulates and distributes positions that could trigger liquidity imbalances. These patterns can influence price action on either side. Retail participants chase such flows, volatility, and reinforcing trend cycles. The market’s periodic expansions and contractions validate the AMD framework as a solid model to conduct market structure analysis.

How the AMD Model is utilized by Traders and Analysts

Investors and analysts implement the AMD model to:

- Determine a particular phase in both bullish and bearish cycles.

- Follow the momentum tactics while in the manipulation stage.

- Recognize the distribution patterns and signals to manage risk.

- Effectively track narrative cycles and liquidity flows.

While the model doesn’t anticipate exact peaks or bottoms, it assists in comprehending broader market behavior across different conditions.

Final Thought

The AMD model describes the crypto market cycle into three phases: accumulation, manipulation, and distribution. The framework can be utilized to analyze both bullish and bearish market trends. Being mindful of these phases helps market participants to understand liquidity, sentiment, and long-term dynamics and take informed decisions.