Key Takeaways

- Wyoming deployed (FRNT), the first U.S. state-backed stablecoin, across seven major blockchains.

- The state minted 700,000 FRNT tokens, 100,000 on each network, marking its full transition from pilot to live deployment.

- Each token is pegged 1:1 to the dollar and backed by cash and Treasuries, with a 2% reserve for stability.

- Wyoming’s move leads a broader trend, as North Dakota, California, and Texas explore state-level stablecoin and digital asset initiatives.

The State of Wyoming has officially deployed its state-backed stablecoin across seven blockchains, marking the first time a U.S. state has launched a government-issued digital currency on public networks.

The stablecoin went live on Ethereum, Solana, Avalanche, Arbitrum, Optimism, Polygon, and Base, under the supervision of the Wyoming Stable Token Commission.

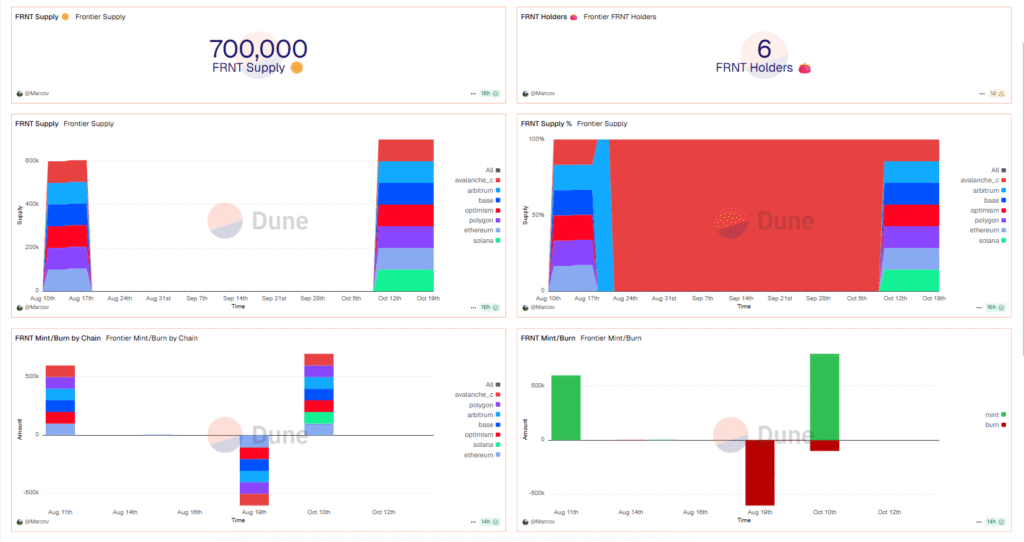

On-chain data compiled by Dune Analytics researcher Marcov shows that 700,000 tokens were minted in a coordinated rollout on October 20, with 100,000 tokens deployed on each network.

According to the project’s official website, the stablecoin has now moved from its pilot phase to public deployment, advancing Wyoming’s ambition to lead in blockchain-based financial infrastructure.

Analysts say the initiative could become a blueprint for how governments issue programmable digital dollars in the future, though questions remain over adoption, distribution, and integration with existing financial and regulatory systems.

What is FRNT and why Wyoming launched it

Regulatory and legislative foundation

The Wyoming Stable Token Act, passed in March 2023, established the legal framework for a state-backed stablecoin fully redeemable for U.S. dollars and created the Wyoming Stable Token Commission to oversee its issuance, reserves, audits, and blockchain deployment.

Under the law, each token is pegged 1:1 to the U.S. dollar and supported by reserves consisting of cash and U.S. government securities held under state custody. Additionally, the reserves must remain at least 2% higher than the total tokens in circulation, ensuring a margin of protection for long-term stability.

The design reflects the state’s intent to create a fully regulated, publicly backed form of digital money rather than a privately issued stablecoin.

Multi-chain deployment and real-world use cases

Instead of limiting the token to a single blockchain, Wyoming launched FRNT across seven networks using interoperability technology developed by LayerZero Labs. This approach allows the token to move seamlessly between chains and ensures wider accessibility.

Furthermore, Real-world utility has also been built into the rollout. FRNT will be compatible with Visa through the payments platform Rain, enabling users to spend the digital token via both physical and virtual cards, including integration with Apple Pay and Google Pay.

Before the public release, FRNT was tested for government payments such as vendor settlements, reducing transaction times from weeks to seconds. Officials say these early trials demonstrated the token’s potential to streamline public payments and reduce administrative overhead.

Additionally, FRNT has been given a public-benefit structure under which interest earned from its reserves will go to Wyoming’s School Foundation Fund rather than private entities, reinforcing the state’s intent to keep the stablecoin’s financial returns within the public sector.

The Rise of State-Led Digital Currency Experiments

Wyoming’s stablecoin is one of several state-level initiatives emerging across the United States as governments explore how digital currencies can fit within traditional financial systems.

North Dakota, for example, has announced a similar effort through a partnership between the state-owned Bank of North Dakota and fintech firm Fiserv to create the “Roughrider” stablecoin, set for a 2026 debut and designed to support in-state financial institutions.

At the same time, other states are focusing on regulation rather than issuance. California has enacted the Digital Financial Assets Law (DFAL), which will require companies engaged in digital-asset activities, including stablecoin issuers, to obtain a license from the state’s Department of Financial Protection and Innovation by July 1, 2026.

Texas, meanwhile, has introduced legislation addressing digital asset reserves and exploring gold-backed digital currencies, though it has yet to launch a stablecoin of its own.

Taken together, these initiatives highlight a growing trend of U.S. states positioning themselves as testing grounds for digital-currency policy and oversight, each seeking to balance innovation with consumer protection and financial stability.

Read More: Ant Group, JD.com Pause Stablecoin Projects as China Regulators Push Back