Key Takeaways

- An ASTER whale dumped 6.1 million tokens worth $12.07 million.

- Price action suggests that a further decline could trigger a bearish continuation, with the price potentially reaching the $1.25 level.

- Despite the bearish outlook, Aster’s on-chain data indicates a bullish trend, hinting that a recovery may be on the horizon.

With whale dumping, Aster (ASTER) faced intensified selling pressure as the token slipped 8% today, according to TradingView data. This marks the third consecutive day of decline for ASTER, with the token losing over 18% of its value during this period.

Aster Whale Dump and Its Impact

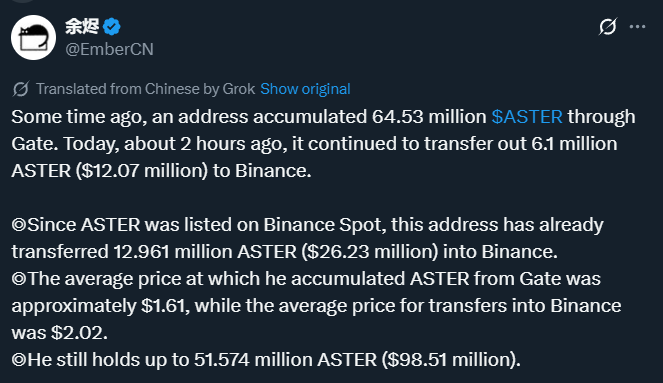

Today, the on-chain analytics platform EmberCN shared a post on X revealing that an ASTER whale dumped 6.1 million tokens worth $12.07 million in the early Asian trading hours at an average price of $2.02.

As a result of this whale dump, the token plummeted 8%, with its price slipping from $2.01 to the current $1.785 level, which aligns with the support of an ascending trendline. However, the downward momentum in ASTER price remains a concern, further strengthened by the whale’s recent offloading.

Now the question arises: will the asset hold this support, or will the downward momentum continue?

Aster Price’s Technical Outlook : Key Levels In Sight

According to TradingView’s four-hour chart, ASTER appears to be forming a symmetrical triangle pattern. Meanwhile, the asset’s price is approaching the lower trendline, hinting at a potential breakdown risk if the downward momentum continues.

Based on the current price action, if the asset breaks below the lower trendline and closes a four-hour candle under the $1.70 level, it could trigger a bearish continuation, with the price potentially reaching the next support at $1.25 in the future.

However, bullish sentiment could return only if the ASTER price holds above the trendline support and breaks out of the upper descending trendline. If this happens, the asset could see a price jump of 17%, potentially reaching the $2.40 level or even higher.

At press, the asset’s Average Directional Index (ADX) value stands at 15.50, below the key threshold of 25, indicating a weak directional momentum in the asset.

Aster’s On-Chain Signals Potential Reversal

Looking at the current scenario, ASTER appears to be weakening and may continue its downward momentum, but its on-chain data tells a different story.

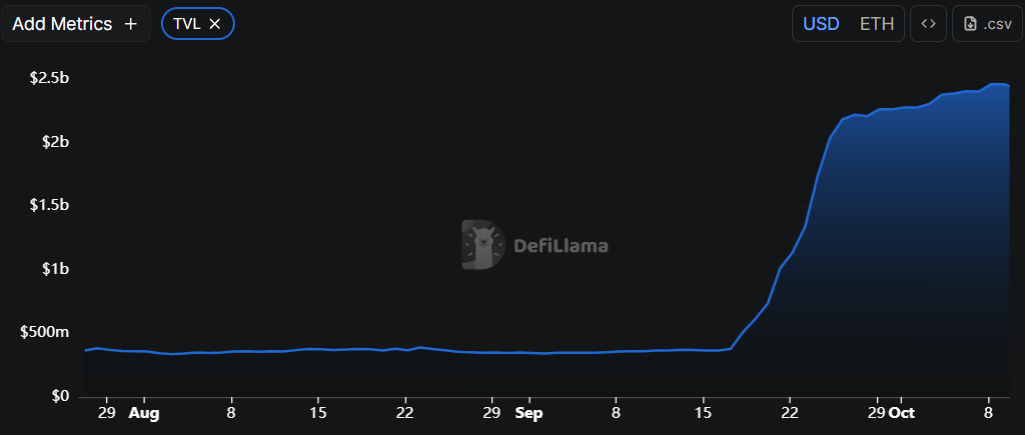

According to DeFi aggregator DeFiLlama, the total value locked (TVL) in the Aster protocol continues to rise, reaching a peak of $2.448 billion today, surpassing its competitor Hyperliquid. The surge in TVL indicates a higher inflow of capital and reflects strong investor confidence in the asset.

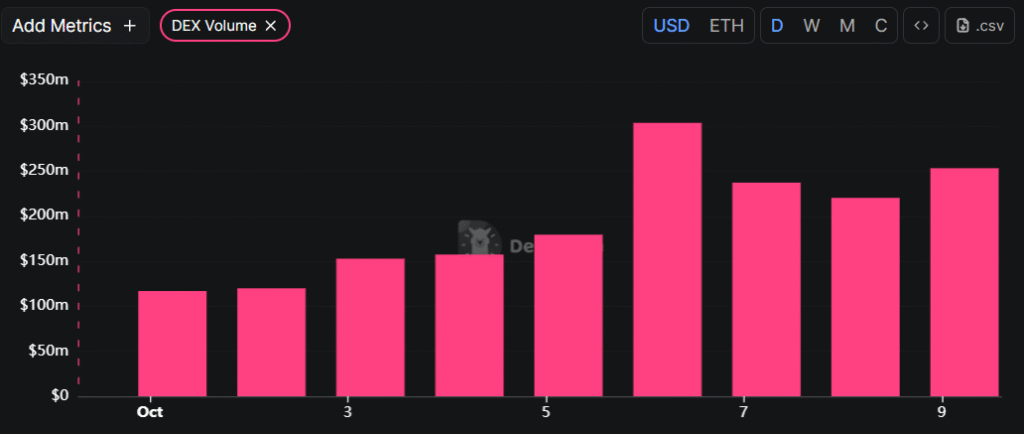

Not just TVL, but Aster’s DEX volume has also continued to accelerate since the beginning of October 2025, more than doubling in value. Data from DeFiLlama shows that the DEX volume has jumped from $116.79 million to $253.12 million at press time, indicating a surge in trading activity and growing interest from investors and traders in ASTER.

When combining these on-chain metrics, it appears that ASTER could soon see a price reversal, potentially ending its bearish trend.

Also Read: Tron Transfer Activity Hits New High: Is TRX Price Gearing Up for Another Rally?