Key Takeaways:

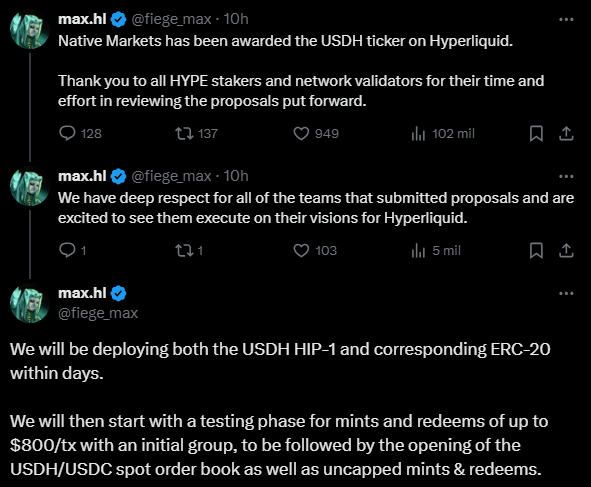

- Native Markets won the USDH ticker following a Hyperliquid governance vote by HYPE stakers and validators.

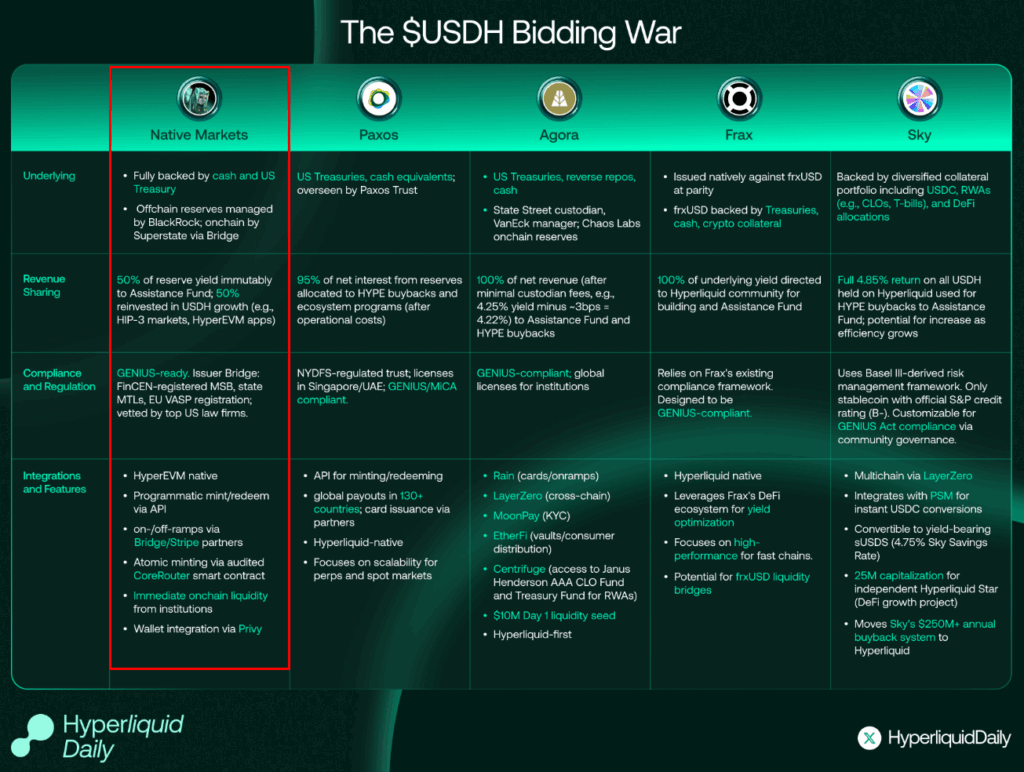

- The startup defeated major contenders like Paxos and Frax Finance by promising a natively integrated, yield-sharing model.

- A phased rollout begins with a testing cap of $800 per transaction before a full public launch.

