Key Takeaways

- Japan’s Financial Services Agency (FSA) has proposed reducing the tax on cryptocurrency gains from up to 55% to a flat 20%, aligning it with traditional stock investments and potentially saving high-income traders significant sums.

- The proposal includes reclassifying cryptocurrencies as “financial products”, which could pave the way for Japan’s first crypto exchange-traded funds (ETFs).

- With over 12 million Japanese crypto accounts and $34 billion in assets, retail demand is prompting regulators to treat digital assets as legitimate investment tools rather than mere payment methods.

- Major Japanese banks, including Sumitomo Mitsui, are actively exploring stablecoins and tokenized assets, highlighting growing institutional interest in blockchain integration.

- Japan’s proposals aim to keep pace with jurisdictions like the US, EU, and Hong Kong by enhancing investor protections and attracting crypto capital, potentially reversing its previously conservative regulatory stance.

Landmark Shift in Crypto Policy Proposed

Japan’s Financial Services Agency has put forward a preliminary proposal that could potentially reduce cryptocurrency taxes from 55% to 20% while exploring pathways for the country’s first crypto exchange-traded funds |(ETFs). When implemented, the framework would represent one of the most significant shifts in global crypto policy since the US approved Bitcoin ETFs.

Proposed Tax Relief Could Transform Investment Landscape

The suggested flat 20% tax rate would potentially align cryptocurrency gains with traditional stock investments, which could save high-earning crypto traders tens of thousands of dollars annually. Under Japan’s current progressive tax system, crypto profits face rates up to 55% – among the world’s highest for digital assets.

“This change could make crypto investing dramatically more attractive to both retail and institutional players,” the FSA noted in its preliminary proposal.

The proposed tax restructuring forms part of Japan’s broader “New Capitalism” strategy aimed at potentially positioning the country as an investment-led economy capable of competing with crypto-friendly jurisdictions like Singapore and Switzerland.

Reclassification Could Open Door to ETF Market

Beyond the proposed tax relief, the draft framework suggests reclassifying cryptocurrencies as “financial products” under the Financial Instruments and Exchange Act (FIEA) – the same regulatory framework governing traditional securities. This fundamental shift under consideration would move crypto regulation away from the Payment Services Act, which currently treats digital assets primarily as payment methods.

The proposed reclassification could potentially unlock Japan’s long-awaited crypto ETF market. While the US has already attracted over 1,200 institutional investors to Bitcoin spot ETFs – including major pension funds and Goldman Sachs – Japan has remained on the sidelines due to existing regulatory constraints.

“Japan wants to compete for institutional capital that’s currently flowing to US crypto products,” said a regulatory analyst familiar with the preliminary proposal.

Massive Domestic Crypto Adoption Drives Proposed Reform

The regulatory proposal comes as Japan witnesses unprecedented crypto adoption among its citizens. More than 12 million domestic crypto accounts hold assets worth over 5 trillion Japanese yen ($34 billion) as of January 2025.

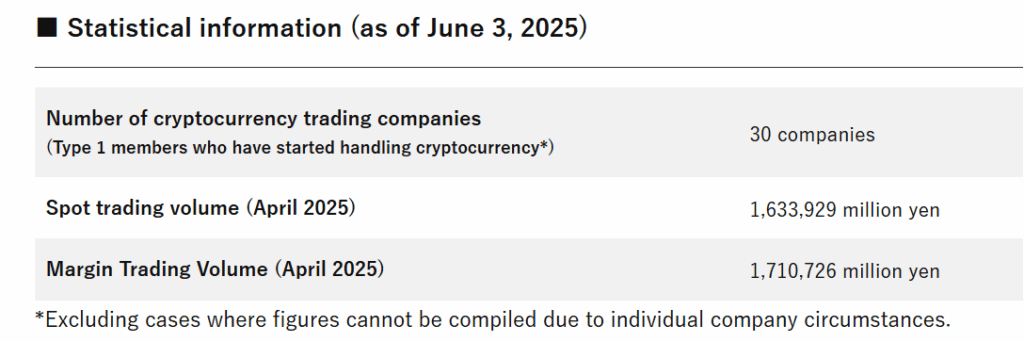

The trading volume of crypto is quite high in Japan as they are more than 12 million domestic users ; source: Japan Crypto Asset Business Association (JCBA)

This surge in retail adoption, particularly among tech-savvy investors, appears to have influenced regulators to consider treating crypto as a legitimate investment asset rather than merely a payment mechanism.

The timing aligns with growing institutional interest globally. There has been explosive growth in institutional crypto holdings, with major financial institutions increasingly viewing digital assets as portfolio diversification tools.

Major Banks Already Exploring Stablecoins

Japan’s crypto evolution extends beyond the current regulatory proposals. In April, financial giant Sumitomo Mitsui Financial Group partnered with Ava Labs and Fireblocks to explore stablecoin commercialization, focusing on both yen and dollar-pegged digital currencies.

The collaboration is examining the potential use of stablecoins for settling tokenized real-world assets including stocks, bonds, and real estate – signaling institutional interest in broader blockchain integration.

Global Competitive Pressures Drive Consideration

The proposed reforms also reflect Japan’s recognition that it risks falling behind in the global crypto race. While jurisdictions like Hong Kong and the European Union advance comprehensive digital asset frameworks, Japan’s current regulatory approach has limited its competitiveness.

The suggested enhanced investor protections, clearer compliance standards, and potential tax parity with traditional investments could position Japan as a preferred destination for crypto businesses and investors seeking regulatory certainty.

Should these measures be approved and implemented, the changes would represent a dramatic reversal from Japan’s historically cautious approach, and it could trigger similar reforms across Asia-Pacific markets eager to capture the growing crypto investment flows.

Read More: Japan’s Metaplanet Doubles Down on Bitcoin Strategy Despite Global Trade Volatility