Key Takeaways:

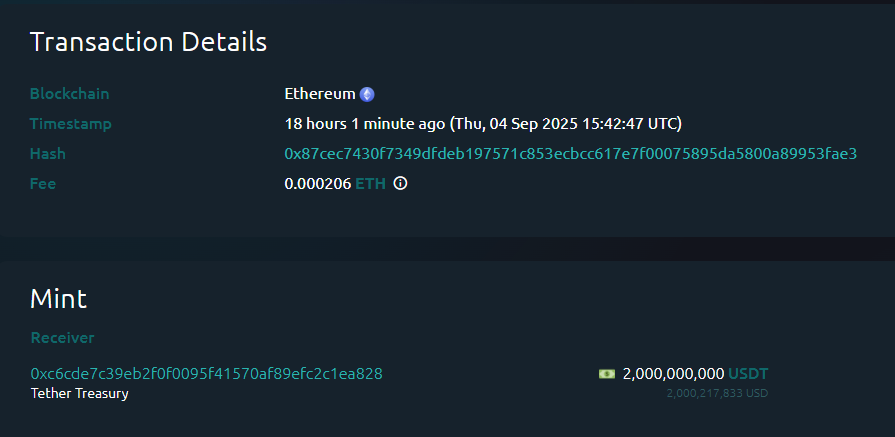

- This week, Tether minted $2 billion in USDT, performing its largest single minting since December 2024.

- The minting comes as Bitcoin is pulling back from recent highs amidst the larger crypto market downturn.

- CEO Paolo Ardoino stated that the minting occurred at a request for inventory replenishment for cross-chain swaps.

Table of Contents

An Unusual Minting During a Pullback

In an unusual action that quickly grabbed the market’s attention, Tether has minted its largest single USDT issuance in nine months by creating $2 billion USDT on the Ethereum blockchain. The timing of this minting is significant as it occurs just as the larger crypto market is experiencing a pullback, leading to speculation.

The mint was first detected by on-chain tracking services such as Whale Alert on September 4. Tether CEO Paolo Ardoino was quick to add context, emphasizing that it was largely to comply with a request from major exchange Binance to process a $2 billion cross-chain swap from the Tron network to Ethereum. In the past, he stressed that these actions were “authorized but not issued” transactions, meaning the new tokens are pronged in Tether’s treasury as inventory for the future demand but not immediately circulating.

Echoes of History

The timing bears striking similarities to a December 2024 $2 billion mint. That one occurred in a pullback after Bitcoin (BTC) first broke the $100,000 barrier. After that mint, BTC increased about 8% over 11 days. This situation is similar enough that analysts and traders are eagerly watching to see if a parallel recovery will take place and possibly drive Bitcoin pushing towards the $118,000 level again.

Read also: Stripe and Paradigm Launch Tempo, A New Stablecoin Payments Blockchain

The Expanding Stablecoin Backbone

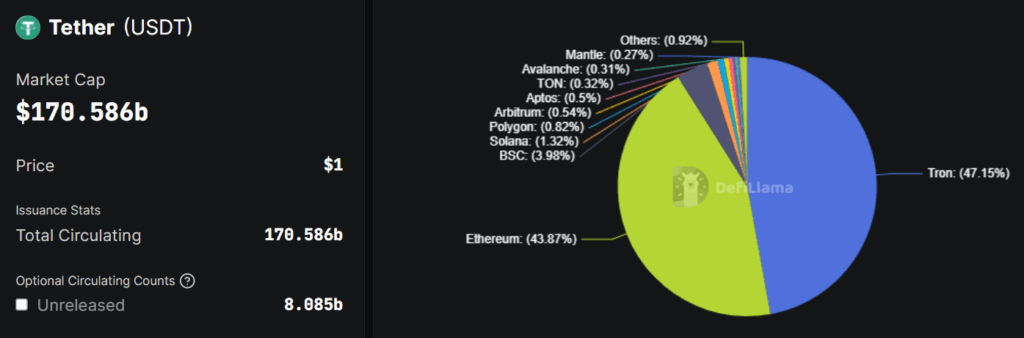

This is also indicative of the immense and growing importance of stablecoins. The entire stablecoin environment has a whopping $288 billion market cap (at the time of writing) and is now taking 7.79% of the entire crypto market. Tether’s USDT has a market cap of $170 billion, and it can now be said, without doubt, that it is the essential liquidity backbone of both centralized and decentralized finance.

Liquidity on the Sidelines

While Tether describes the mint as a typical operational event, its sheer size always looms large during a market downturn; it is like putting a pool of buying power to the side. Whether or not they use this liquidity to initiate a market rally is the most pressing question for traders.

Final Thought: Could this be a strategic deployment of dry powder waiting to enter the market at lower entry price points, or just a technical smart move with actual demand switching between blockchains?

FAQs

What does “minting” USDT mean?

Minting is the process by which Tether produces new units of USDT stablecoin on a blockchain, based on expected market demand.

Why mint during a market dip?

Tether says they mint for ‘inventory replenishment’, which usually means they reserve minted coins for large exchange sell requests, but it doesn’t necessarily mean they are minting to push down on prices.

What is market dominance?

It’s the percentage of the total crypto market’s value that a single asset, like Bitcoin or all stablecoins combined, represents.

For more stablecoin stories, read: MetaMask Stablecoin Launch: mUSD to Bridge Web2 and Web3 Payments