Key Takeaways

- The Arbitrum (ARB) price uptick may only be triggered if the asset surpasses the $0.50 level.

- Currently, 72.9% of ARB traders on Binance hold long positions.

- Daily transactions on Arbitrum surged by 18%, with 2.5 million recorded in the past 24 hours.

After losing 25% of its value, Arbitrum (ARB) appears to be preparing for a broader market rebound. This speculation is driven by bullish on-chain metrics and the current price action, which suggest that ARB is inching closer to a 20% price uptick.

At press time, the asset is down 1.25% over the past 24 hours and is currently holding strong support at the $0.49 level.

Examining ARB’s performance, you might wonder how it could rise by 20% despite being down 1.25%.

Arbitrum (ARB) Price Action and Upcoming Levels

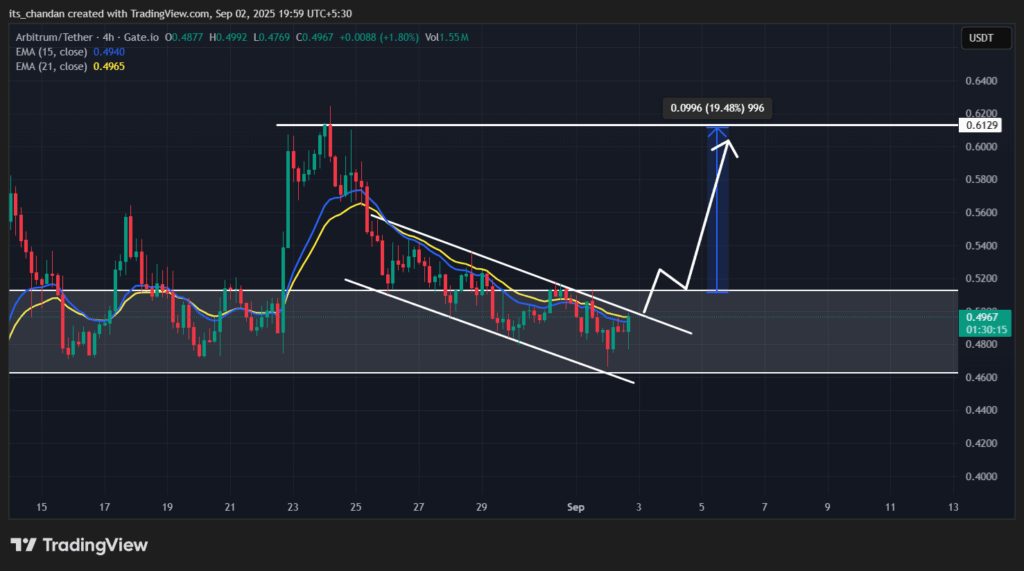

According to the TradingView chart, the ARB token appears bullish. On the four-hour time frame, the asset seems to be approaching a breakout from a descending channel pattern.

This pattern asset has been forming since August 25, 2025, and is now nearing a breakout. However, the asset is currently facing resistance from the 15-day and 21-day Exponential Moving Averages (EMA).

Based on recent price action, if the token successfully breaks out of the bearish channel and closes a four-hour candle above the psychological level of $0.50, it may see a 20% price uptick. However, before that, the ARB token must clear both EMAs.

On-Chain Metrics Hints Bullish Signal

In addition to the bullish price action, traders and investors have shown strong interest and confidence in the token, as revealed by the on-chain analytics tool Coinglass.

$1.81 Million Worth of ARB Left the Exchanges

Over the past 24 hours, data shows that both investors and traders have been accumulating and betting on long positions along with other bullish activity.

Coinglass’s spot inflow/outflow data reveals that ARB has been continuously flowing out of exchanges since August 24, 2025. Over the past 24 hours alone, exchanges recorded an outflow of $1.81 million worth of ARB tokens. This substantial outflow suggests potential accumulation and reflects investors’ confidence and interest in the token.

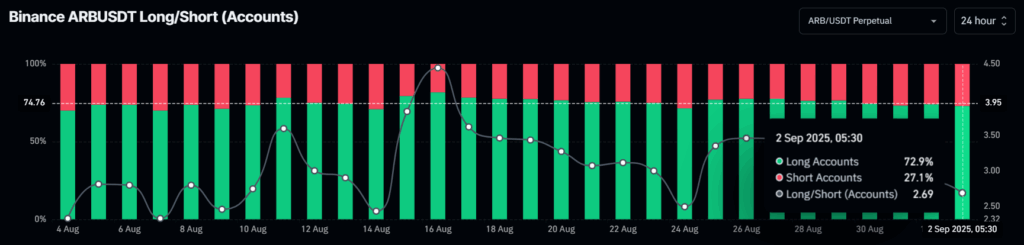

73% of ARB Traders Go Long on Binance

Additionally, traders are showing strong participation in long positions. At press time, Binance’s ARB/USDT long/short ratio stands at 2.69, indicating that for every 2.69 long positions, there is one short position.

This metric further reveals that 72.9% of traders are currently betting on the long side, while 27.1% are on the short side.

Both metrics partially confirm that bulls are dominating the ARB token, indicating strong upside potential.

Given the current market sentiment, on-chain analytics tool Nansen shows that Arbitrum has seen a sharp rise in participation, recording 2.5 million transactions in 24 hours—an 18% increase.