- Bolivia will bring stablecoins into its formal banking system, allowing banks to provide savings, credit and payment services using digital dollar assets.

- The government is negotiating more than nine billion dollars in multilateral financing, with a significant share expected to be released within the next three months.

- Bolivian dollar bonds strengthened after the announcement, reaching their highest level since 2022 and adding to a sharp rally seen throughout the year.

- Officials are pairing the digital finance push with broader economic reforms, including the removal of two major taxes and plans for a leaner 2026 budget that would reduce public spending.

Bolivia plans to introduce stablecoins into its regulated banking system while it negotiates a large package of financing that exceeds 9 billion dollars, Economy Minister Jose Gabriel Espinoza said on Tuesday. The government sees these digital assets as part of a broader effort to ease pressure on foreign currency reserves and modernize the financial sector as President Rodrigo Paz begins his term.

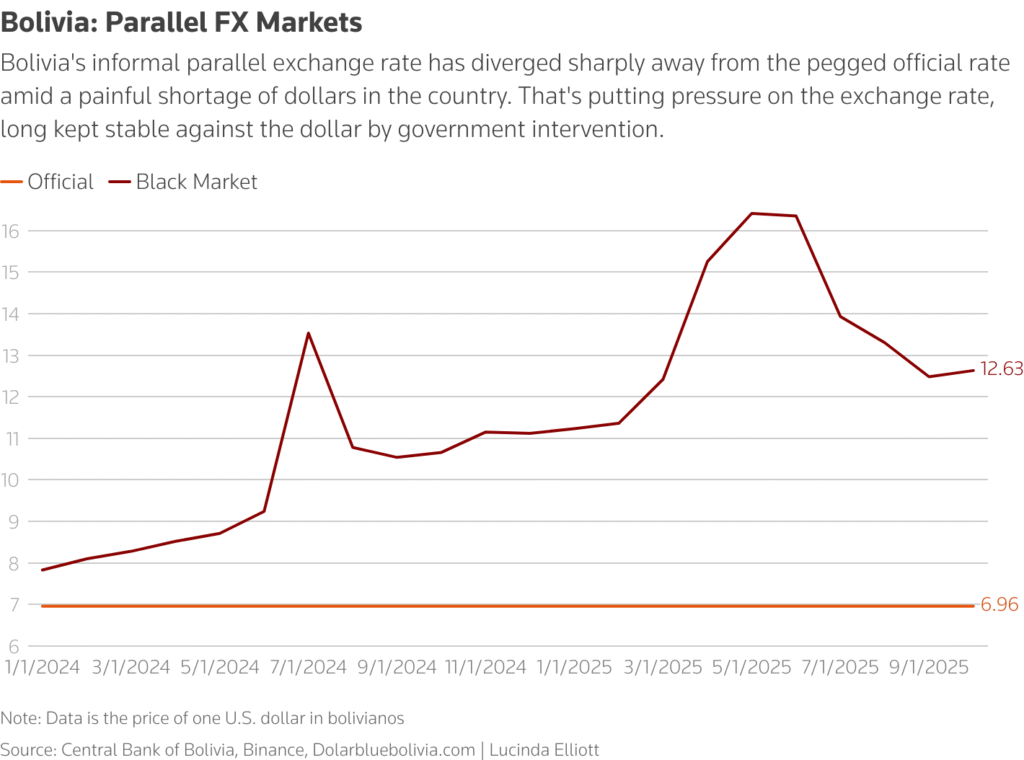

Espinoza said the government is seeking new financing methods to steady an economy pressured by rising prices, a widening fiscal gap and a persistent shortage of foreign currency, according to a Reuters report. He added that international lenders expect to release a sizable share of the money within the next three months.

According to Espinoza, institutions including the World Bank and the Development Bank of Latin America are preparing facilities that will channel money toward private investment in infrastructure, renewable energy and financial inclusion projects. The minister described the plan as a shift away from the state-directed model that dominated economic policy during the previous administration.

Government Push Toward Crypto Integration

As part of the modernization program, Espinoza said the government will allow banks to offer a range of cryptocurrency services beginning with stablecoins. These services will include savings accounts, credit cards and loan products. The objective, he said, is to let stablecoins function as a legal tender payment tool within the regulated financial network.

Crypto activity in Bolivia has risen sharply since the authorities lifted an earlier ban last year. Analysts say many citizens have turned to dollar-backed digital tokens to protect savings from the weakening boliviano and to manage cross border payments with fewer delays. Officials believe that bringing these instruments into the formal system could strengthen transparency, improve liquidity and reduce reliance on cash dollar markets.

Shifts in Tax Policy and Fiscal Planning

President Paz has promised a market-oriented approach that encourages private investment without undermining social programs. The government announced the removal of the wealth tax along with the tax on financial transactions. However, both changes must be approved by Congress, as must the new credit agreements.

Economy minister added that the government plans to present a stricter financial plan for the year 2026 that will trim public expenditures by roughly a third. He stressed that the move was the government’s own decision rather than a response to any request from the International Monetary Fund, though he noted that La Paz is willing to engage in talks with the Fund if approached.

Read More: Paxos Selects Plume and Two Other Platforms for First USDG0 Rollout; Full Details Inside