Key Takeaways

- Cardano (ADA) has formed a bullish divergence on the daily chart, hinting that a potential reversal may be on the horizon.

- Price action suggests that if ADA sustains above the $0.50 level, it could see an 18% price uptick and potentially reach the $0.60 level.

- Derivative tools reinforce ADA’s bullish outlook, as traders are strongly betting on long positions and investors appear to be accumulating ADA tokens.

Amid the ongoing bearish market sentiment, Cardano (ADA) has formed a bullish pattern on the daily chart, hinting at a possible reversal from current levels. While the broader market continues to bleed and ADA is no exception, all eyes are now on how the asset reacts to this newly formed bullish setup.

Cardano (ADA) Current Price Momentum

Today, ADA has recorded a 2.45% price dip and is currently trading above the $0.51 level, according to TradingView data. However, during the same period, crypto participants have shown strong confidence in the asset, resulting in a massive 72% surge in trading volume.

Also Read: Yield-Bearing rcUSD+ Token Launches on Polygon, Bridging TradFi and DeFi

ADA Price Action and Upcoming Levels to Watch

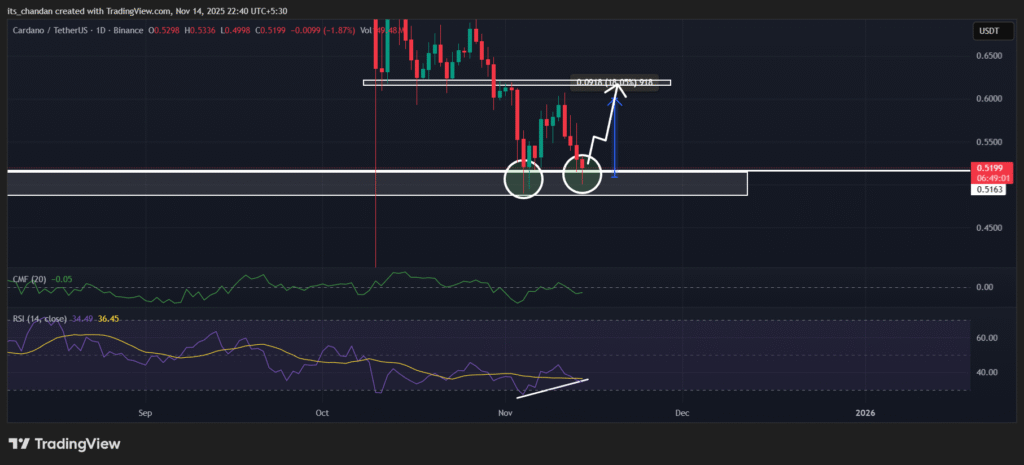

According to TimesCrypto’s technical analysis, ADA has printed a bullish divergence on the key support level of $0.50 on the daily chart, indicating that a potential reversal may be on the horizon.

Historically, whenever ADA’s price has reached or approached the $0.50 level, it has often witnessed a reversal — and this time, the bullish divergence further strengthens that outlook.

Based on the current price action, if ADA sustains or holds above the $0.50 level, it could see an impressive price recovery and potentially gain upward momentum. If this happens, ADA has a strong chance of soaring 18% and reaching the $0.60 level.

However, the downward momentum may continue if the asset fails to hold the key support at $0.50.

As of now, ADA’s CMF (Chaikin Money Flow) value reaches -0.06, indicating weakening buying pressure and a growing risk of further downward momentum in the price.

Short-Term and Long-Term Sentiment Support Bullish Reversal

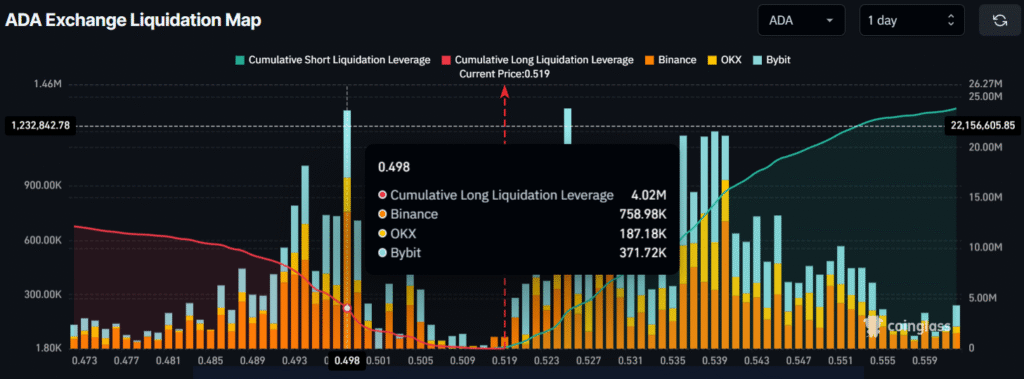

Given the current market sentiment and historical performance, it appears that bulls are strongly defending the key support by heavily betting on long positions.

According to the derivatives platform Coinglass, $0.498 and $0.525 are the two major liquidation levels on the lower and upper sides, currently acting as key support and resistance for the asset. At these levels, traders have built $4.02 million worth of long positions and $2.96 million worth of short positions, highlighting the bulls’ dominance.

These liquidation levels and traders’ strong long positions suggest that ADA is unlikely to fall below the $0.498 level anytime soon.

Another metric further strengthening the bulls’ dominance is investor accumulation at the current level. According to Coinglass, the spot inflow/outflow metric shows that, so far today, exchanges across the crypto market have recorded an outflow of $8.67 million worth of ADA, indicating potential accumulation.

When combining both sets of data from the derivatives tools, it appears that ADA’s long-term and short-term sentiment has begun to shift, suggesting that a reversal could be possible soon.