Key Takeaways

- Stream Finance has suspended all withdrawals after an external fund manager disclosed a devastating $93 million loss.

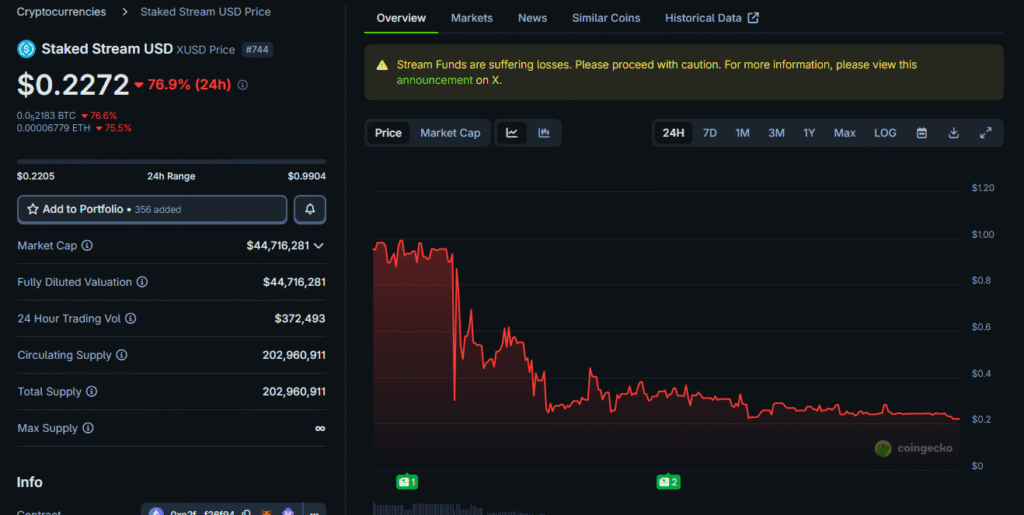

- The platform’s stablecoin, Staked Stream USD (XUSD), depegged, crashing to $0.51 first and then as low as $0.22.

- The incident threatens contagion across several decentralized finance (DeFi) protocols, which hold over $285 million in loans backed by Stream’s assets.

Table of Contents

A $93 Million Hole and a Frozen Platform

Stream Finance has abruptly stopped all deposits and withdrawals and sparked outrage in the decentralized finance (DeFi) space. The crisis was triggered after an external fund manager overseeing the platform’s assets reported roughly a $93 million loss within the customers’ accounts. In response, Stream Finance has engaged lawyers from Perkins Coie LLP to lead a comprehensive investigation into the catastrophic incident.

The platform said it is now actively trying to withdraw all of the remaining liquid assets; however, a timeline has been provided for when users might regain access to their funds.

Read also: Balancer Exploit Drains $120M in Major DeFi Security Breach

The Domino Effect: Depegging and DeFi Contagion

The announcement immediately struck a blow to confidence in the platform’s native stablecoin. The Staked Stream USD (XUSD), which is supposed to maintain a 1:1 value with the U.S. dollar, depegged violently, trading down to as low as $0.51 in the first hours to completely plummeted to an even lower of $0.22, at the time of writing.

This collapse reveals a large inherent vulnerability in the wider DeFi ecosystem. Analysts estimate that over $285 million in outstanding loans on platforms such as Euler and Morpho are secured by Stream’s assets, leaving many other protocols and their users at risk of losing substantial amounts.

Read also: Kadena Blockchain Halts as Founding Team Shuts Down, KDA Token Crashes 66%

An Educational Story of Opaque Yield Farming

To this point, and even with a strengthened ecosystem, Stream Finance’s downfall serves as a strong illustration of hidden risks amid complex, yield-seeking DeFi schemes. The platform’s lack of transparent and demonstrable proof-of-reserves and its reliance on an opaque external fund manager have left users facing massive losses and a frozen platform, for the moment.

All-in-all, this event reminds us of the necessity of increasing transparency and improving risk management in decentralized finance.

FAQs

Why did Stream Finance freeze withdrawals?

Stream Finance froze withdrawals from its platform to prevent a bank run after facing a $93 million loss from an external fund manager, allowing time for an investigation and to secure remaining assets.

What is Staked Stream USD (XUSD)?

Staked Stream USD (XUSD) is a stablecoin issued by Stream Finance that was designed to be pegged to the US dollar but has since depegged following the platform’s $93 million loss to trade as low as $0.22 at the time of writing.

Can I get my money out of Stream Finance?

Currently, no. All withdrawals were suspended indefinitely. The platform has not provided a timeline for when users might be able to access their funds; this will depend on the outcome of the ongoing investigations.

For more DeFi-related stories, read: Kamino and Immunefi Bug Bounty Program Launches with Record $1.5M Prize Pool