Key Takeaways

- Ten major European banks have formed a consortium to launch a regulated Euro stablecoin by the second half of 2026.

- The project, operating under a new Dutch entity called Qivalis, is seeking an Electronic Money Institution (EMI) license.

- The Euro stablecoin aims to provide a European alternative to the dominant dollar-backed tokens, such as USDT and USDC, for on-chain payments.

Table of Contents

A Unified Front for Digital Sovereignty

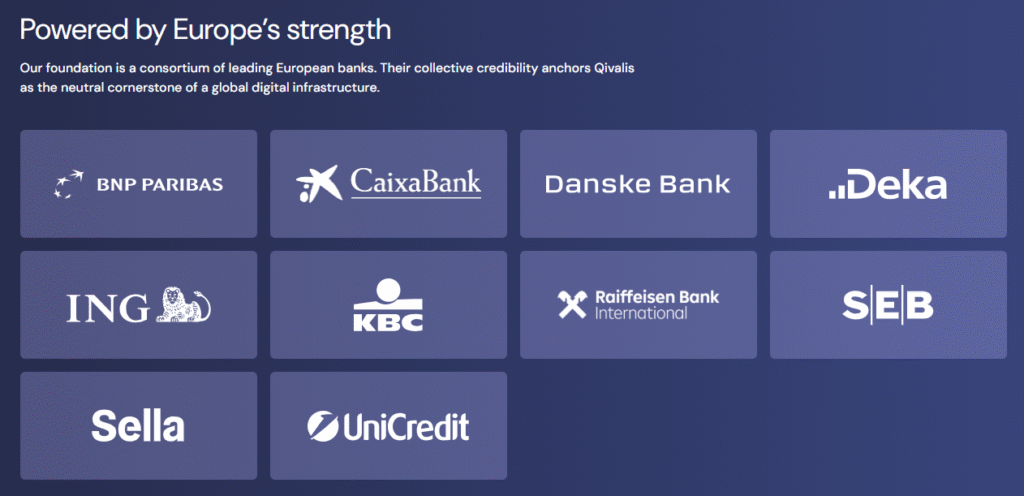

To regain traction in the digital currency space, ten European banks (including BNP Paribas, ING, UniCredit, and CaixaBank) have come together to create a consortium that will support a fully regulatory-compliant Euro stablecoin by 2026.

As part of this initiative, the group has formed a new Dutch entity called Qivalis that recently applied to De Nederlandsche Bank for an Electronic Money Institution license. While many have been drawn to the benefits of the digital currency space, US-based stablecoins, which are backed by U.S. dollars, have become dominant. Therefore, Qivalis was created to facilitate the development of a stablecoin that meets the EU’s Markets in Crypto-Assets (MiCA) Regulations and allows the European Union (EU) to achieve “strategic autonomy” and control of payments.

Read also: UK Forges Ahead with Comprehensive Crypto Assets and Stablecoin Regulation Under FCA’s Watch

Building on Regulatory Certainty

Due to the regulatory clarity provided by MiCA, stablecoin issuers are now required to fully back their stablecoins with 1:1 euro reserves and provide adequate consumer protections. This enables the consortium banks to collectively support one another and share the significant compliance and technology burdens necessary to launch a regulated Euro stablecoin.

The token is designed for secure, near-instant on-chain payments and settlements, while still benefiting from all the advantages afforded by a blockchain-based currency, such as the creation of new use cases for corporate payroll, tokenised securities, and cross-border transactions.

Read also: Blockrise Secures Coveted MiCA License, Pioneering Regulated Bitcoin Finance in the EU

Redefining the Future of European Finance

The planned 2026 launch of this consortium-backed Euro stablecoin constitutes an important turning point with respect to the financial infrastructure of the European Union. In moving forward, this stablecoin indicates that established banks across the region will not only be monitoring developments related to digital assets but also updating their current technology systems and integrating that technology into their legacy banking systems to facilitate the ongoing growth of euro usage.

Successful implementation of the Euro stablecoin may serve as a major building block for the tokenized economy in Europe, providing a significant shift away from complete dependency on third-party payment systems and establishing the euro as a valuable competitor within the emerging world of programmable currencies.

FAQs

Which banks are involved in the Euro stablecoin project?

The consortium includes BNP Paribas, Banca Sella, CaixaBank, Danske Bank, DekaBank, ING, KBC, Raiffeisen Bank International, SEB, and UniCredit.

How is this different from existing euro stablecoins?

In contrast to existing private euro-pegged tokens, this will be a regulated financial instrument issued by a licensed consortium of major banks, specifically designed for compliance with the EU’s MiCA framework, ensuring higher standards of transparency and consumer protection.

When will the regulated Euro stablecoin be available?

The group, operating as Qivalis, is targeting a launch in the second half of 2026, pending regulatory approval of its Electronic Money Institution license from the Dutch central bank.

For more Europe regulation-related stories, read: EU Parliament Backs Landmark Social Media and AI Age Limits to Protect Youths Under 16