Key Takeaways

- After the market crash, Tether and Circle minted $1.75 billion in new stablecoins.

- Tether CEO Paolo Ardoino praised USDT’s resilience while rival stablecoin USDe briefly depegged during the turmoil.

- Ethereum investment firm Bitmine acquired over $100 million in ETH, signaling institutional confidence in the recovery.

Table of Contents

Massive Liquidity Injection Post-Crash

In a timely reaction to last week’s unprecedented collapse in the market, Tether and Circle have collectively injected $1.75 billion in new stablecoin liquidity into the crypto ecosystem:

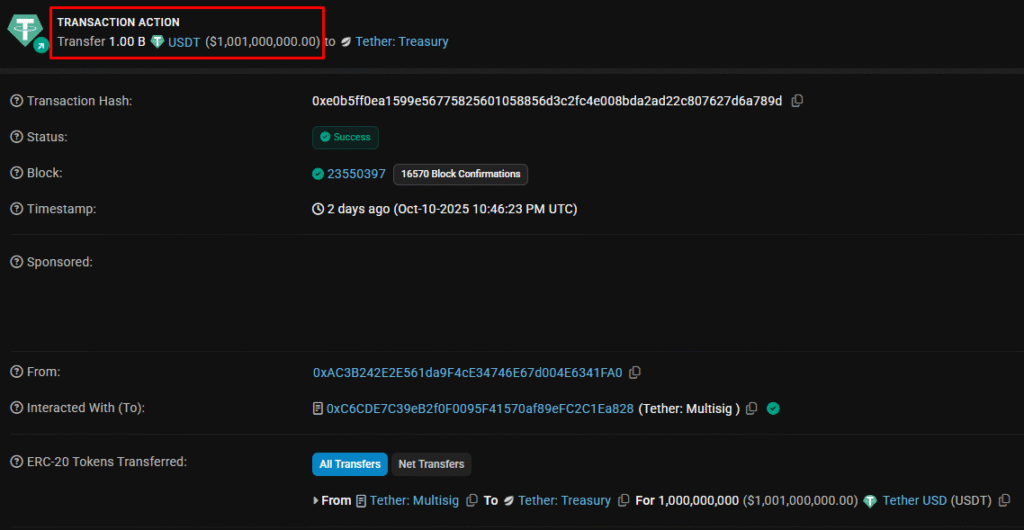

- Tether minted approximately $1 billion in new USDT on Ethereum

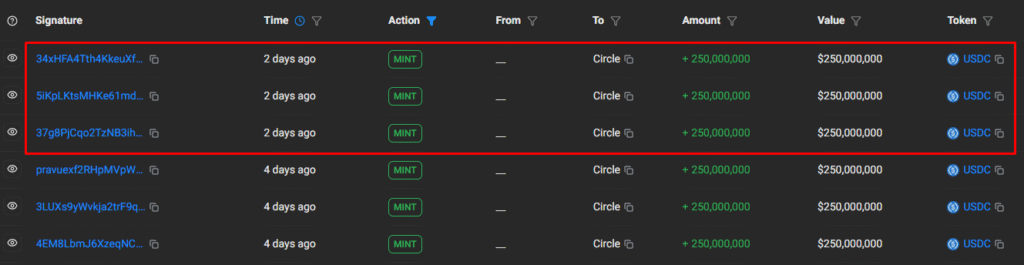

- Circle issued $750 million in USDC on Solana

This substantial issuance represents one of the largest short-term stablecoin expansions this year and suggests that major market participants are preparing to acquire digital assets at discounted prices rather than exiting the market entirely.

Read also: SUI Native Stablecoins Launch: Ethena and BlackRock Power New suiUSDe and USDi

Contrasting Stablecoin Performance Under Pressure

The latest market volatility highlighted two models of stablecoins in stark contrast to each other. While Tether and Circle maintained their dollar pegs throughout the crisis, Ethena Labs’ synthetic dollar USDe briefly depegged to as low as $0.65 on Binance due to what the project described as an internal pricing discrepancy. Tether CEO Paolo Ardoino seized the moment to emphasize USDT’s reliability, declaring it “the best collateral for derivatives and margin trading” and subtly criticizing competitors using what he characterized as less reliable backing mechanisms.

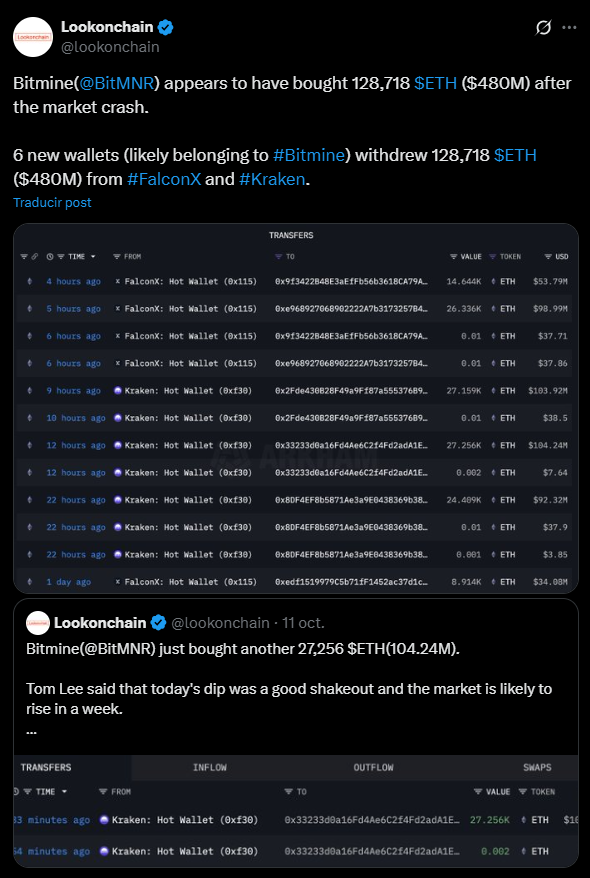

Moreover, tech firm Bitmain acquired 128,718 ETH, worth around $480 million, following the market crash news.

Read also: MetaMask Stablecoin Launch: mUSD to Bridge Web2 and Web3 Payments

Institutional Confidence in Recovery

The rapid interventions of Tether and Circle to expand the supplies of stablecoins occurred alongside major institutional purchase. The rapid interventions of Tether and Circle to expand the supplies of stablecoins occurred alongside major institutional purchases.

Market analysts, including Fundstrat’s Tom Lee, characterized the sell-off as a “good shakeout” rather than a fundamental collapse, suggesting the liquidity injection and institutions accumulating substantial positions show what appears to be confidence that the market might be able to recover itself, as this was happening despite the record $19 billion in liquidations.

FAQs

Why do stablecoin issuers, Tether and Circle, mint new tokens after crashes?

They expand supply to meet increased demand from investors converting volatile assets into stablecoins or preparing to buy discounted crypto assets.

How did USDT perform compared to other stablecoins?

USDT maintained its dollar peg perfectly throughout the crypto market crash, while Ethena’s USDe, for example, briefly depegged to $0.65 on Binance due to exchange-specific issues.

What signals institutional confidence in market recovery?

Bitmine’s purchase of $480 million in ETH immediately after the crash shows major players are accumulating at lower prices, anticipating a rebound.

For more stablecoin-related stories, read: MoneyGram Stablecoin App Launches to Revolutionize Remittances