Key Takeaways

- Argentines turning to crypto has surged as the peso falls 4% in October amid election uncertainty.

- Stablecoin arbitrage strategies yield up to 4% per transaction through the “rulo” method.

- Local exchanges report 40-50% increases in volume as Argentines seek protection against potential post-election devaluation.

Table of Contents

Economic Jitters Fuel (Further) Crypto Adoption

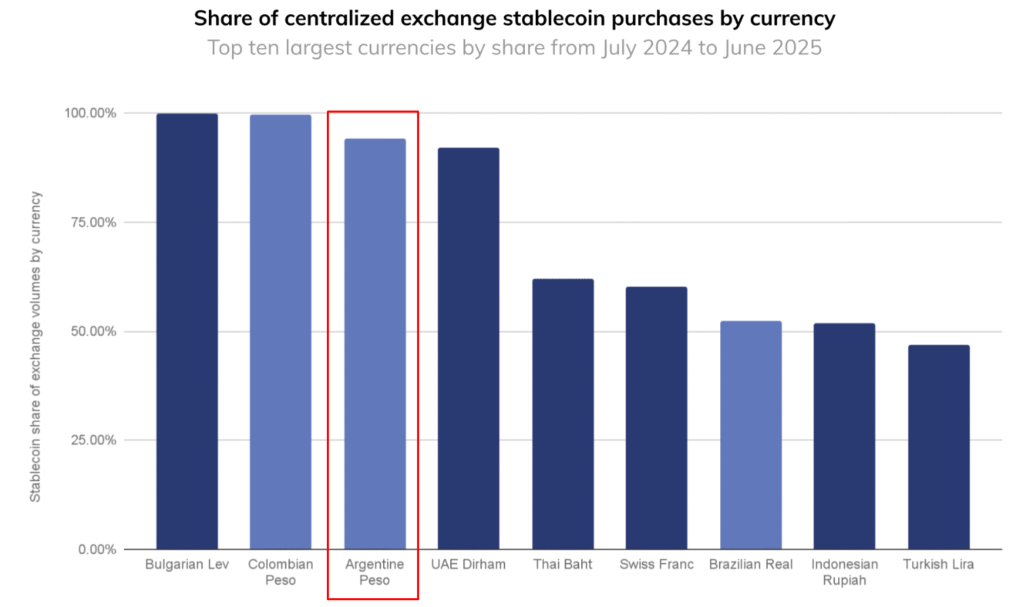

A perfect storm of economic uncertainty is driving the highest number of Argentines turning to crypto ahead of critical October elections. With the peso weakening 4% this month alone and the central bank implementing strict capital controls, these situations are leading citizens to use stablecoins as both a savings instrument and an investment vehicle.

The phenomenon illustrates how cryptocurrencies have evolved from speculative assets to necessary financial products in economies experiencing hyperinflation and currency instability, creating a stark contrast to more stable markets where crypto remains largely optional.

Read also: LIBRA Scandal Update: Argentine Court Weighs Arrests for Milei’s Advisors

Understanding the “Rulo” Arbitrage Strategy

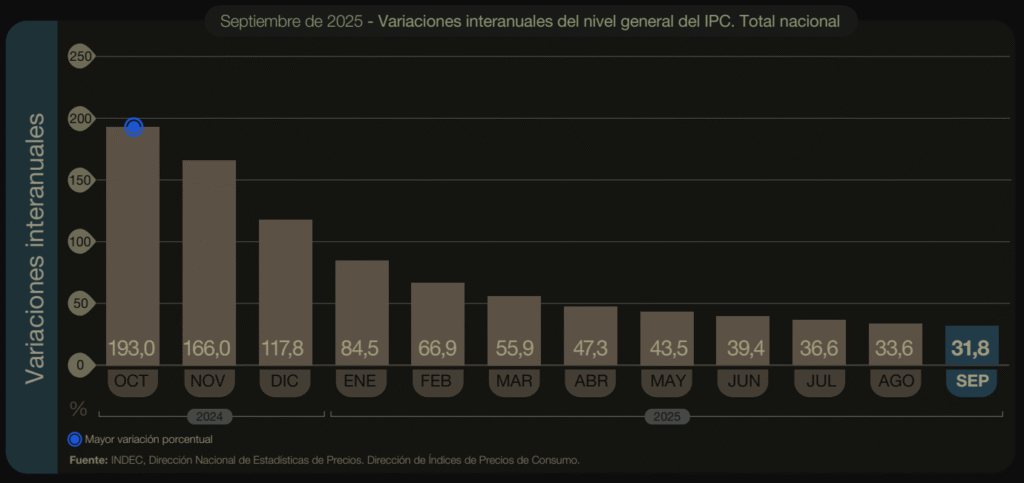

The surge in Argentines turning to crypto is largely focused on a simple but clever arbitrage strategy that, in Argentina, is called “rulo.” See, traders exploit the 7% gap between Argentina’s official and parallel exchange rates by converting dollars into stablecoins, then selling them for pesos on platforms where the currency trades cheaper. So far, each transaction yields gains of at least 4%, extraordinary profits in any market, but even more impressive in an economy where annual inflation still hovers around 30% despite improvements from last year’s 211% peak.

Read also: Toyota, Yamaha, and BYD Now Accept USDT in Bolivia Amid Dollar Crisis

Election Anxiety Fuels Financial Innovation

The timing of this crypto surge is no coincidence, as Argentines turning to crypto has increased significantly in advance of October 26 midterm elections that could determine President Javier Milei’s economic policy direction. A vast portion of Argentina’s population fears a poor performance by Milei’s bloc, which could force another peso devaluation to shore up dwindling central bank reserves.

The political uncertainty and the economic fragility have transformed stablecoins from niche assets into mainstream financial shelters, with exchanges like Ripio and Lemon Cash reporting 40-50% volume spikes since early October.

FAQs

Why are Argentina’s October elections significant for crypto adoption?

The October 26 midterm elections could determine whether President Javier Milei maintains enough political support to continue his economic policies. A poor result might trigger further peso devaluation, making crypto even more attractive as a hedge against currency collapse.

How significant is Argentina’s crypto adoption?

Argentina has one of the world’s highest crypto adoption rates, with stablecoins becoming integrated into daily financial life. Many professionals now receive salaries in crypto, and citizens increasingly use digital dollars for savings rather than trusting the volatile peso.

What is the “rulo” strategy?

There’s a large portion of Argentines turning to crypto as well as generating profits from the ‘rulo’ as an arbitrage method where traders or regular citizens buy stablecoins with dollars, then sell them for pesos on platforms where the currency trades at a discount to the official rate, generating up to 4% profit per transaction by exploiting exchange rate disparities.

For more crypto adoption stories, read: Bealls Retail Crypto Payments Launch at 660+ Stores Nationwide & 99+ Cryptos Accepted