Key Takeaways

- Stablecoin Rules: Ottawa to regulate fiat-backed stablecoins, requiring reserves, redemption rights, and data safeguards.

- Central Bank Oversight: The Bank of Canada to get C$10 million over two years to administer the new framework.

- AI Investment: Government commits C$925.6 million over five years to build sovereign AI infrastructure.

- Digital Strategy: Ottawa to launch a new AI strategy and Digital Transformation Office to speed public sector innovation by 2025.

Table of Contents

Canada is moving to establish a formal regulatory framework for fiat-backed stablecoins as part of its 2025 federal budget, introducing new oversight measures aimed at improving the safety and reliability of digital payments.

The proposed legislation will target non-prudentially regulated issuers, requiring them to hold sufficient reserves, set clear redemption policies, adopt risk management practices, and protect user data. The government also plans to include national security safeguards to uphold the integrity of the system.

Under the new legislation, the Bank of Canada will receive C$10 million over two years starting in 2026–27 to administer the framework. Ongoing costs, estimated at C$5 million a year, will be recovered through fees charged to regulated stablecoin issuers.

Alongside the legislation, the federal government will amend the Retail Payment Activities Act to enable the regulation of payment service providers that process transactions involving designated stablecoins.

The budget frames the initiative as a step toward building trust in digital assets and ensuring Canadians can access secure and transparent stablecoin products. The measure is also expected to benefit demographics more likely to hold stablecoins, such as men and younger Canadians, according to research by the Financial Consumer Agency of Canada.

Canada Bets on AI, Quantum, and Digital Transformation to Drive Productivity

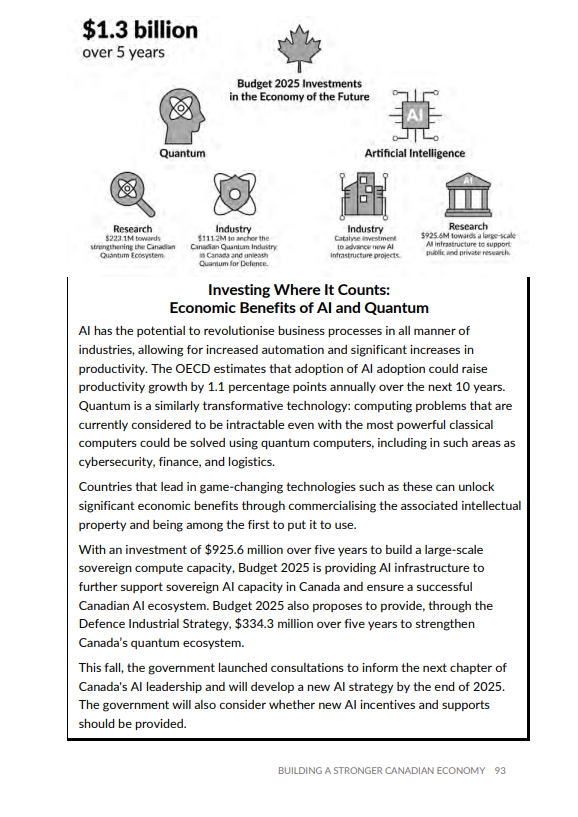

The 2025 federal budget also lays out an extensive plan to harness artificial intelligence, quantum computing, and other emerging technologies to strengthen Canada’s productivity and digital sovereignty.

Leading the technology push, Ottawa will commit C$925.6 million over five years, starting in 2025–26, to expand national computing capacity through a sovereign public AI infrastructure.

C$800 Million to Boost Competitiveness

The funding, including C$800 million from existing fiscal provisions, is intended to strengthen Canada’s competitiveness in global AI research while enabling the Canada Infrastructure Bank and the Minister of Artificial Intelligence and Digital Innovation to collaborate with industry on future large-scale infrastructure projects.

C$25 Million for TechStat to Track AI Impact

To measure the technology’s economic and social impact, the government will provide C$25 million over six years, plus C$4.5 million ongoing, for Statistics Canada to implement the Artificial Intelligence and Technology Measurement Program (TechStat). The National Research Council will also explore ways to attract private capital to scale the Canadian Photonics Fabrication Centre, supporting innovation in AI-related and quantum applications.

C$334.3 Million to Strengthen Quantum Technology

The budget further commits C$334.3 million over five years through the Defence Industrial Strategy to strengthen the country’s quantum technology ecosystem. Together, these measures aim to ensure Canada remains competitive in fast-evolving global technology markets.

To accelerate adoption within government, Ottawa will establish an Office of Digital Transformation to lead the deployment of AI and automation across federal departments.

Building a Made-in-Canada AI System

Additionally, Shared Services Canada, working with the Department of National Defence and the Communications Security Establishment, will develop a made-in-Canada AI system to enhance cybersecurity and data sovereignty while supporting domestic innovators.

AI Integration Across Key Federal Departments

Federal agencies will adopt AI to streamline operations and cut costs. Shared Services Canada will automate IT support, the Department of Justice will apply analytics to manage routine work, Transport Canada will digitize back-office processes, and Public Services and Procurement Canada will expand digital procurement systems to improve efficiency.

C$7.75 Billion in Savings Driven by Automation

The budget’s broader fiscal plan calls for C$7.75 billion in savings over three years starting in 2027–28, with technology and automation expected to drive much of the efficiency. The Canada Revenue Agency plans to use AI to automate risk assessments, cutting repetitive tasks by half and delivering an estimated C$1.1 billion annual fiscal gain by 2028–29.

The government will also introduce a new national AI strategy by the end of 2025 and expand incentives for digital investment through a Productivity Super-Deduction and improvements to research tax credits. These policies are designed to make it cheaper for Canadian companies to invest, scale, and commercialize innovation.

By coupling cost restraint with high-value technology spending, Ottawa aims to modernize public services, stimulate private sector investment, and position the country at the forefront of the global AI and quantum economy.

Read More: Fetch.ai, Secret Network Partner to Protect Diagnostic Imaging Data With Confidential Computing