Key Takeaways:

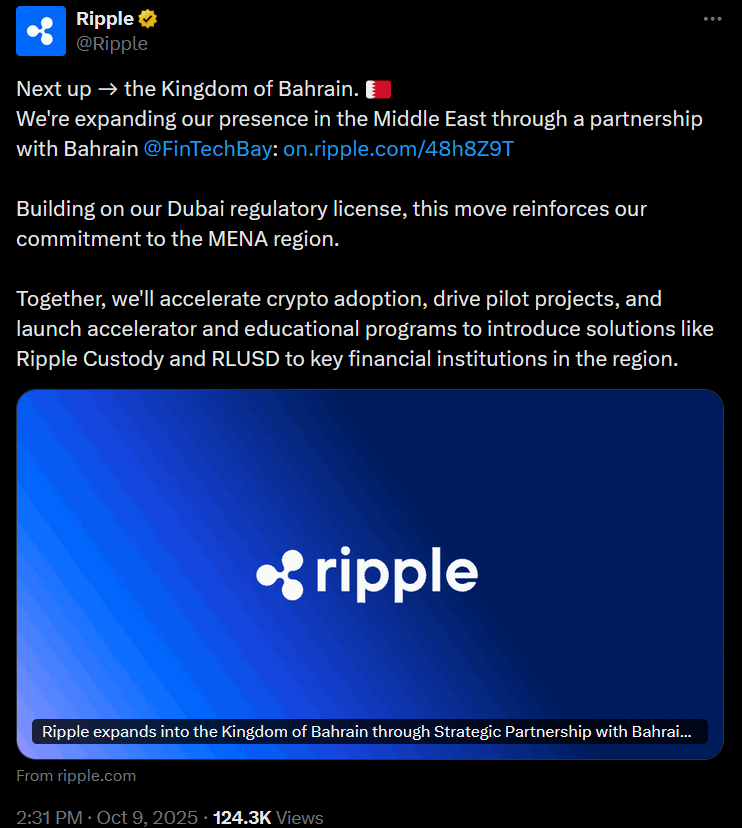

- Ripple has announced future plans to expand its stablecoin, Ripple USD (RLUSD), into Bahrain through a strategic partnership with Bahrain Fintech Bay, strengthening its regional presence after securing a Dubai license earlier this year.

- The collaboration focuses on blockchain-based pilot projects, cross-border payments, tokenization, and educational programs designed to build Bahrain’s fintech talent and infrastructure.

- The Central Bank of Bahrain (CBB) introduced a new framework in July 2025 to license and regulate stablecoin issuers, allowing fiat-backed digital currencies tied to the Bahraini dinar, U.S. dollar, or other approved currencies.

- With early crypto regulations, licensed exchanges like Rain and CoinMENA, and the establishment of Bahrain FinTech Bay, the Kingdom has emerged as a leading example of how regulation and innovation can coexist in the digital asset economy.

Ripple, the blockchain company behind the XRP token and a leading provider of digital asset infrastructure, has announced its future plans to expand its stablecoin Ripple USD (RLUSD) into Bahrain through a strategic partnership with Bahrain Fintech Bay (BFB), the country’s flagship fintech hub.

The partnership extends Ripple’s growing presence in the Middle East, following its regulatory license in Dubai earlier this year. It aims to support Bahrain’s ambitions to strengthen its blockchain ecosystem and position itself as a regional leader in digital finance innovation.

Under the agreement, Ripple and BFB will collaborate on pilot projects and proofs-of-concept focused on blockchain technology, cross-border payments, tokenization, and stablecoins. The initiative will also feature educational programs, accelerator activities, and local fintech events designed to foster new partnerships and build local expertise.

“The Kingdom of Bahrain has emerged as an early adopter of blockchain technology, and was one of the first jurisdictions globally to regulate cryptoassets,” said Reece Merrick, Managing Director, Middle East and Africa at Ripple. “At Ripple we look forward to working with Bahrain Fintech Bay to continue laying the foundations for a thriving local blockchain industry, as well as ultimately offering our digital assets custody solution and stablecoin Ripple USD (RLUSD) to Bahrain’s financial institutions.”

Highlighting the importance of the collaboration, Suzy Al Zeerah, Chief Operating Officer at Bahrain Fintech Bay, said the partnership with Ripple underscores the hub’s mission to connect global innovators with Bahrain’s fintech ecosystem, opening opportunities for pilot projects, talent development, and advanced financial solutions that will drive the region’s digital future.

Bahrain’s Steady March Toward Regulated Digital Finance

Bahrain has steadily positioned itself as one of the Gulf’s most progressive hubs for blockchain and digital assets, taking measured steps toward building a regulated, innovation-friendly ecosystem.

In July 2025, the Central Bank of Bahrain (CBB) introduced a comprehensive framework for licensing and regulating stablecoin issuers, making the Kingdom one of the first jurisdictions in the region to formally supervise fiat-backed digital currencies.

The new rules allow licensed firms to issue single-currency stablecoins backed by the Bahraini dinar, U.S. dollar, or other approved fiat currencies. The framework is designed to strengthen investor protection, enhance transparency, and bring unregulated stablecoin activity under clear oversight.

That milestone followed years of groundwork. In 2019, the CBB launched its Crypto-Asset Module, an early regulatory framework that established clear standards for capital, custody, and compliance across crypto service providers.

This regulatory clarity encouraged domestic platforms, such as Rain and CoinMENA, to obtain official licenses, giving local investors access to regulated crypto trading.

Together, these efforts have helped Bahrain evolve from a traditional financial center into one of the Middle East’s earliest examples of how regulation and innovation can coexist in the crypto era.

Read More: Coinflow Secures $25M from Pantera Capital, Coinbase to Scale Stablecoin Payments