Key Takeaways

- K Bank and BPMG plan a partnership to advance stablecoin services in South Korea

- The firms are also considering major overseas partners in Thailand and Dubai for proof-of-concept projects as they gear up to expand globally.

- It is interesting to note that K Bank’s partnership comes after the lender has previously ventured extensively in crypto.

South Korea’s K Bank takes steps to strengthen South Korea’s stablecoin ecosystem. The nations digital lender taps on a new partnership with blockchain startup BPMG to bring advance services in the region. The collaboration stems from the idea of developing financial services powered by stablecoins on a global scale.

Through the partnership, the two companies plan to build practical stablecoin solutions that will focus on everyday uses, per local media reports. This includes cross-border transfers, currency exchange, and payments.

K Bank and BPMG are also exploring leveraging distributed ledger technology to simplify cross-border transaction processes and minimize intermediaries. The move will likely offer a solution that reduces costs and accelerates the process of stablecoin transactions.

South Korea’s K Bank takes steps to strengthen South Korea’s stablecoin ecosystem. The nations digital lender taps on a new partnership with blockchain startup BPMG to bring advance services in the region. The collaboration stems from the idea of developing financial services powered by stablecoins on a global scale.

Through the partnership, the two companies plan to build practical stablecoin solutions that will focus on everyday uses, per local media reports. This includes cross-border transfers, currency exchange, and payments.

K Bank and BPMG are also exploring leveraging distributed ledger technology to simplify cross-border transaction processes and minimize intermediaries. The move will likely offer a solution that reduces costs and accelerates the process of stablecoin transactions.

The two businesses want to develop tools that can automatically monitor legislation and transaction data across nations using BPMG’s blockchain and AI expertise. This will ensure that their stablecoin services remain dependable, secure, and compliant.

Further, K Bank and BPMG are in talks with major overseas partners in Thailand and Dubai on proof-of-concept projects as they gear up to expand globally.

The online lender’s move comes at a time when the stablecoin market in South Korea has garnered attention and hype from market participants of all age groups.

South Korea’s K Bank Takes Stablecoin Route: Why is This Significant?

The collaboration between blockchain startup BPMG and South Korea’s K Bank is a significant step in making stablecoins more useful in daily finance. The two platforms can create a more efficient and less expensive method of sending money internationally.

This can help crypto investors make payments and exchange currencies in a less cumbersome manner. The two major components of the partnership will include K Bank’s reliable banking network and BPMG’s knowledge of blockchain and artificial intelligence.

By focusing on global compliance and building tools that adapt to different countries’ rules, the upcoming stablecoin solutions aim to be safe and reliable. This move could help South Korea become a leader in the global stablecoin market and promote wider adoption of digital banking.

South Korea’s K Bank: Past Moves in Crypto

It is interesting to note that K Bank’s partnership comes after the lender has previously ventured extensively into crypto. One of the most notable partnerships that K Bank undertook is with South Korean crypto exchange Upbit.

The Upbit collaboration has been a key reason for K Bank’s recent fast growth as well. As of the end of March, 5.56 trillion won ($4.5 billion), or about half of Kbank’s deposits of 11.54 trillion won ($9.28 billion), were used for cryptocurrency trading at Upbit, according to statistics provided to the Korean National Assembly.

This collaboration comes at a time when South Korea’s top banks are gearing up to launch crypto and stablecoin services before the nation’s new regulations come into effect. By staying ahead of the rules, these banks hope to give customers safe, compliant ways to explore cryptocurrencies.

South Korea’s Stablecoin Market Set For Steady Rise

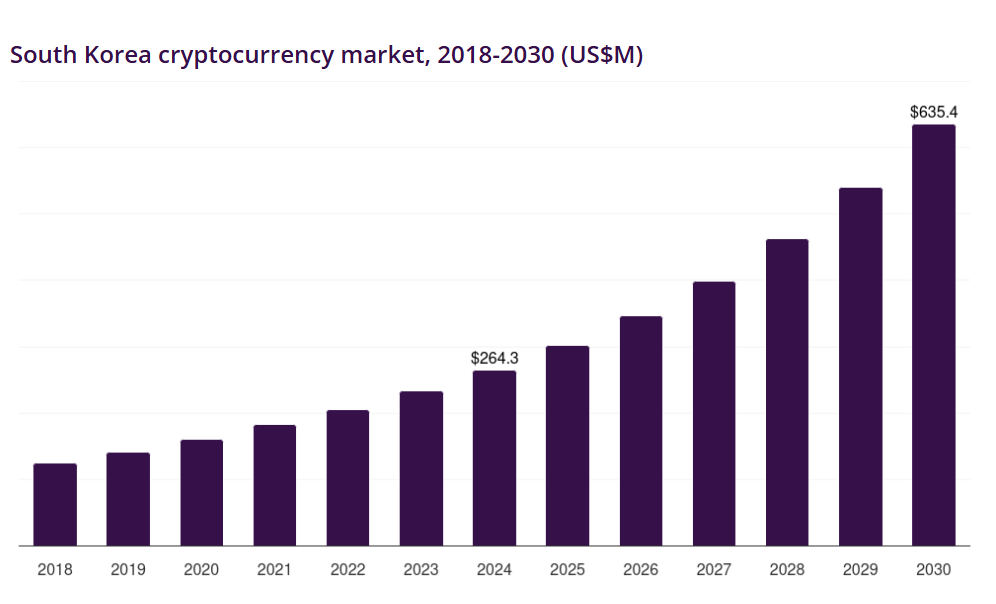

The overall cryptocurrency market in South Korea is expanding quickly. It generated nearly $264 million in 2024 and is predicted to reach $635 million by 2030, with a 16% rate of growth.

The market’s expansion is a reflection of banking and commerce’s growing use of digital assets. Additionally, the demand for cryptocurrencies has picked up among the younger generation in the country.

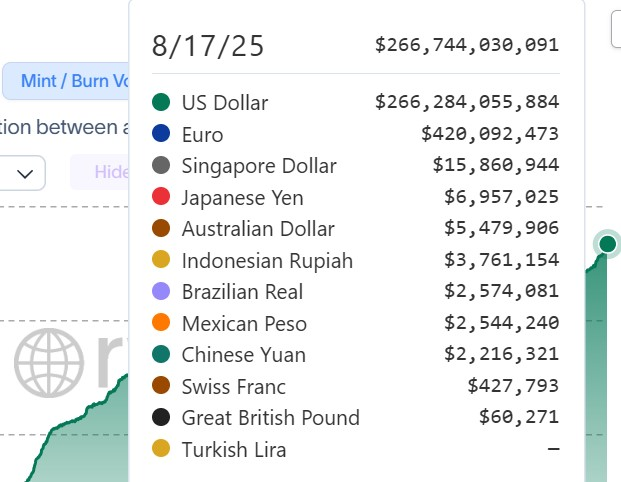

Due to this rise in crypto demand, South Korea is entering into the stablecoin race, but with its own local twist. Policymakers and banks are now advocating for won-pegged stablecoins as an alternative to dollar-backed coins like USDT and USDC, which are responsible for about half of the nation’s cryptocurrency outflows.

The goal is to facilitate digital payments and transfers while maintaining value circulation inside the local economy. Regulators emphasise that the deployment will be gradual to preserve financial stability, although major players like KB Kookmin, Shinhan, and Woori Bank are getting ready to conduct pilots as early as 2025–2026.