Key Takeaways

- Cardano (ADA) appears poised for a strong rally, with the potential to surge up to 70% in the coming days.

- A crypto expert recently tweeted that ADA could reach $1.15, highlighting the asset’s growing bullish momentum.

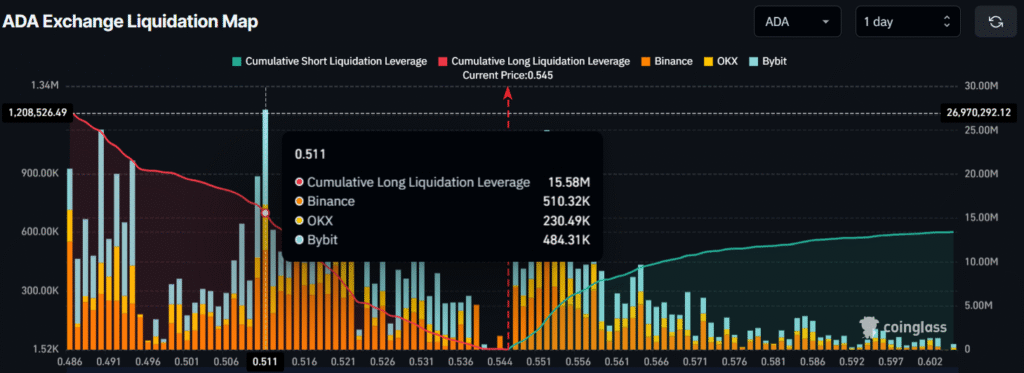

- ADA’s major liquidation data highlights $0.511 as a key support level, where traders have built $15.58 million worth of long positions.

After tumbling 47% since August 2025, Cardano (ADA) may have hit its bottom and is now eyeing a major price reversal. The daily chart shows ADA trading in a parallel channel between $0.98 and $0.51 all year, with Tuesday’s dip marking its fifth test of the $0.51 support level, which is now garnering massive attention from crypto enthusiasts.

ADA Current Price and Expert Prediction

At press time, ADA is trading at $0.54, registering a price uptick of 5.15%. This surge from the key historical level has triggered significant participation, as reflected in the trading volume, which surged 22% to $1.75 billion during the same period.

Looking at ADA’s price momentum, a crypto expert shared a post on X, including a visual suggesting that ADA has the potential to reach the $1.15 level in the coming days. In the post, the expert noted that $0.52 is a support level that has triggered strong rebounds for Cardano since November 2024.

Cardano (ADA) Technical Outlook: Key Levels to Watch

According to TimesCrypto’s technical analysis of the daily chart, ADA has been hovering within a parallel channel pattern between $0.98 and $0.51 since the beginning of 2025, with the recent dip to $0.51 marking its fifth visit to the lower boundary.

Based on historical patterns, whenever the asset reached this lower boundary, it experienced a significant price reversal, and the chart now suggests that ADA could follow the same trend.

The current price action indicates that ADA’s upside potential is contingent on holding the $0.51 level. If it does, the asset could see a price increase of up to 70%, potentially reaching the $0.98 level in the future.

However, if the current momentum fails and the price falls below $0.51, it could trigger a significant decline.

At press time, ADA’s Average Directional Index (ADX) stands at 48.26, well above the key threshold of 25, indicating strong directional momentum in the asset.

Derivative Tool Strengthens ADA’s Bullish Outlook

Adding to the bullish outlook, derivative data from Coinglass also support ADA’s upward momentum, as traders have shown strong interest in long positions. As of now, ADA’s major liquidation levels stand at $0.511 on the lower side (support), where strong interest has been recorded, and $0.552 on the upper side (resistance).

At these levels, traders are over-leveraged, having built $15.58 million worth of long positions and $3.52 million worth of short positions. This data suggests that buyers are currently dominating, betting nearly five times more than sellers.

Also Read: Has Altcoin Season Finally Arrived? Know Key Details Here!