Key Takeaways

- With a 24% price jump, TAO has defied the market trend and outperformed Bitcoin (BTC) and Ethereum (ETH).

- The key factors driving TAO’s upward momentum appear to be the launch of the Safello Bittador Staked TAO ETP (STAO) and the upcoming halving.

- Price action suggests that if TAO holds above the $515 level, it could soar to $600.

Today, Bittensor (TAO) defied the market trend, delivering an impressive performance that not only outperformed major assets like Bitcoin (BTC) and Ethereum (ETH) but also signaled the potential for further upward momentum. According to CoinMarketCap data, the token has surged 24% over the past 24 hours, ranking second on the top gainers list.

TAO’s Current Price Momentum

Currently, TAO is trading at $528, recording a price surge of over 24% in the past 24 hours, according to CoinMarketCap data. The notable rally has triggered massive participation from traders and investors, as evident from the trading volume, which jumped 111% to $1.01 billion.

Why is Bittensor (TAO) Price Rising?

Given the massive price uptick, you might be wondering what’s driving TAO’s price to rally so strongly, especially at a time when the overall market appears to be struggling.

The key factors behind today’s upward momentum seem to be linked to the launch of the Safello Bittador Staked TAO ETP (STAO), introduced by Safello and Deutsche Digital on the SIX Swiss Exchange.

Another factor strengthening TAO’s bullish outlook and upward momentum is the anticipation of its first halving, expected to take place in early December 2025. This event will cut TAO emissions by 50%, effectively reducing the token supply.

Expert Bold Prediction

Given the current market sentiment, a well-followed crypto community on X made a bold prediction, stating that TAO is headed straight to $1,000. The post quickly gained widespread attention from the crypto community and created a buzz across the crypto landscape.

TAO Technical Outlook and Key Levels

Besides these bold predictions, TimesCrypto’s technical analysis suggests a different story. On the daily chart, it appears that today’s price uptick has cleared a key resistance level at $495, which the asset had been struggling with for over 10 months. Now, TAO is poised to close a daily candle above this level.

Based on the current price action, if TAO successfully closes a daily candle above the $515 level today, it could surge by 17.5% and reach the next key resistance at $600. TAO’s bullish thesis will only be validated if the asset sustains above the $515 level; otherwise, it will be invalidated.

At press, TAO’s Supertrend indicator continued its green trend and hovered below the asset price, suggesting the asset is in an uptrend with strong buying pressure. Whereas, the Chaikin Money Flow (CMF) value reached 0.10, indicating rising capital inflows and increasing accumulation among traders.

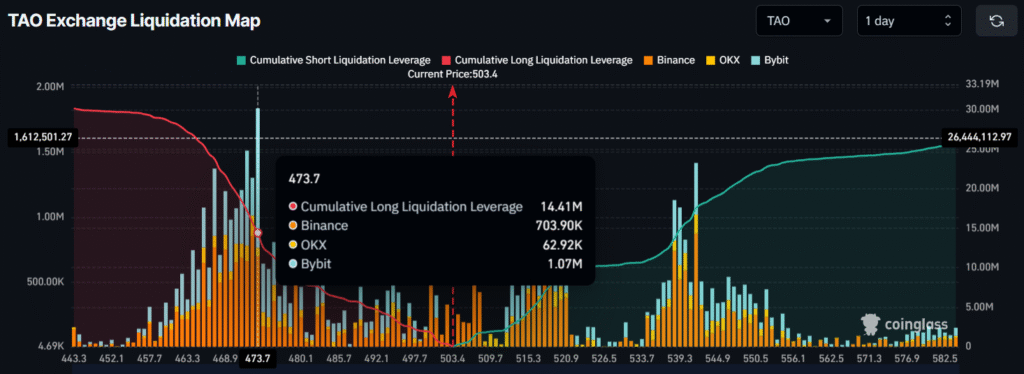

Major Liquidation Levels

Looking at the current market sentiment, it appears that traders are following the same trend by taking long positions, according to data from the derivatives platform Coinglass.

The data reveals that TAO’s major liquidation levels currently stand at $473.7 on the lower side and $541.7 on the upper side. At these levels, traders have built $14.41 million worth of long positions and $9.25 million worth of short positions, indicating a bullish outlook among traders.