Key Takeaways

- Chainlink (LINK) short-term outlook appears bearish, with a potential 3.50% dip on the horizon.

- Crypto whales have purchased 2 million LINK coins over the past 48 hours.

- Exchanges have lost 370.73 million LINK from their reserves over the past 30 days, hinting at potential accumulation.

Despite the price decline, interest from whales and investors in Chainlink (LINK) has surged, as they appear to be accumulating the coins. On X, a prominent crypto expert shared data from the on-chain analytics tool Santiment, revealing that whales holding 100,000 to 1 million LINK have purchased 2 million coins.

This substantial accumulation was recorded over the past 48 hours, during which the LINK price hovered between $23.70 and $24.85.

Chainlink Accumulation Surges, Time To Buy?

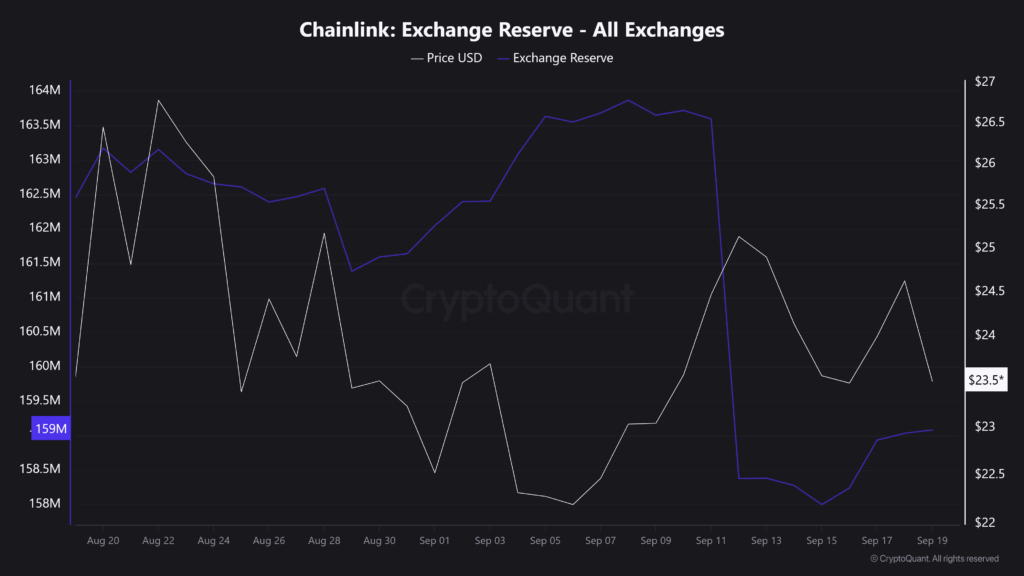

Adding to the bullish sentiment, a local crypto media outlet shared on-chain data showing that LINK balances on exchanges have just dropped to their lowest levels since 2022. This highlights that LINK continues to flow out of exchanges.

While digging deep, it appears that 370.73 million LINK have left exchanges over the past 30 days. A decline in exchange reserves is often a sign of potential accumulation by whales, retailers, and institutions, making it a bullish signal for LINK holders.

This massive accumulation now raises the question, is this an ideal time to buy the LINK token, or are we likely to see a downside rally?

Chainlink Price and Experts’ Long-Term Prediction

Today, September 19, 2025, LINK has recorded a price dip of 2.10% over the past 24 hours, reaching a key support level of $23.85, which now serves as a make-or-break point for the asset.

Despite the price hovering at a key level, several bold price predictions have recently surfaced on X, suggesting that experts remain strongly bullish on LINK.

A crypto expert shared a post along with a weekly chart, stating that LINK is on the verge of breaking out of a strong descending trendline, which could trigger a parabolic rally. According to the chart, if LINK breaks out of the trendline, it could see a 184% price increase, potentially reaching the $79.16 level.

Several other predictions have also emerged, but they all appear to be long-term projections.

Chainlink (LINK) Technical Outlook: Upcoming Levels to Watch

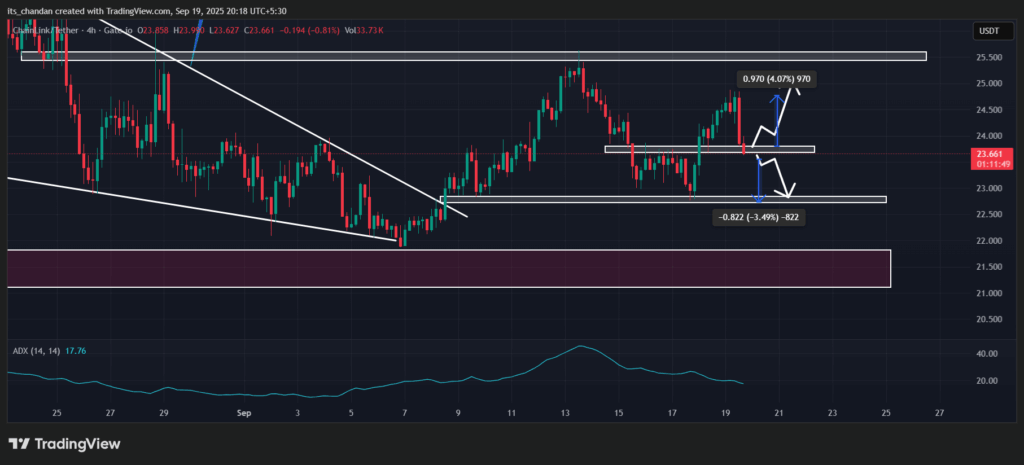

According to TimesCrypto’s technical analysis, LINK’s short-term price outlook appears bearish. On the four-hour chart, the asset has engulfed the entire green bullish candle it formed over the past 48 hours with a large red candlestick. Additionally, the four-hour candle seems to be losing the local support level of $23.75.

Based on the current price action, if LINK’s four-hour candle closes below the $23.70 level, a quick 3.50% price dip is possible, with the asset potentially reaching the $22.80 level in the coming days. On the other hand, if LINK holds the $23.75 level, it could see a sharp reversal and an upside rally.

At press, the Average Directional Index (ADX) value reached 17.85, which indicates a weak trend and low market momentum.