Key Takeaways:

- Sky (formerly MakerDAO) has submitted a proposal to issue Hyperliquid’s new USDH stablecoin.

- The proposal includes a 4.85% yield for holders and a $25 million fund to bootstrap Hyperliquid decentralized finance (DeFi).

- A validator vote on September 14th will decide between competing bids from Agora, Paxos, and Frax.

Table of Contents

USDH Stablecoin: The High-Stakes Bidding War

With the formal announcement of Sky, formerly MakerDAO, the race to become the first official issuer of Hyperliquid’s new USDH stablecoin has intensified.

With proposals from Agora, Paxos, and Frax Finance as well, this all-out bidding war will be decided by a validator vote next week on September 14th. This vote is likely to have a huge impact on the Hyperliquid ecosystem for years to come.

To this point, Hyperliquid, a high-performance decentralized exchange (DEX) in the decentralized finance (DeFi) sector, announces the launch of its own native USDH stablecoin, which will lessen its reliance on Circle’s USDC stablecoin. The company has now entered into fierce competition, including firms with some of the biggest names in the crypto space. Arguably, Sky’s proposal, led by its founder, Rune Christensen, is the most solid, with $13 billion in collateral and seven years of history to offer huge value.

Read also: Hyperliquid DEX Review: Is It Worth Trading on the Biggest Decentralized Derivatives Platform?

What Sky Provides

Sky’s proposal is a full-stack ecosystem proposition. The offer to the Hyperliquid community is a 4.85% yield across all USDH stablecoin balances, an interest rate that currently exceeds that of U.S. Treasury Bills. It guarantees $2.2 billion in immediate USDC redemption liquidity, providing significant stability.

In addition to the stablecoin, Sky is providing a $25 million “Genesis Star” fund to bootstrap independent DeFi projects exclusively on Hyperliquid, replicating an operation similar to their Spark subsidiary.

Significant Competition

Sky has serious competitors:

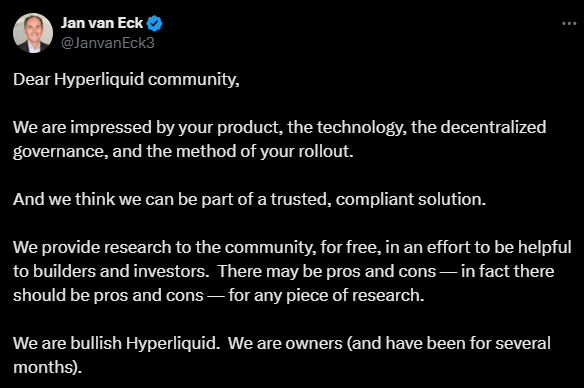

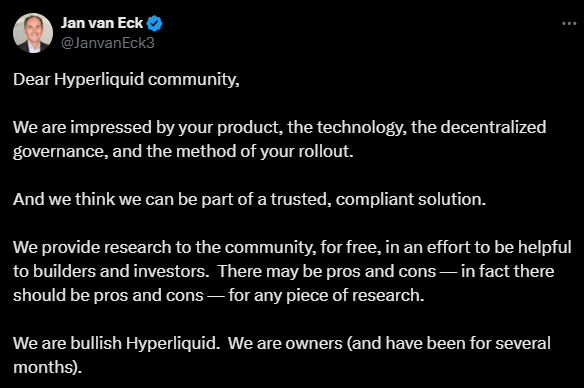

- Agora, with VanEck CEO Jan van Eck backing a compliant, regulatory-first approach.

- Paxos which has proposed allocating 95% of what they earn on reserves to buy back Hyperliquid’s HYPE token.

- Frax Finance which has established a “community-first” model where treasury yield goes 100% to users.

More Than Just a New Stablecoin

The decision now is not simply a stablecoin choice, but also about selecting a strategic partner for Hyperliquid’s longitudinal growth. It should be noted that Sky’s offer is not just a currency; it is a complete economic engine aimed to catalyze DeFi development on the chain.

Final Thought: Will Hyperliquid validators prioritize Sky’s immense liquidity and yield, or will a more specialized contender like Agora’s compliant framework win the day?

FAQs

What is the USDH Stablecoin?

It is the planned native stablecoin for the Hyperliquid decentralized exchange.

Who decides the issuer?

Hyperliquid network validators will vote on September 14th, 2025.

What is Sky’s key advantage among other competitors?

It has massive existing liquidity and proven infrastructure from running MakerDAO and DAI.

For more stablecoin-related stories, read: Stripe and Paradigm Launch Tempo, A New Stablecoin Payments Blockchain