Key Takeaways

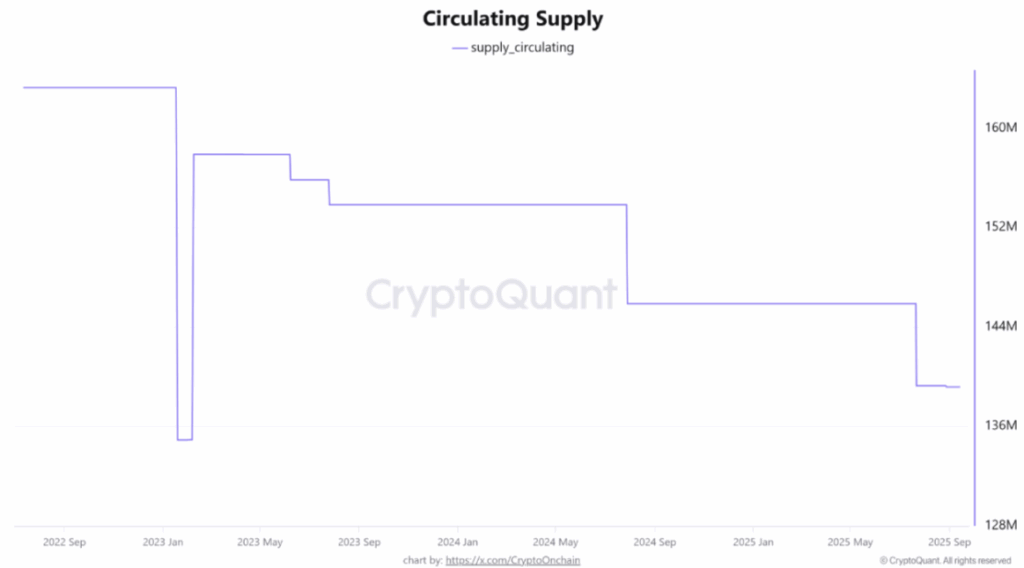

- BNB’s circulating supply has reached 139.187 million, the lowest level since January 2023.

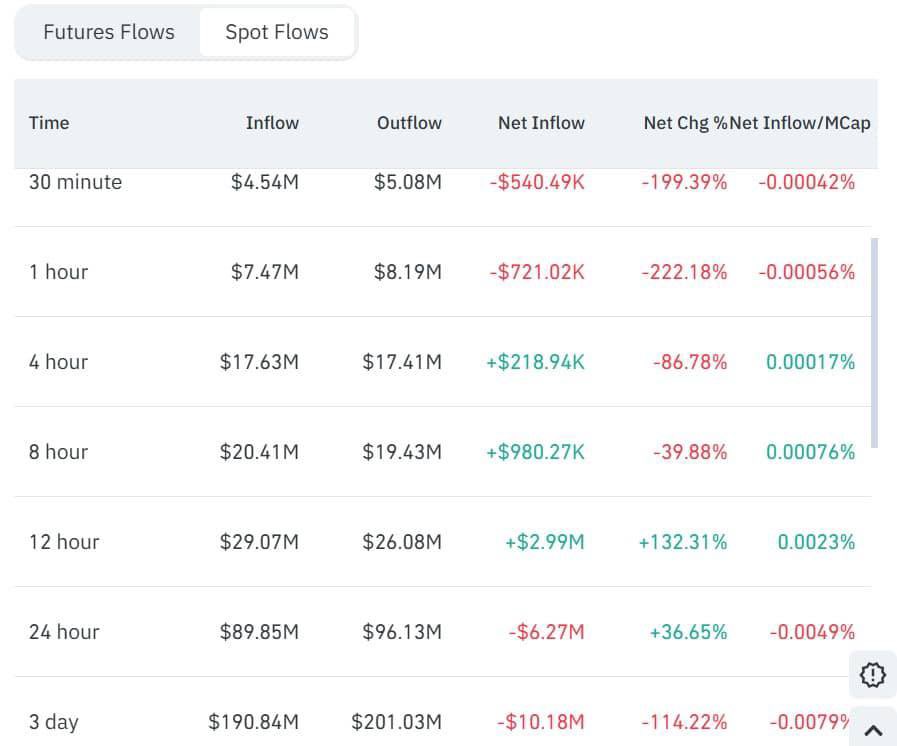

- $6.27 million worth of BNB has left the exchanges, hinting at ongoing accumulation.

- BNB buy volume reached 21.38k BNB, compared to 18.25k BNB in sell volume.

Bullish sentiment around Binance Coin (BNB) is heating up, despite the broader market continuing to struggle. CryptQuant experts recently revealed that BNB’s circulating supply has reached its lowest level since January 2023.

BNB Supply Drops to Lowest Level

According to a recent report, BNB’s circulating supply has reached 139.187 million. The lowest recorded supply was 134 million BNB in January 2023. This decline in circulating supply could potentially push the price higher and reduce selling pressure. In simple terms, it’s a bullish signal for BNB holders.

The expert further stated, “Such declines are typically driven by token-burning mechanisms and supply caps, and can create positive price action by reducing potential selling pressure; however, the market’s reaction will depend heavily on the timing of the event, overall market conditions, and demand.”

