Key Takeaways:

- BlackRock holds $15 billion in ETH, and publicly listed companies hold 2% of the entire ETH supply as of now.

- According to trader and analyst Mags, Google searches for “altcoin” have reached their highest levels since 2021.

- Approximately 72 crypto ETFs await approval from the SEC, once approved they could trigger a major altcoin rally.

The broader cryptocurrency market currently remains in green and is seeing consistent growth, with the entire crypto market capitalization (market cap) rising by 6.9% in a week, going from $3.76 trillion to $4.02 trillion. However, despite Bitcoin (BTC) reaching a new all-time high (ATH) above 124K, it dropped down to the levels of $118,800 at the time of writing. Ethereum (ETH) has shown exponential growth, outpacing BTC, as it has grown over 80% within 3 months.

Crypto analyst and trader who has been holding BTC since 2016, going by the X persona @thescalpingpro or also known as Mags, with over 100K followers, recently tweeted about why this could be the greatest altcoin season ever. Mags states numerous reasons for what could potentially accelerate the current bullish sentiment surrounding altcoins.

Beyond the charts, the analyst highlights that the fuel for this potential rally is coming from all corners of the market.

Institutional Conviction: The analyst notes that institutions are holding “massive crypto positions,” a sign that “smart money” is already positioned for a major move. Mags specifically points out BlackRock, the world’s largest asset manager, which now holds over $15 billion in ETH through its spot exchange-traded fund (ETF). Moreover, publicly listed companies hold over 2 million ETH according to ethereumtreasuries.net, representing over 2% of the total ETH supply.

According to data from Santiment, Social Volume levels for ETH reached a 3-month high. In this case, the Social Volume metric measures the total number of social media posts and messages where ETH has been mentioned at least once. When the Social Volume rises, so does the price, hinting at increased conversations driving the bullish sentiment for ETH.

Soaring Retail Interest & Product Development: Google searches for the keyword “altcoin” have reached their highest level since the height of the 2021 bull run, indicating that retail investor interest is quickly returning. Wallet solutions like Phantom are making it easier for newbies to access the market, potentially bringing in the next wave of retail investors and traders to crypto.

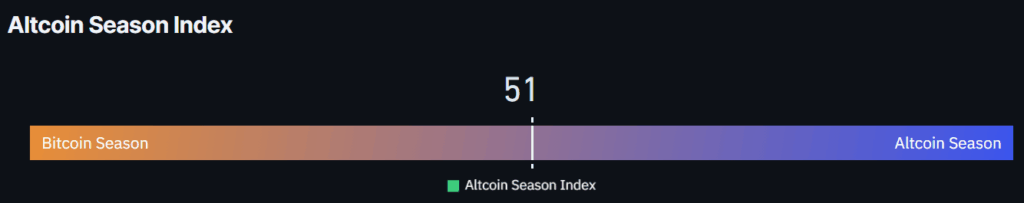

The Altcoin Season Index is approaching “altseason” territory. Altcoin market capitalization is on the verge of surpassing its previous all-time high, while the total crypto market capitalization has recently established a new record.

Regulatory Developments: The Securities and Exchange Commission (SEC) is reportedly preparing to approve 72 crypto ETFs, according to Eric Balchunas, senior ETH analyst for Bloomberg, as reported on April 21st. Once approved, this move could open the floodgates for institutional capital for other altcoins.

The previous altcoin seasons were often driven by hype and speculation. However, this setup includes a mix of institutional participation and regulatory developments. If ETH breaks its ATH and momentum carries across the market, traders believe this rally could surpass anything seen in 2017 or 2021.