Key Takeaways

- Ethena’s USDe stablecoin is now available on Kraken, debuting on a U.S.-based exchange for the first time.

- ENA prices bounced back on the positive news, following five days of losses that destroyed more than 20% of its value.

- Being listed shows that USDe has passed strict compliance checks, giving investors and traders confidence in its legitimacy and security.

Ethena’s USDe stablecoin is making its debut on Kraken, marking its first U.S. exchange listing. The move comes amid a broader hype for the stablecoin market which has seen a steady rise for the past three years.

USDe, created by Ethena Labs, offers a new twist on stablecoins. Instead of relying on banks or cash reserves to maintain its value, USDe stays pegged to the U.S. dollar using a smart method called delta-neutral hedging, which balances Bitcoin and Ethereum derivatives. This means it can remain stable while staying independent of traditional financial systems, giving users a more innovative and flexible way to hold and use digital dollars.

The distinct structure differentiates it from conventional stablecoins, such as USDC, which are backed by treasuries and dollars. Its introduction on Kraken, one of the most reputable and regulated exchanges in the United States, demonstrates that the stablecoin has successfully passed stringent compliance inspections.

The timing is interesting because the Trump administration has been focused on rules that encourage crypto innovation while still keeping an eye on risks like money laundering. The Kraken listing does more than just add credibility to USDe, it also shows how stablecoins are growing and becoming more recognized in everyday U.S. markets.

The news of the listing has also boosted Ethena prices which surged against a larger market drop. Even though the majority of the crypto market was struggling, Ethena’s native token, ENA, made an unexpected return, rising 5% in a single day.

ENA prices bounced back on the positive news, demonstrating investor confidence, following five days of losses that destroyed more than 20% of its value following the Fed’s rate cut on September 18. Nonetheless, it was significant that this increase occurred after a 32% decline in trade volumes the day before. Given that fewer people were trading, it is unclear if the bounce is long-lasting or only a temporary uptick.

Why is the Kraken Listing Important For Ethena’s USDe?

The Kraken listing is a big deal for Ethena’s USDe stablecoin because it gives the token both credibility and wider reach. Kraken is one of the most trusted and regulated crypto exchanges in the U.S.

Getting listed indicates that USDe has cleared tough compliance checks. That builds confidence among investors and traders that the stablecoin is legitimate and secure.

It also makes it much easier for U.S. users and institutions to trade and use USDe in their daily transactions. Beyond just market access, the listing highlights growing acceptance of alternative stablecoins in mainstream crypto. Being on Kraken boosts USDe’s visibility and chances of becoming a go-to option for trading, payments, and DeFi activity.

Read Also: Top 5 Stablecoins Every Investor Should Know

Ethena’s USDe Listing Comes Amid Rise in Stablecoin Hype

Ethena’s decision to list USDe on Kraken follows a broader hype for stablecoins amid institutional demand and investor confidence. Stablecoins have become an inegral part of the of decentralized finance (DeFi) ecosystem.

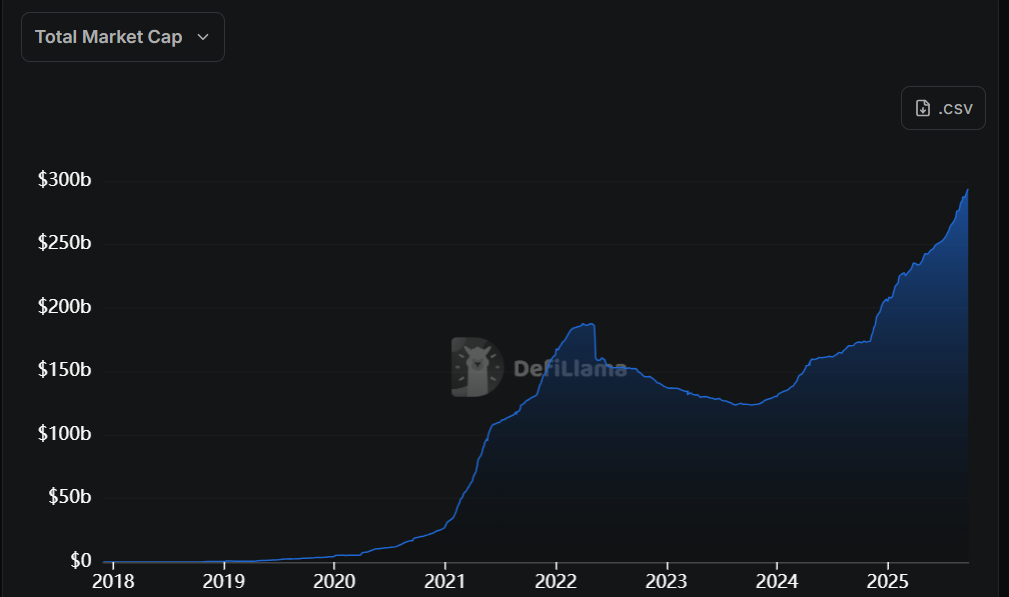

The main selling point for these fiat-pegged coins is that they give users a way to move money around without worrying about the wild price swings of regular digital assets. In 2025 alone, the total market cap for stablecoins has surged past $294 billion, showing their importance and credibility.

The fiat-pegged coins have garnered interest from investors of all genres. Traders park funds in them during volatile markets, DeFi platforms rely on them for lending and liquidity, and more everyday users are turning to them for fast payments.

Some popular names like USDT, USDC, and DAI dominate the market at present. However, new models such as synthetic and algorithmic stablecoins are adding fresh options, using innovative mechanisms to hold their dollar peg.

Further, regulators in the U.S. and Europe are keeping a close eye on these market developments, balancing the risks of misuse with the opportunities for innovation. As stablecoins continue to gain traction, they have carved out a crucial role as the link between traditional finance and Web3.