Table of Contents

USDH Ticker: A Win-Win Situation

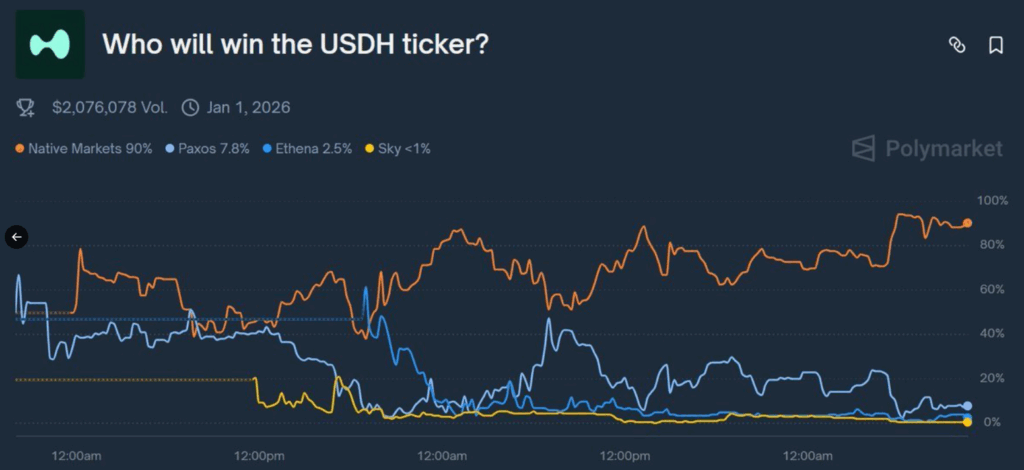

The fight for the USDH ticker was one of the most publicized governance events of the year, with an upstart battling more entrenched players, including Sky, Paxos, Fraxl Finance, and Ethena. In a win for decentralized finance (DeFi) and the community, Native Markets was victorious.

They were able to effectively communicate a proposal and framework for deep, native integration with the Hyperliquid ecosystem versus the established structures of external offerings that its opponents proposed. The win was not without controversy, as some industry executives suggested that the process felt contrived, as if the outcome was already known to the players.

The Winning Bid: Native Alignment and Shared Yield

So, what made Native Markets different? Their winning bid was based on two fundamental principles:

- Native alignment

- Community value sharing

The firm will collateralize the USDH stablecoin with a reserve of cash and U.S. Treasuries in a pool managed by BlackRock off-chain and tokenized in an on-chain reserve with Bridge and Superstate. Crucially, all yield generated from these reserves will be split evenly between Hyperliquid’s Assistance Fund and initiatives for ecosystem growth, directly rewarding the community that voted for it.

Read also: Stripe and Paradigm Launch Tempo, A New Stablecoin Payments Blockchain

What’s Next for USDH?

To this point, the rollout will be methodical. In the upcoming days, Native Markets will deploy the smart contracts. After that, they’ll go through a controlled test phase where minting and redeeming will be capped at $800 per transaction to maintain system stability. Once it has been stress-tested, the full USDH ticker will go live with an uncapped mint/redeem function and a USDH/USDC spot order book on the Hyperliquid exchange.

More Than a Stablecoin

This win is more than just a stablecoin; it is also a win for the downtrodden spirit of decentralized governance. It shows that in a community-owned ecosystem, newcomers can emerge and be successful with no ties to legacy institutions if they are aligned with the community.

Moreover, Hyperliquid will have removed a material dependence on partial assets (like USDC), by having a natively integrated stablecoin and will be one step further to a self-sustaining and efficient DeFi economy.

Final Thought: Does Native Markets’ win mean a new chapter in DeFi governance, marking a shift from brand recognition to community alignment?

FAQs

What is the USDH ticker?

The USDH ticker is the designation for the native US dollar-pegged stablecoin on the Hyperliquid decentralized exchange.

How was the winner decided?

The winner was chosen through a governance vote by HYPE token stakers and network validators who reviewed competing proposals from various firms.

What makes Native Markets’ USDH different?

It is designed to be natively integrated with the Hyperliquid model, with a portion of the reserve yield shared directly back with the Hyperliquid community and ecosystem.

For more stablecoin-related stories, read: Aave’s Horizon Platform Unlocks $26B in Tokenized RWAs for Stablecoin Institutional Lending