Key Takeaways

- AVAX price has formed a bearish pattern; if it closes a candle below the $16.70 level, it could see a 12% price dip.

- $1.27 million worth of AVAX long positions are on the verge of liquidation as the price continues to decline.

- AVAX’s bearish outlook could only shift if the price soars and crosses the $17.88 mark.

The risk of a price crash in Avalanche (AVAX) is rising as the asset’s chart prints a bearish structure. Not just that, but derivative tools are also reinforcing this sentiment, with traders’ bets on the short side increasing, raising questions about whether this is an ideal selling opportunity or if the price will bounce back.

AVAX Price and Declining Volume

As per the latest TradingView data, AVAX price continues to decline, recording a 2.10% price dip today and currently trading at the $16.80 level. With the asset’s price falling, market participants appear hesitant, as reflected in the trading volume, which has dropped by 11% to $421 million.

Also Read: Here’s Why BTC Price is Falling?

Technical Outlook: Key Levels to Watch

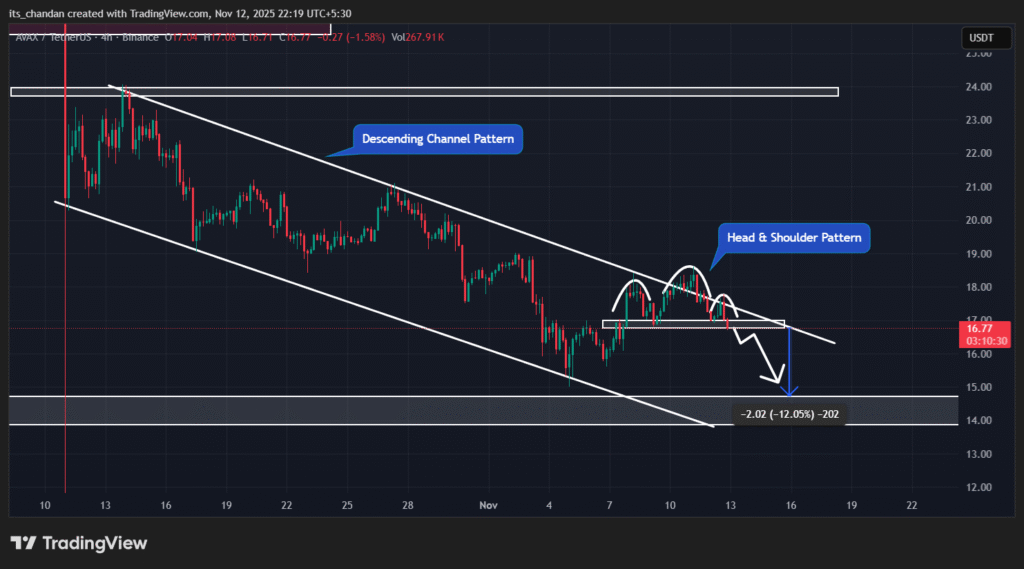

According to TimesCrypto’s technical analysis, the broader market trend for AVAX remains bearish as it continues to move within a descending channel pattern between its upper and lower boundaries. On the four-hour chart, when the price reached the upper boundary today, it formed a bearish head-and-shoulders pattern and now appears to be breaching the neckline.

Based on the current price action, if the AVAX price successfully clears the neckline and closes a four-hour candle below the $16.70 level, it could see another 12% dip, potentially reaching the $14.65 level in the coming days. The asset’s bearish outlook would only be validated if it closes below the neckline; otherwise, the bearish scenario would be invalidated.

With bearish price action, AVAX’s CMF value has reached -0.12, indicating increasing selling pressure and weakening buying momentum in the market.

Derivative Tool Strengthens AVAX Bearish Outlook

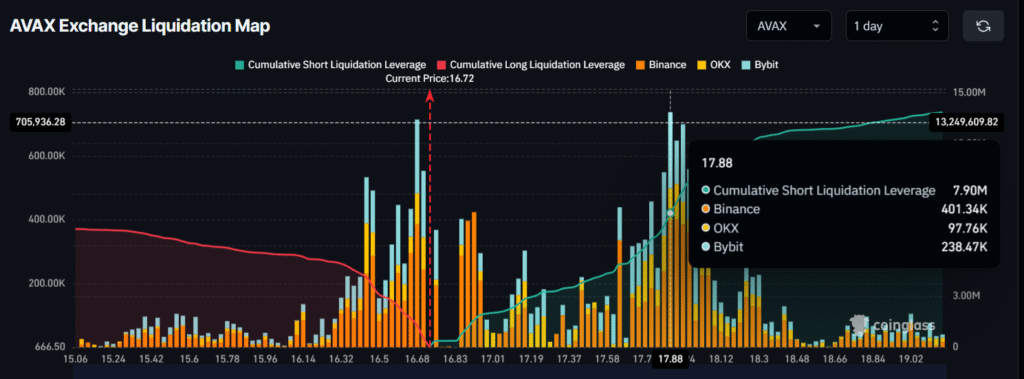

Adding to the bearish strength, the derivative tool Coinglass further reinforces AVAX’s current outlook, as traders’ short bets have increased significantly amid the falling price.

According to the AVAX Exchange Liquidation Map, the asset’s major liquidation levels stand at $16.68 on the lower side (support) and $17.88 on the upper side (resistance). At these levels, traders have built $1.27 million worth of long positions and $7.90 million worth of short positions, clearly indicating seller dominance.

However, as the AVAX price approaches the $16.68 level, hitting this zone could trigger the liquidation of $1.27 million worth of long positions, potentially leading to a sharp price dip, as there is no strong support below this level.

Combining these derivative tools with the price action, it appears that the current market trend for AVAX is bearish, with a strong possibility that it could continue in this direction. However, this trend could only reverse if the price surges and triggers liquidations at the $17.88 level.