Key Takeaways

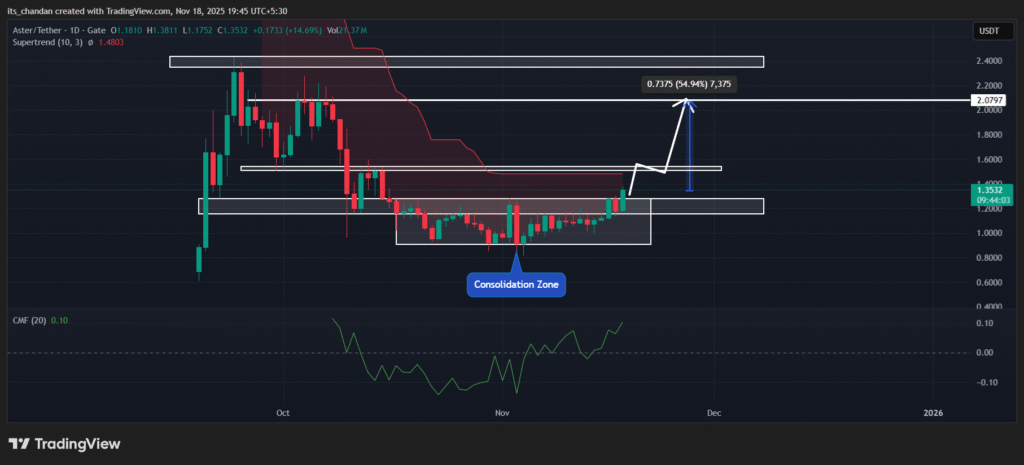

- Aster (ASTER) has broken out of a 30-day-long consolidation, opening the door for potential upside continuation.

- Price action suggests that if ASTER closes the daily candle above the consolidation zone, it could rally another 55% and may reach the $2.08 level.

- ASTER’s rising Open Interest (OI) and OI-weighted funding rate indicate strong demand among traders.

Aster (ASTER), the native token of the Binance-backed, perpetual-focused decentralized exchange Aster, is making waves with its strong performance. While the broader crypto market struggles to gain momentum today, ASTER has surged 15%, emerging as the top gainer of the day.

In addition, the latest price rally has helped the asset break out of its prolonged consolidation phase, which it had been trading in between $0.90 and $1.278 for the past 30 days. This breakout—combined with today’s surge and rising retail demand—has further strengthened ASTER’s bullish upside potential.

ASTER Price and Rising Retail Demand

As per the latest TradingView data, ASTER is trading at $1.345 after a 15% price uptick today. Meanwhile, traders and investors have shown strong interest in the asset, as evident from the trading volume, which jumped 31% to $1.29 billion, according to CoinMarketCap data.

In addition to the price rally, retail interest in the asset is also rising. According to CoinGlass, ASTER Futures Open Interest (OI) has surged by 4.58% to $613.64 million, suggesting that traders are increasingly betting on long positions.

With rising OI, the asset’s OI-weighted funding rate has also soared to 0.0144%, indicating that traders are paying a premium to hold their long positions. In the crypto landscape, a rate above 0.010% reflects aggressive demand for long positions among traders, hinting at further potential gains.

The key catalyst behind the recent rally appears to be the Double Harvest trading competition, running from Nov 17 to Dec 21, 2025, which offers a prize pool of $10 million. Participants are required to hold ASTER to be eligible.

Another catalyst driving today’s upside rally appears to be the current price action on the daily chart.

Also Read: Is Crypto Bull Run Over? $1.1 Trillion Wiped Out from the Market!

Aster (ASTER) Technical Outlook: Key Levels to Watch

According to TimesCrypto’s technical analysis, ASTER has broken out of a 30-day consolidation zone that formed between $0.90 and $1.278 on October 17, 2025. On the daily chart, the asset has moved out of this range but has yet to confirm a breakout with a strong close, which remains challenging due to current market volatility.

Based on the current price action, if ASTER’s upside rally sustains and it closes the daily candle above $1.36 or above the consolidation zone, it could be considered a successful breakout. If this occurs, ASTER could see a 55% price uptick and potentially reach the $2.08 level.

However, the next major hurdle in its upward momentum stands at $1.53. A level that has previously triggered price reversals. If the asset clears this hurdle, it could more easily continue its upside rally.

As of press time, ASTER’s Chaikin Money Flow (CMF) value has reached the 0.11 level, indicating strong buying pressure and consistent capital inflows into the asset.