Key Takeaways

- Top automakers have started accepting USDT in Bolivia as a payment method amidst a critical dollar shortage

- Bolivia’s foreign reserves have seen a 98% drop since 2014, and businesses and consumers are looking for alternatives to address the issue, using alternatives like stablecoins.

- This is a historical moment, as crypto transactions in Bolivia have grown 630% year-over-year (YoY).

Table of Contents

A Practical Reaction to Economic Crisis

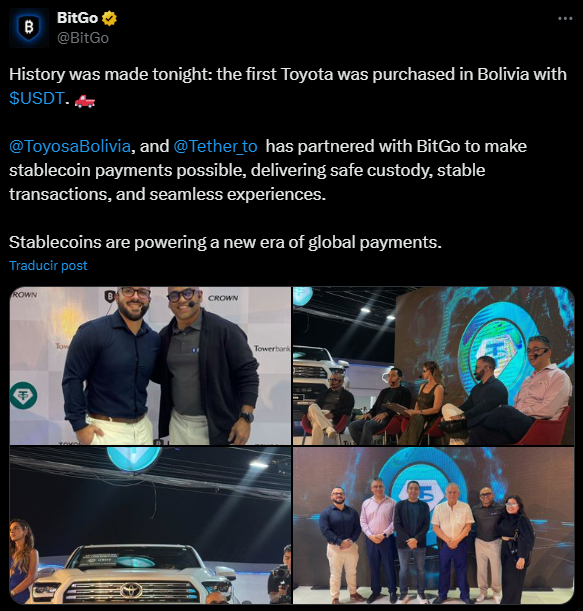

The acceptance of Tether USDT in Bolivia by big global manufacturing companies is not a guess about crypto, but an adaptation to severe economic circumstances these days. The country’s dollar reserves have plummeted from $12.7 billion to just $171 million over the last decade, making it practically impossible for businesses to obtain USD for international trade and price stability. Tether CEO Paolo Ardoino confirmed the partnerships, with crypto custodian BitGo providing the secure infrastructure to enable these large transactions.

From Importing Cars to Buying Groceries

This development extends far beyond car dealerships. Bolivian importers have been employing what is called a “circular stablecoin economy“, buying USDT locally and converting them into dollars for paying suppliers abroad. Retailers, and even vendors in the airport, have started pricing everyday products in USDT, which simply allows them to hedge against not only the volatility of the bolivian peso, but also the scarcity of the dollar.

So far, the organic, bottom-up adoption shows the utility of stablecoins for solving real-world, everyday friction in financial transactions. The National Deputy in Bolivia and leader in legislative innovation of cryptoassets, Mariela Baldivieso, informed that the new crypto custody service will be available from October 28. “This represents a significant step towards the integration of cryptocurrencies in the country, bringing us closer to a more inclusive and accessible financial future for all,” she added.

Read also: MoneyGram Stablecoin App Launches in Colombia to Revolutionize Remittances

A Latin American Stablecoin Laboratory

Bolivia’s fast embrace of Tether USDT, coming just a year after it lifted a blanket crypto ban, positions it as a key case study in stablecoin’s profound use cases. For example, crypto transactions skyrocketed 630% in the past year to $430 million, demonstrating powerful demand.

While the political future could influence policy after October’s election, the current commercial adoption is driven by sheer necessity, proving that in times of crisis, digital dollars can provide a critical lifeline.

The Digital Dollar Goes Mainstream

The adoption of USDT in Bolivia strongly demonstrates stablecoins shifting crypto trading tool to an essential financial infrastructure. For millions living in economies with unstable currencies, USDT is becoming more than simply an asset; it may just be the most readily accessible dollar.

Final Thought: If major corporations are now adopting USDT for high-value transactions, is the wall that separates traditional finance (TradFi) from crypto coming down at last?

FAQs

Why are businesses using USDT in Bolivia?

They use USDT to mitigate an acute shortage of physical U.S. dollars, which are required for international trade and as a safeguard against the loss of value against the local Bolivian peso currency.

Is this adoption of USDT in Bolivia driven by the government?

No, this is mainly a market-driven response by businesses and consumers to an economic crisis from a lack of U.S. dollars, but the government did lift the crypto ban in 2024.

How do people actually do transactions with USDT in Bolivia?

Customers simply send USDT from their digital wallets to the merchant’s wallet. Crypto custody firms, such as BitGo, are supporting the backend infrastructure, securely holding funds for large transactions.

For more Latin America crypto stories, read: Kapital Fintech Becomes First LATAM AI Unicorn With $1.3B Valuation