Key Takeaways

- BNB is finally listed on Robinhood and is set to be listed on Coinbase.

- Price action hints that BNB is in the golden Fibonacci zone, suggesting a potential reversal is on the horizon.

- The BNB listing update has pushed the price up by 1.55%, defying the broader market trend.

Binance’s BNB Smart Chain (BNB) is seeing renewed optimism as major exchanges and competitors like Robinhood and Coinbase move toward listing the asset, sparking hopes for a potential price reversal. Robinhood has officially listed BNB, while it is yet to go live on Coinbase.

In a recent post on X, Coinbase announced that it will soon support BNB on the BNB Smart Chain network.

Exchange Listings and Their Impact on BNB Price

These updates from both major exchanges helped BNB gain a 1.55% price increase during a period when the overall cryptocurrency market is bleeding, with Bitcoin (BTC) and Ethereum (ETH) posting declines of 0.65% and 2%, respectively.

As of press time, BNB is trading at $1,072, with a price uptick of over 1.55% today, according to TradingView. However, market participation remains low, as trading volume has plummeted over 20% to $3.65 billion. This indicates that market participants are still hesitant about whether the BNB rally will sustain, with the price hovering at a make-or-break level.

BNB Technical Outlook: Upcoming Levels to Watch

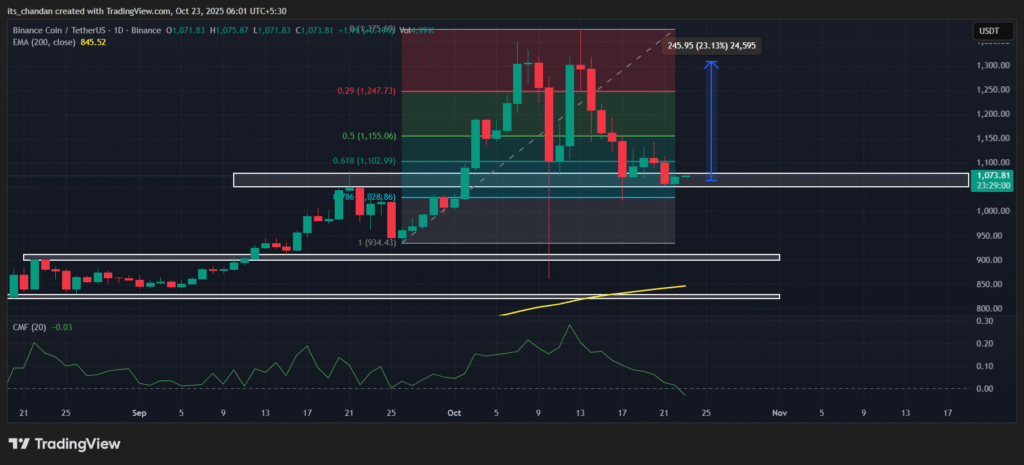

TimesCrypto’s technical analysis reveals that BNB is in the golden Fibonacci zone between 61.8% and 78.6%, which is considered a potential reversal area. Moreover, the price has held this level for over a week, now acting as a make-or-break level for the asset.

Based on the current price action, if BNB sustains above the $1,050 level, there is a strong possibility that the asset could surge by 23% and reach the $1,300 level. Conversely, if uncertainty persists and the price breaks below this key support, a sharp decline is also possible, potentially driving the price down to $900.

BNB’s bullish thesis remains valid only as long as it holds the $1,050 level; otherwise, it could be invalidated.

Despite BNB holding the key $1,050 support, the Chaikin Money Flow (CMF) indicator, which measures buying and selling pressure, shows selling pressure in the market, with its value currently at -0.03.

Given the current market sentiment, several bold predictions have recently surfaced on X. One well-followed crypto expert predicted that BNB will reach $5,000 before ETH. This post on X gained widespread attention from crypto enthusiasts.

Major Liquidation Levels

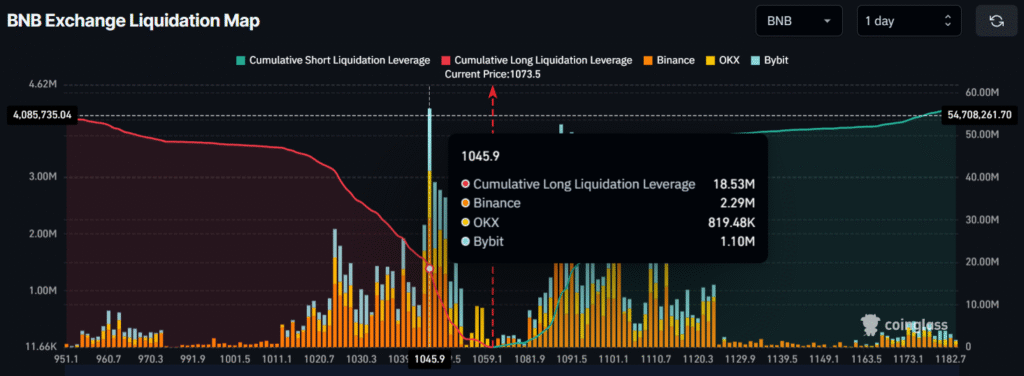

As of press time, data from derivatives platform Coinglass reveals that traders with a bullish outlook are currently dominating the market.

Today, BNB’s major liquidation levels stand at $1,045.9 on the lower side and $1,089.1 on the upper side. At these levels, traders have built $18.53 million worth of long positions and $9.23 million worth of short positions.

This clearly indicates that bulls are currently in control of the asset, while bearish interest is fading.