BNB Price Gains Momentum

At press, BNB is trading near $934, having climbed 2.75% over the past 24 hours. Market participants also appear to be supporting this price uptick, as the asset’s trading volume during the same period has risen 6.75% compared to the previous day.

$6.3M BNB Withdrawn from Exchanges

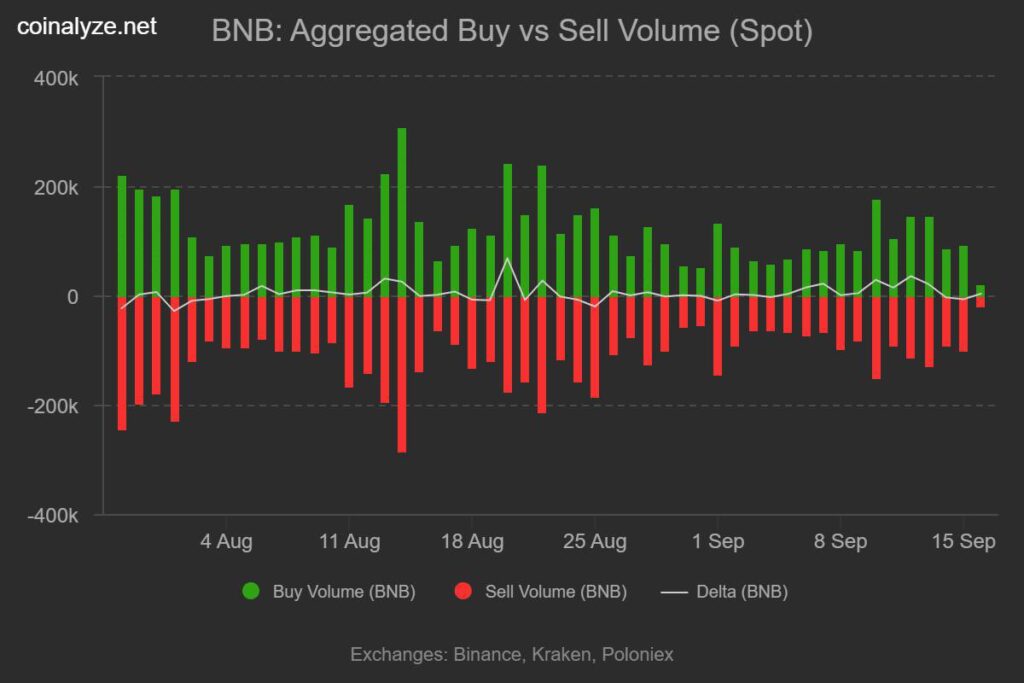

Recently, a well-followed crypto expert revealed that BNB continues to show strong demand despite its recent all-time high. The expert further shared that BNB buyers have been aggressively stepping into the spot market.

Over the past 24 hours, BNB buy volume reached 21.38k BNB, compared to 18.25k BNB in sell volume, indicating that buyers are dominating and leaving a positive delta. This also highlights a ‘buy the dip’ behavior, as investors appear to be seizing the opportunity while BNB’s price plummeted after hitting its ATH.

Adding to the strength, on-chain data over the past 24 hours reveals that over $6.27 million worth of BNB has left the exchanges. This hints at potential accumulation by investors and long-term holders.

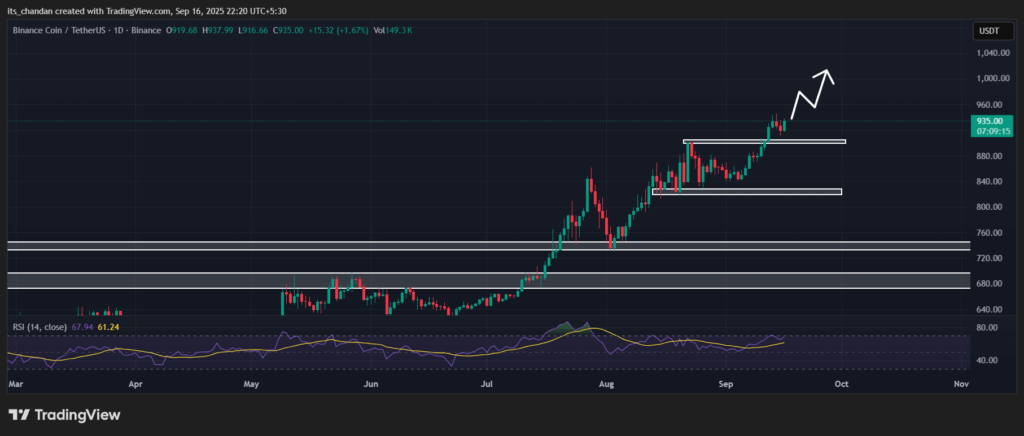

BNB Price Outlook and Technical Analysis

According to TimesCrypto’s technical analysis, BNB appears bullish, having successfully retested its breakout level at $905. On the daily chart, it appears that BNB is once again heading toward a new all-time high.

Based on the current price action, if this momentum continues, there is a strong possibility that BNB could reach the psychological level of $1,000 in the coming days. On the other hand, if momentum fades and the price falls below $900, it could see a sharp decline, potentially dropping to the $830 level in the future.

Currently, BNB’s Relative Strength Index (RSI) stands at 67.72, indicating that the asset is nearing overbought territory, but it still has enough room to continue its upside momentum in the coming days.