Key Takeaways:

- Standard Chartered warns that up to $1 trillion could exit emerging market banks as demand for U.S. dollar-pegged stablecoins accelerates amid currency pressures and inflation risks.

- The bank expects stablecoin holdings in emerging economies to reach about $1.22 trillion, rising from roughly $173 billion today, as individuals and businesses seek digital access to dollar-pegged assets.

- A U.S. Treasury report released in April projects the global stablecoin market could expand nearly tenfold to around $2 trillion by 2028, driven by regulatory clarity and broader institutional adoption.

- Both reports suggest the world’s financial system is entering a new phase, where stablecoins play a growing role in how money moves and in how the U.S. dollar extends its reach across digital networks.

Standard Chartered expects a sharp acceleration in stablecoins adoption, warning that up to $1 trillion could move out of emerging market banking systems and into stablecoins within the next three years.

The bank’s research team said in a new report that digital tokens tied to the dollar, could attract around $1 trillion from emerging economies by 2028, taking total holdings in these markets to about $1.22 trillion, up from roughly $173 billion today.

The shift, it said, is being driven by individuals and businesses in countries where access to U.S. dollars is limited and local currencies are under pressure.

Standard Chartered noted that the growing shift toward stablecoins could drain deposits from emerging market banks, particularly in countries battling inflation, currency weakness or capital controls.

The bank added that stablecoins’ appeal lies in their accessibility, as digital dollars move instantly, hold steady value and remain outside traditional banking risks.

U.S. Government Report Envisions $2 Trillion Stablecoin Market by 2028

A recent presentation submitted to the U.S. Treasury Borrowing Advisory Committee offers a closer look at how the rise of stablecoins could reshape the global flow of money.

The document, titled Digital Money, lays out how U.S. dollar-pegged stablecoins are evolving from niche crypto tools into a structural force in international finance. It outlines a future where digital dollars increasingly compete with bank deposits, influencing demand for U.S. Treasuries and even shaping the reach of American monetary policy.

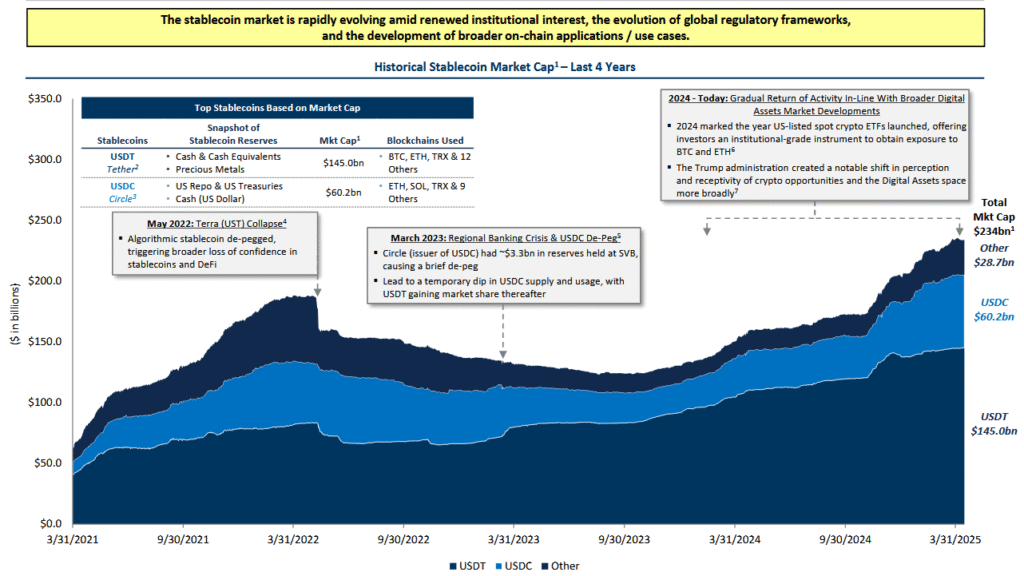

According to the document, the global stablecoin market, valued then at about $234 billion, could expand nearly tenfold to around $2 trillion by 2028. That growth is expected to be fueled by regulatory clarity in the United States, new institutional adoption, and the growing presence of blockchain-based settlement systems.

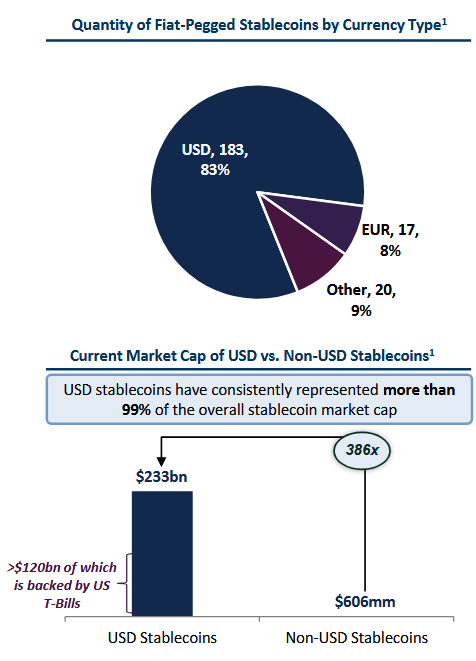

The document notes that U.S. dollar-denominated coins account for nearly the entire stablecoin market, reinforcing the dollar’s global reach at a time when banking systems in many regions continue to face trust and liquidity challenges.

It also states that as stablecoins become more embedded in payment and savings systems, they could steadily draw deposits away from local banks, particularly in economies struggling with inflation, capital controls or restricted access to dollar-based accounts.

New legislation, including the proposed GENIUS Act, would likely cement the role of stablecoins in financial markets, by requiring issuers to hold high-quality, short-term U.S. government assets. That structure, while designed to ensure stability, could generate an estimated $900 billion in additional demand for Treasury bills, further linking digital assets to the traditional debt market.

The document concludes that stablecoins, though still in their early stages, could become a defining channel for global liquidity in the coming years.

Both reports signal a structural change in how money flows across the world, with stablecoins gaining ground as a digital extension of the U.S. dollar and becoming an increasingly important part of the global financial framework.

Read More: Stablecoin Cap Hits $300B, How Will It Impact Crypto Market?